IA 44-095 2023 free printable template

Show details

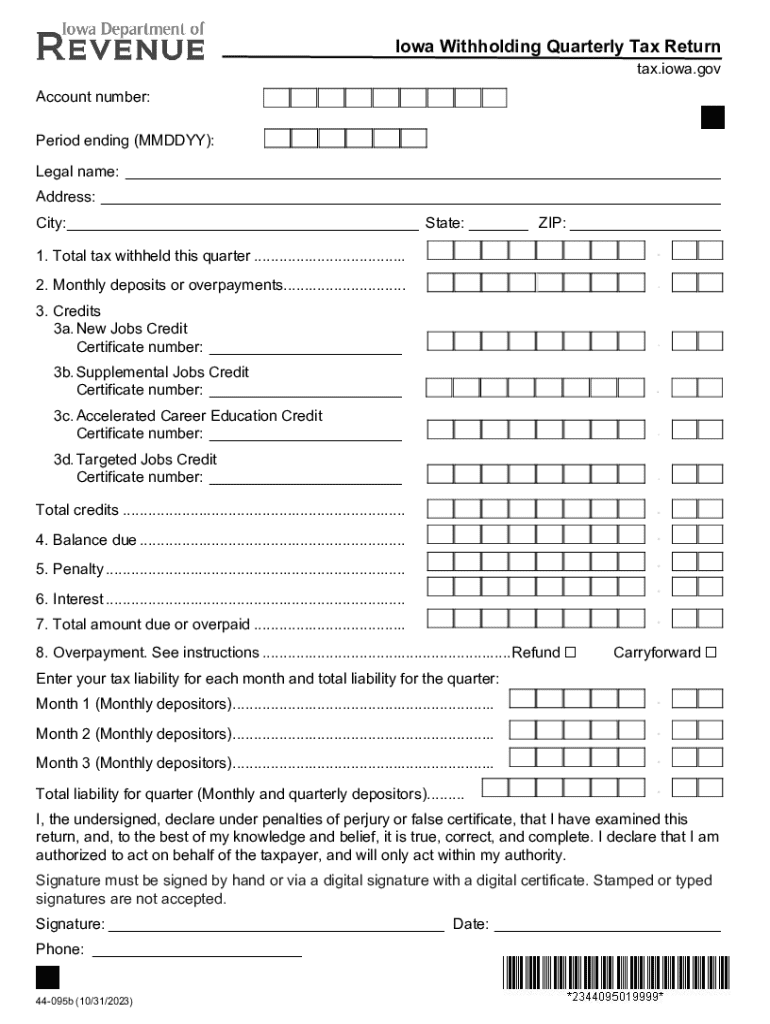

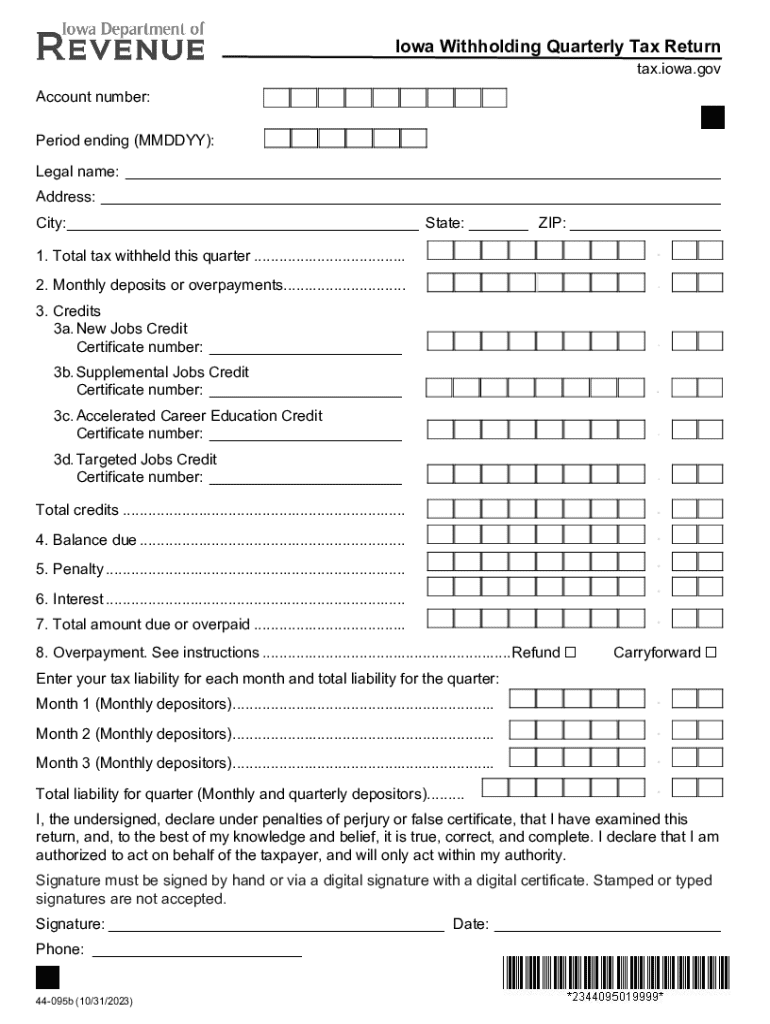

Complete the Iowa Withholding Quarterly Tax Return form accurately. This guide covers filing deadlines, penalties, and how to manage credits effectively.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IA 44-095

Edit your IA 44-095 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IA 44-095 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IA 44-095 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IA 44-095. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IA 44-095 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IA 44-095

How to fill out IA 44-095

01

Gather necessary personal information including your name, address, and contact details.

02

Review the instructions provided on the form to understand the requirements.

03

Fill out each section carefully, providing accurate and truthful information.

04

Use clear and concise language, avoiding jargon where possible.

05

Double-check all entries for accuracy and completeness before submission.

06

Sign and date the form where required.

Who needs IA 44-095?

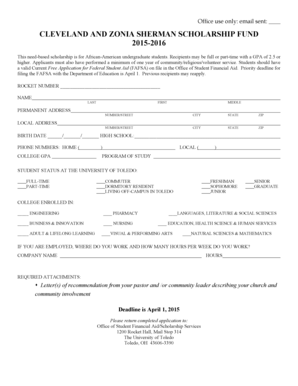

01

Individuals applying for benefits or services that require the IA 44-095 form.

02

Organizations assisting applicants in completing the form.

03

Anyone needing to report changes in their eligibility status related to the program.

Fill

form

: Try Risk Free

People Also Ask about

What are exempt withholdings?

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

How do I find out how much I owe the Iowa Department of Revenue?

You have a debt with the Iowa Department of Revenue or other agency. For more information regarding this debt, call 515-281-3114.

Where to get Iowa State income tax forms?

To access tax forms and publications for the State of Iowa, please visit the State of Iowa Department of Revenue website.

Am I exempt from Iowa withholding?

An exemption is provided for pensions, annuities, self-employed retirement plans, deferred compensation, IRA distributions, and other retirement benefits to qualified individuals. To qualify you must be 55 years of age or older, disabled, or a surviving spouse of an individual who would have qualified.

What makes you exempt from Iowa taxes?

The following individuals qualify for the exclusion: Those who are 55 years of age or older. Those who are disabled*. Surviving spouses or other qualifying survivors who receive retirement income due to the death of an individual who would have qualified for the exclusion.

How many allowances should I claim in Iowa?

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IA 44-095?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific IA 44-095 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit IA 44-095 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit IA 44-095.

How can I fill out IA 44-095 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your IA 44-095. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is IA 44-095?

IA 44-095 is a tax form used in the state of Iowa for reporting information related to certain tax payments.

Who is required to file IA 44-095?

Individuals or entities who have made tax payments that require reporting under Iowa tax law are required to file IA 44-095.

How to fill out IA 44-095?

To fill out IA 44-095, provide your identification information, report the amounts of tax payments made, and follow the instructions provided with the form.

What is the purpose of IA 44-095?

The purpose of IA 44-095 is to ensure accurate reporting of tax payments to facilitate proper record keeping and compliance with Iowa tax regulations.

What information must be reported on IA 44-095?

IA 44-095 requires reporting taxpayer identification, payment amounts, dates of payments, and other pertinent details as specified in the form instructions.

Fill out your IA 44-095 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IA 44-095 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.