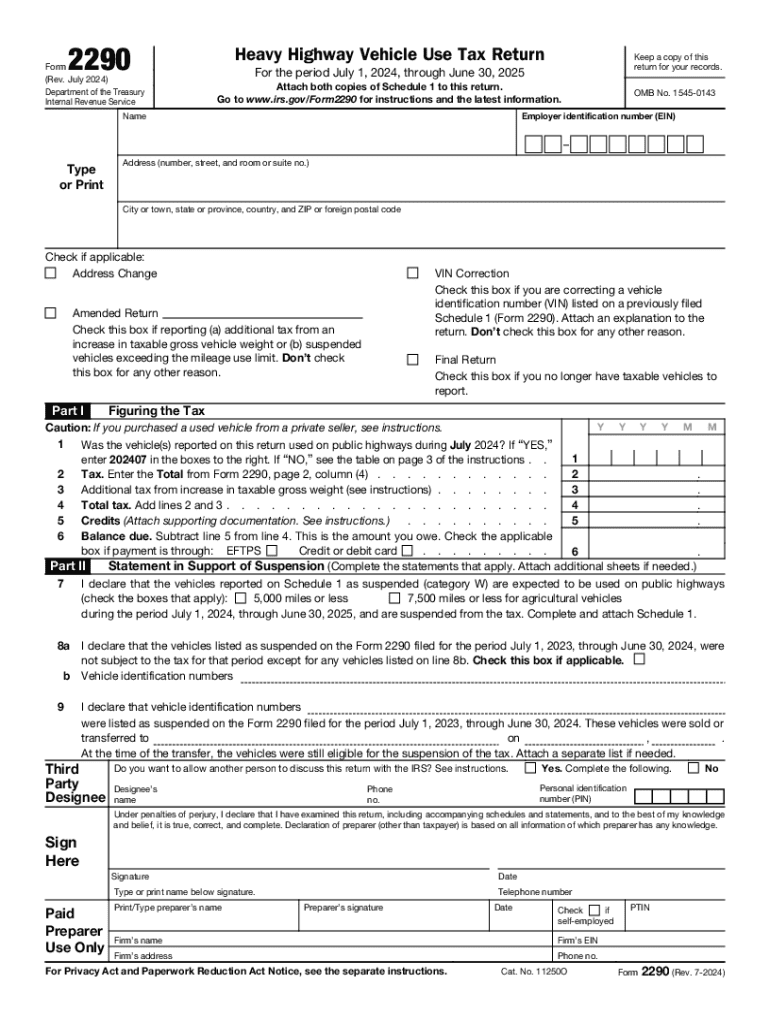

IRS 2290 2024 free printable template

Instructions and Help about form 2290

How to edit form 2290

How to fill out form 2290

Latest updates to form 2290

All You Need to Know About form 2290

What is form 2290?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 2290

What should I do if I accidentally filed the wrong information on my form 2290?

If you've submitted an incorrect form 2290, you need to file an amended return. This process involves completing a new form to correct the data initially reported and marking it as an amendment. Ensure that you detail the corrections clearly, as this will help the IRS process your changes effectively.

How can I verify the status of my submitted form 2290?

To check the status of your form 2290, you can utilize the IRS's online tools or contact them directly. If filed electronically, you should receive a confirmation of acceptance or rejection, along with reasons for any rejections, which can help you troubleshoot and resubmit as necessary.

Are electronic signatures acceptable for filing form 2290?

Yes, electronic signatures are acceptable for submitting form 2290 when filed electronically. However, if you are filing via paper, a physical signature is required. Always ensure you comply with any specific instructions related to electronic filing to avoid issues.

What should I do if I receive an audit notice regarding my form 2290?

If you receive an audit notice related to your form 2290, it's important to review the notice carefully and gather any relevant documentation to support your filing. Respond promptly with the required information, and consider consulting a tax professional for assistance in preparing your response.

What are common errors to avoid when filing form 2290 electronically?

When e-filing form 2290, common errors include mismatched taxpayer identification numbers and incorrect vehicle information. Double-check your entries and ensure all required fields are filled accurately to avoid rejection. Utilizing reliable tax software can also help minimize these issues.

See what our users say