FL DoR DR-18 2006 free printable template

Show details

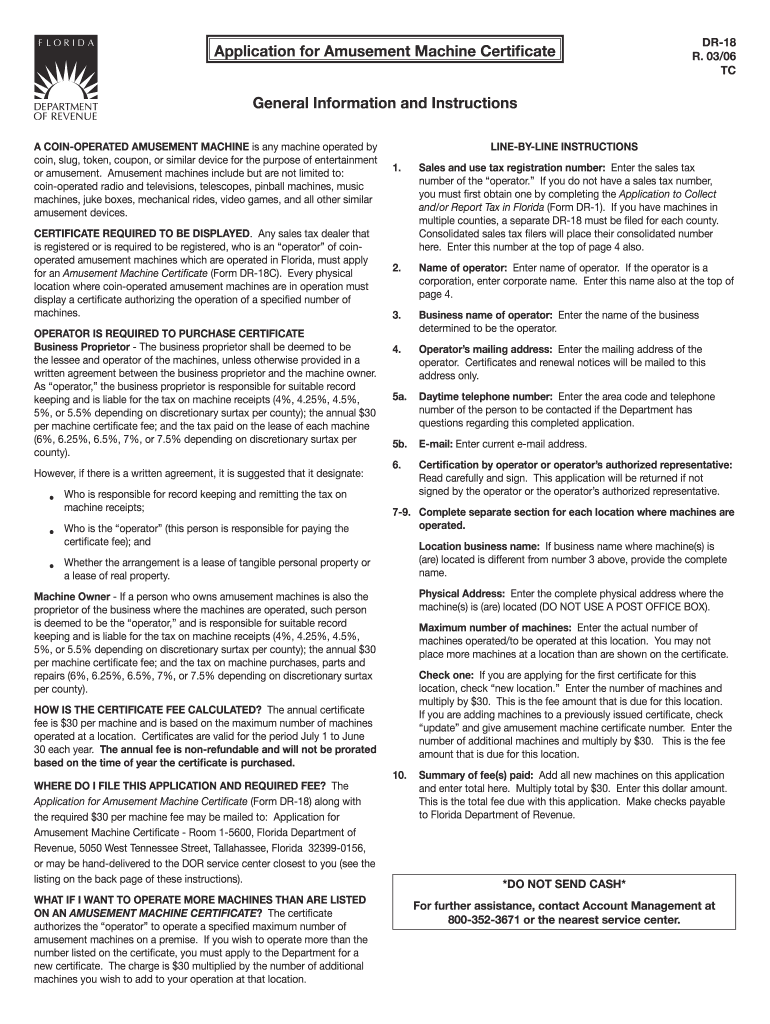

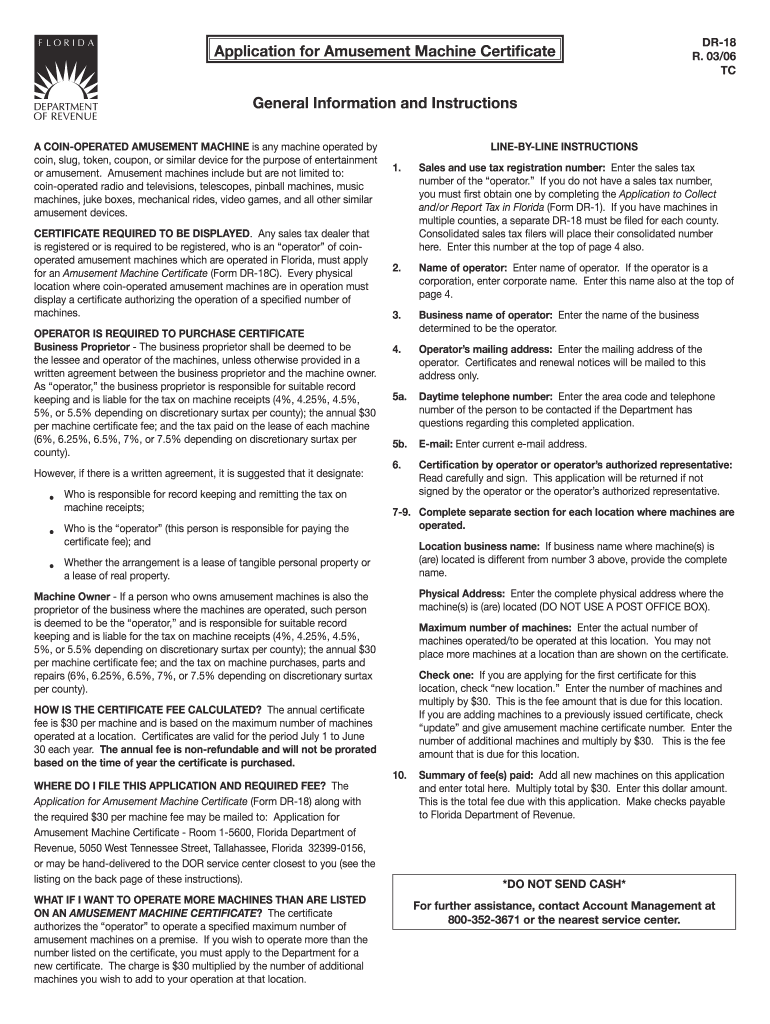

This is the fee amount that is due for this location. If you are adding machines to a previously issued certificate check update and give amusement machine certificate number. CERTIFICATE REQUIRED TO BE DISPLAYED. Any sales tax dealer that is registered or is required to be registered who is an operator of coinoperated amusement machines which are operated in Florida must apply for an Amusement Machine Certificate Form DR-18C. This application must also be submitted when an operator wishes to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign florida dr 18 2006

Edit your florida dr 18 2006 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your florida dr 18 2006 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit florida dr 18 2006 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit florida dr 18 2006. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR DR-18 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out florida dr 18 2006

How to fill out FL DoR DR-18

01

Obtain the FL DoR DR-18 form from the Florida Department of Revenue website or your local tax office.

02

Begin by filling out your name and address in the designated fields at the top of the form.

03

Provide your Social Security Number or Employer Identification Number (EIN) where required.

04

Indicate the type of exemption or deduction you are applying for by checking the appropriate box.

05

Complete all relevant sections regarding your income, expenses, and other financial details as specified in the form.

06

Review your entries for accuracy and completeness before submitting.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate tax office either via mail or electronically, as instructions suggest.

Who needs FL DoR DR-18?

01

Individuals or businesses seeking to claim an exemption or deduction in Florida.

02

Taxpayers who have a change in circumstances that may affect their tax obligations.

03

Property owners applying for tax relief or exemptions such as homestead exemption.

Fill

form

: Try Risk Free

People Also Ask about

What is an amusement machine?

Amusement Machine means any electronic or mechanical machine or device intended for use as a game or source of entertainment or amusement offered for use by the public by any person for profit or gain and shall include a pinball machine, video game, shooting gallery, or other similar machine or device including an

What is the sales tax on amusement machines in Florida?

It is important to know the sales tax rate is not exactly the same across Florida. There is the state rate of 6%. However, some counties charge a county rate.

How much is an arcade license in Florida?

This application and the required $30 per machine fee may be delivered to the nearest Florida Department of Revenue service center or mailed to the address below. Make your check (U.S. funds only) or money order payable to the Florida Department of Revenue.

What equipment is exempt from sales tax in Florida?

Industrial machinery and equipment can include molds, dies, machine tool or other appurtenances/accessors to the machinery and equipment, testing equipment, test beds, computers, and software. Building materials purchased for use in manufacturing or expanding clean rooms in these facilities will also be exempt.

What is the sales tax on equipment in Florida?

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Florida's general state sales tax rate is 6% with the following exceptions: Retail sales of new mobile homes - 3% Amusement machine receipts - 4%

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit florida dr 18 2006 in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing florida dr 18 2006 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit florida dr 18 2006 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing florida dr 18 2006.

How do I edit florida dr 18 2006 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share florida dr 18 2006 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is FL DoR DR-18?

FL DoR DR-18 is a tax form used in Florida for reporting certain tax information to the Department of Revenue.

Who is required to file FL DoR DR-18?

Florida residents or businesses that meet specific criteria related to income or sales tax are required to file FL DoR DR-18.

How to fill out FL DoR DR-18?

To fill out FL DoR DR-18, individuals or businesses need to gather the required documentation, complete the form with accurate information, and submit it to the Florida Department of Revenue by the specified deadline.

What is the purpose of FL DoR DR-18?

The purpose of FL DoR DR-18 is to ensure compliance with Florida tax laws by providing necessary tax information to the state.

What information must be reported on FL DoR DR-18?

FL DoR DR-18 requires reporting of income, taxes owed, deductions, and other relevant financial information as specified in the form's instructions.

Fill out your florida dr 18 2006 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Florida Dr 18 2006 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.