IRS 656-B 2024 free printable template

Instructions and Help about form 656 b

How to edit form 656 b

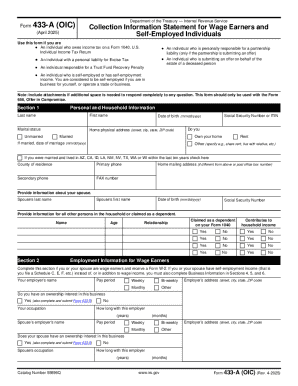

How to fill out form 656 b

Latest updates to form 656 b

All You Need to Know About form 656 b

What is form 656 b?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 656-B

What should I do if I discover an error on my submitted form 656 b?

If you find an error after submitting your form 656 b, you should submit an amended form as soon as possible. Ensure that you clearly indicate which sections were corrected and provide any necessary explanations for the changes made to maintain clarity during the review process.

How can I track the status of my form 656 b after submission?

To track the status of your form 656 b, you can utilize the online tracking system provided by the IRS or the relevant authority. Typically, you will need your submission details such as the date filed and basic personal information to verify receipt and processing status.

What are common errors to avoid when filing form 656 b?

Common errors when filing form 656 b include missing signatures, incorrect information in financial disclosures, and failing to submit all required documents. Carefully reviewing your form before submission can help mitigate these mistakes and ensure a smoother processing experience.

Are there specific privacy measures related to form 656 b filings?

Yes, privacy measures are crucial when submitting form 656 b, as it often contains sensitive financial information. It is important to ensure that you are using secure methods for submission and that you retain copies in a secure location to protect your personal data.

See what our users say