IA 44-095 2024-2025 free printable template

Show details

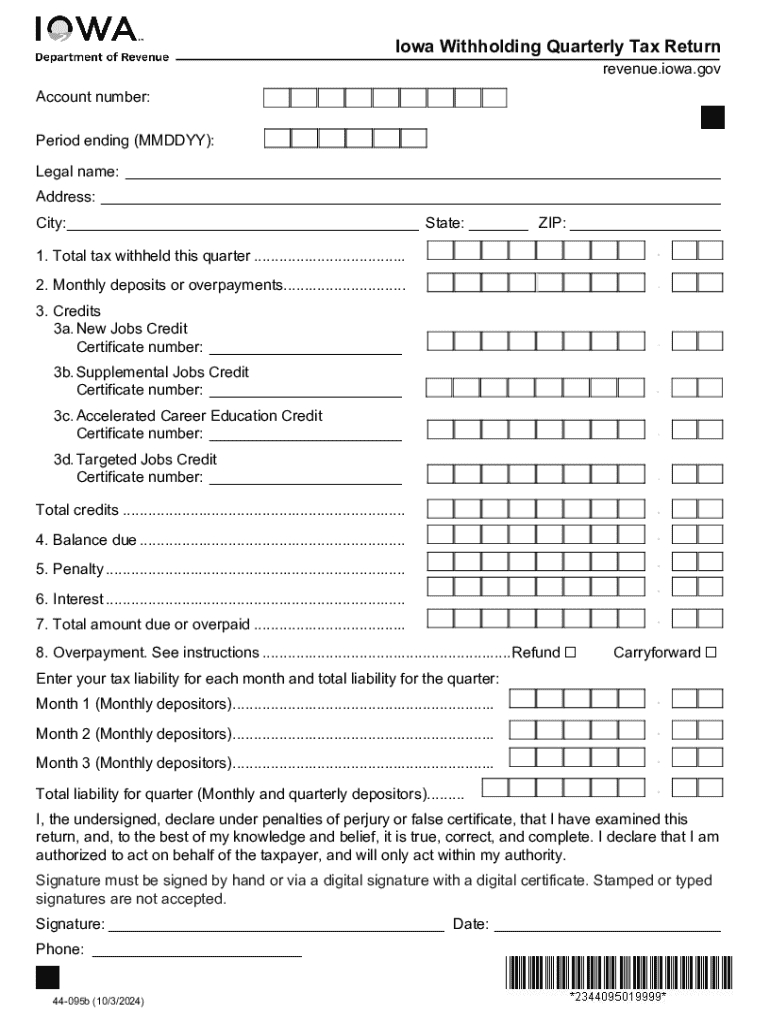

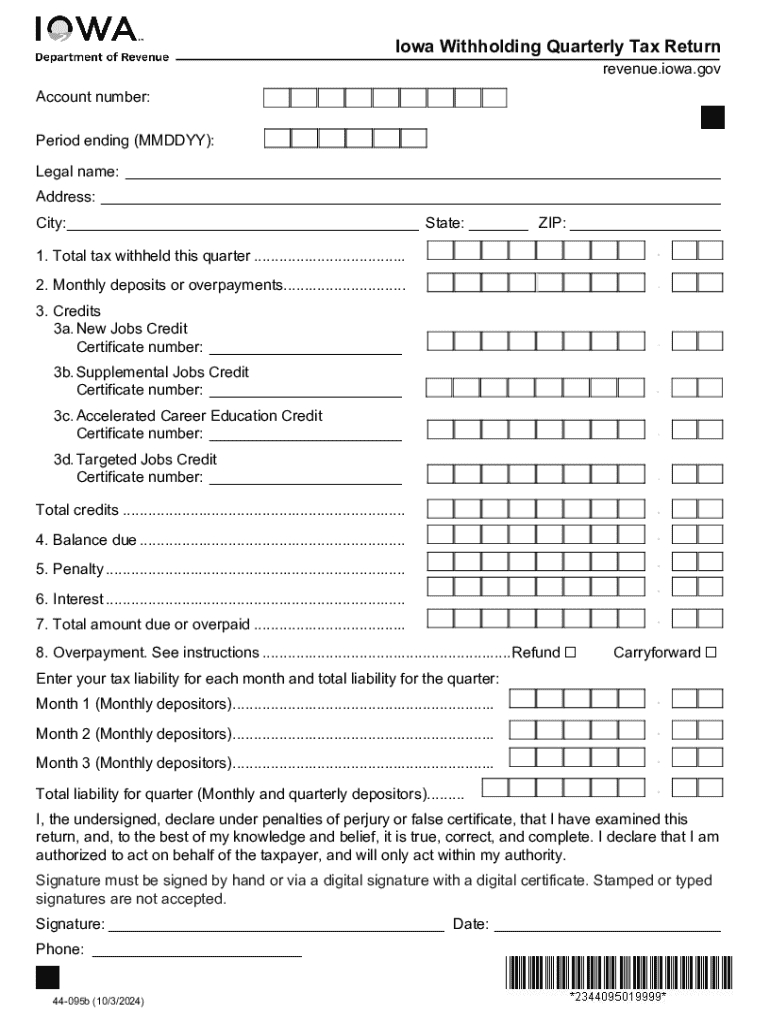

Iowa Withholding Quarterly Tax ReturnInstructions tax.iowa.govYou must file a return even if no tax was withheld. If no tax was withheld, enter zero on line 1 and line 7. Enter exact amounts including

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign iowa 44 095 form

Edit your iowa 44095 2024-2025 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iowa 44095 2024-2025 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing iowa 44095 2024-2025 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit iowa 44095 2024-2025 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IA 44-095 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out iowa 44095 2024-2025 form

How to fill out IA 44-095

01

Obtain the IA 44-095 form from the appropriate agency or website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out your personal details in the designated fields, including your name, address, and contact information.

04

Provide any relevant identification numbers or codes as requested.

05

Complete the sections that require specific information related to your application or request.

06

Review your entries for accuracy before submitting the form.

07

Sign and date the form where indicated.

08

Submit the completed form as directed, either online or by mailing it to the appropriate office.

Who needs IA 44-095?

01

Individuals who are applying for a specific service, benefit, or request that requires completion of the IA 44-095 form.

02

Persons needing to report information or submit documentation as part of a compliance or regulatory process.

Fill

form

: Try Risk Free

People Also Ask about

What are exempt withholdings?

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

How do I find out how much I owe the Iowa Department of Revenue?

You have a debt with the Iowa Department of Revenue or other agency. For more information regarding this debt, call 515-281-3114.

Where to get Iowa State income tax forms?

To access tax forms and publications for the State of Iowa, please visit the State of Iowa Department of Revenue website.

Am I exempt from Iowa withholding?

An exemption is provided for pensions, annuities, self-employed retirement plans, deferred compensation, IRA distributions, and other retirement benefits to qualified individuals. To qualify you must be 55 years of age or older, disabled, or a surviving spouse of an individual who would have qualified.

What makes you exempt from Iowa taxes?

The following individuals qualify for the exclusion: Those who are 55 years of age or older. Those who are disabled*. Surviving spouses or other qualifying survivors who receive retirement income due to the death of an individual who would have qualified for the exclusion.

How many allowances should I claim in Iowa?

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in iowa 44095 2024-2025 form without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing iowa 44095 2024-2025 form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my iowa 44095 2024-2025 form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your iowa 44095 2024-2025 form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete iowa 44095 2024-2025 form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your iowa 44095 2024-2025 form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IA 44-095?

IA 44-095 is a form used in the state of Iowa for reporting certain information related to the state income tax.

Who is required to file IA 44-095?

Individuals and businesses that have specific tax obligations as outlined by the Iowa Department of Revenue are required to file IA 44-095.

How to fill out IA 44-095?

To fill out IA 44-095, gather relevant financial information, complete each section of the form accurately, and submit it according to the instructions provided by the Iowa Department of Revenue.

What is the purpose of IA 44-095?

The purpose of IA 44-095 is to gather necessary tax information and ensure compliance with Iowa state tax laws.

What information must be reported on IA 44-095?

IA 44-095 requires reporting of income details, deductions, and other relevant tax-related information as specified in the form instructions.

Fill out your iowa 44095 2024-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Iowa 44095 2024-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.