FL DoR DR-18 2016 free printable template

Show details

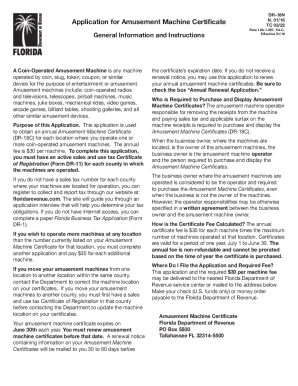

Purpose of this Application. This application is used to obtain an annual Amusement Machine Certificate DR-18C for each location where you operate one or more coin-operated amusement machines. 097 Florida Administrative Code Effective 01/16 the certificate s expiration date. If you do not receive a renewal notice you may use this application to renew your annual amusement machine certificates. If you wish to operate more machines at any location than the number currently listed on your...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign amusement machine certificate florida

Edit your amusement machine certificate florida form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your amusement machine certificate florida form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing amusement machine certificate florida online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit amusement machine certificate florida. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR DR-18 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out amusement machine certificate florida

How to fill out FL DoR DR-18

01

Start with your personal information at the top of the form.

02

Enter your name, address, and contact information accurately.

03

Provide the details of the vehicle including the VIN, make, and model.

04

Fill out the sections regarding the registration status and any liens if applicable.

05

Include the appropriate fees and payment method in the designated area.

06

Review the form for any errors or missing information.

07

Sign and date the form at the bottom.

08

Submit the form to the appropriate Florida Department of Revenue office.

Who needs FL DoR DR-18?

01

Anyone registering a vehicle in Florida for the first time.

02

Individuals who are transferring ownership of a vehicle.

03

Brokers and dealers involved in the sale of used vehicles in Florida.

04

Persons seeking to update vehicle registration information.

Fill

form

: Try Risk Free

People Also Ask about

How do I add 8.25 tax to a price?

Sales Tax Calculation Formulas Sales tax rate = sales tax percent / 100. Sales tax = list price * sales tax rate. Total price including tax = list price + sales tax, or. Total price including tax = list price + (list price * sales tax rate), or. Total price including tax = list price * ( 1 + sales tax rate)

What taxes do you pay in Florida?

Florida's general sales tax rate is 6 percent. Each retail sale, storage for use, admission, use, or rental is taxable, along with certain services. Some items are specifically exempt. Many counties impose a discretionary sales surtax in addition to the 6 percent state tax.

What is an amusement machine?

Amusement Machine means any electronic or mechanical machine or device intended for use as a game or source of entertainment or amusement offered for use by the public by any person for profit or gain and shall include a pinball machine, video game, shooting gallery, or other similar machine or device including an

Are quarter pusher machines legal in Tennessee?

It is illegal to own a slot machine privately in the state of Tennessee.

Are skill games legal in KY?

Games of skill or chance? While Kentucky law bans most forms of gambling, the companies behind these skill games insist they're not games of chance, but games of skill. The skills it takes to play them, however, are not high level.

How much is the entertainment tax in Florida?

For events in Florida, you'll see a charge of up to 7.5% of the total amount charged to the attendee ('buyer total') for Florida Sales Tax.

How do arcade machines work?

Arcade machines are just coin operated machines programmed with games to play. Once the appropriate coin is dropped in the slot, the machine will let you play the game ingly. It was as simple as that, which is why many people easily understood the concept of arcade gaming and loved it.

What is Florida sales tax 2022?

Florida's general state sales tax rate is 6% with the following exceptions: Retail sales of new mobile homes - 3% Amusement machine receipts - 4% Rental, lease, or license of commercial real property - 5.5%

Do I need a license to have a vending machine in Texas?

Obtain a Vending Machine License in Texas To properly operate your business, you must obtain a Texas Coin Operated Machine General Business License. You'll also have to get a license to collect sales tax.

Does Florida have tax on games?

There is no state income tax on gambling winnings in Florida.

What is the sales tax on $100 in Florida?

The Florida (FL) state sales tax rate is currently 6%.

What is a skill based amusement machine?

ing to the OCCC, a SBAM is a gaming machine that is dependent upon skill to win. It can be electrical, mechanical, video, or digital in nature.

What is a coin operated machine?

Coin-operated means the device is both activated and operated by the purchaser upon providing the device with a payment or payment indicator. Examples include: Inserting a coin, paper currency, or . Swiping a card. Entering a code.

What taxes are not charged in Florida?

There is no personal income tax in Florida. Florida Sales Tax: Florida sales tax rate is 6%. Florida State Tax: Florida does not have a state income tax.

Are coin pusher machines legal in Texas?

Businesses that offer coin-operated amusement machines for their customers must be licensed or registered by the Comptroller's office. The agency also collects a state occupation tax for each machine exhibited.

What are amusement machines?

Amusement Machine means any mechanical, electronic, computerized machine or device, pinball or video game or terminal, television game or any other similar device offered for use to the public for profit or gain; Sample 1.

What is a coin operated amusement machine?

7993 Coin-Operated Amusement Devices. Establishments primarily engaged in operating coin-operated amusement devices, either in their own or in other places of business. Such amusement devices include juke boxes, pinball machines, mechanical games, slot machines, and similar types of amusement equipment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send amusement machine certificate florida to be eSigned by others?

amusement machine certificate florida is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete amusement machine certificate florida online?

pdfFiller has made it easy to fill out and sign amusement machine certificate florida. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit amusement machine certificate florida on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing amusement machine certificate florida right away.

What is FL DoR DR-18?

FL DoR DR-18 is a form used by the Florida Department of Revenue for taxpayers to report and remit certain taxes.

Who is required to file FL DoR DR-18?

Businesses and individuals who are liable for specific taxes in Florida, such as sales and use tax, are required to file FL DoR DR-18.

How to fill out FL DoR DR-18?

To fill out FL DoR DR-18, taxpayers must provide their business information, report taxable sales, calculate the tax owed, and submit any payments due.

What is the purpose of FL DoR DR-18?

The purpose of FL DoR DR-18 is to facilitate the reporting and payment of state taxes to ensure compliance with Florida tax laws.

What information must be reported on FL DoR DR-18?

FL DoR DR-18 requires reporting of total sales, exempt sales, taxable sales, tax collected, and any adjustments or penalties applicable.

Fill out your amusement machine certificate florida online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Amusement Machine Certificate Florida is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.