Get the free Standard FHA VS. Jumbo FHA - Sierra Pacific Mortgage - Wholesale

Show details

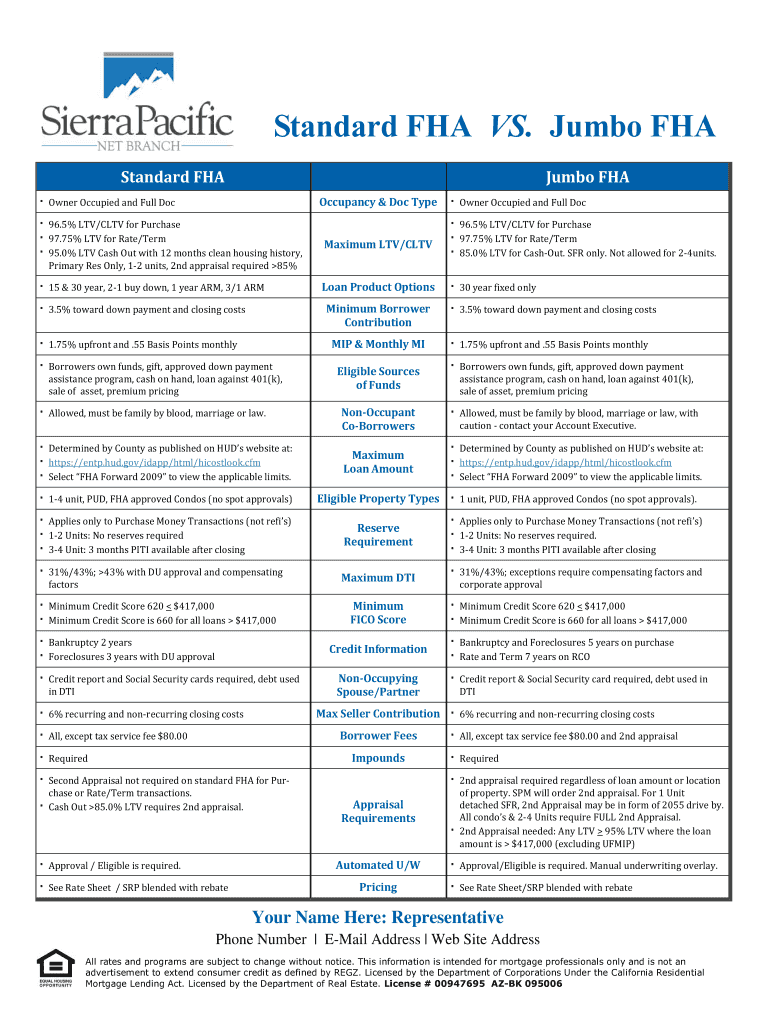

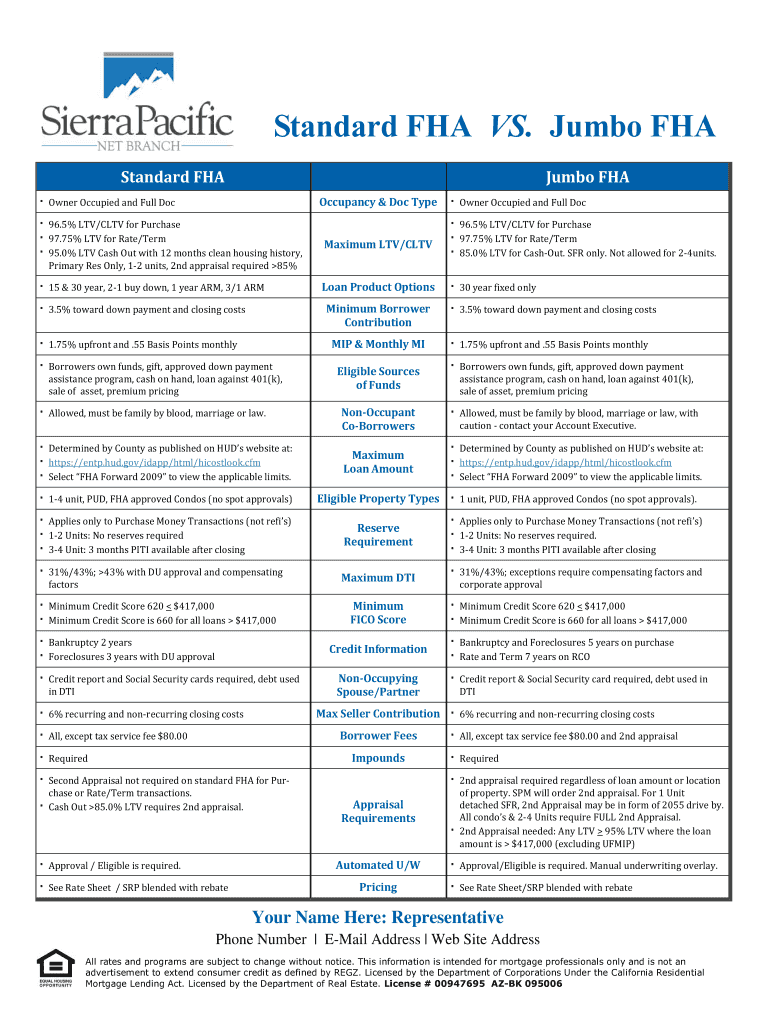

Information Technology Solutions Standard FHA VS. Jumbo FHA Standard FHA Jumbo FHA Occupancy & Doc Type Owner Occupied and Full Doc 96.5% LTV/CTV for Purchase 97.75% LTV for Rate/Term 95.0% LTV Cash

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standard fha vs jumbo

Edit your standard fha vs jumbo form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standard fha vs jumbo form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit standard fha vs jumbo online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit standard fha vs jumbo. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out standard fha vs jumbo

How to fill out standard FHA vs jumbo:

01

Understand the loan types: A standard FHA loan is a government-backed mortgage insured by the Federal Housing Administration, which allows borrowers to make a lower down payment and have more lenient credit requirements. On the other hand, a jumbo loan is a type of non-conforming mortgage that exceeds the loan limits set by Fannie Mae and Freddie Mac.

02

Gather necessary documentation: To fill out either standard FHA or jumbo loan applications, you will need to gather various documents such as proof of income, tax returns, bank statements, employment history, and identification documents. Make sure to have these documents ready.

03

Determine your eligibility: Assess your financial situation to determine if you qualify for either standard FHA or jumbo loans. Calculate your debt-to-income ratio and credit score and compare them with the lenders' requirements for each loan type. This will help you decide which loan type is suitable for your needs.

04

Choose the appropriate lender: Research and compare different lenders who offer standard FHA and jumbo loans. Evaluate their interest rates, loan terms, fees, and customer reviews to find a reputable lender that suits your financial goals.

05

Contact the lender: Reach out to your chosen lender and express your interest in applying for either a standard FHA or jumbo loan. Ask any questions you may have regarding the application process, loan requirements, and any other concerns.

06

Complete the application: Obtain the loan application form from your lender and carefully fill it out with accurate information. Double-check all fields to ensure there are no errors or missing details that could delay or hinder the loan approval process.

07

Provide supporting documents: Attach all the necessary supporting documents to your loan application. These include but are not limited to income verification, bank statements, tax returns, employment history, and identification documents. Make sure all documents are up to date and reflect your current financial standing.

08

Submit the application: Once you have completed the loan application and gathered all the required documents, submit them to your lender. It's advisable to keep copies of all the documents for your records.

Who needs standard FHA vs jumbo:

01

First-time homebuyers: Standard FHA loans are often favored by first-time homebuyers who may not have a large down payment or established credit history. The FHA loan program offers more flexible requirements, making it accessible to those who might otherwise struggle to obtain financing.

02

Borrowers with a lower credit score: If you have a lower credit score, qualifying for a jumbo loan may be more challenging. Standard FHA loans generally have more lenient credit requirements, making them a viable option for borrowers who may not meet the stricter criteria of jumbo loans.

03

Homebuyers looking to purchase an expensive property: Jumbo loans are designed for borrowers who need to finance larger loan amounts that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. If you are in the market to buy a high-end or luxury property, a jumbo loan may be necessary to cover the cost.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is standard fha vs jumbo?

Standard FHA loans are mortgages that are insured by the Federal Housing Administration and conform to their lending limits, while jumbo loans exceed those limits.

Who is required to file standard fha vs jumbo?

Individuals or families looking to finance a home purchase may consider either a standard FHA loan or a jumbo loan, depending on their financial situation and the cost of the property.

How to fill out standard fha vs jumbo?

To fill out a standard FHA loan or a jumbo loan application, applicants must provide detailed information about their income, assets, debts, and credit history.

What is the purpose of standard fha vs jumbo?

The purpose of standard FHA loans is to make homeownership more accessible by offering government-backed mortgages with lower down payment requirements, while jumbo loans provide financing for high-value properties that exceed FHA limits.

What information must be reported on standard fha vs jumbo?

Applicants must report their financial information, employment history, credit score, and details about the property they wish to purchase when applying for a standard FHA loan or a jumbo loan.

How can I manage my standard fha vs jumbo directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your standard fha vs jumbo as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make edits in standard fha vs jumbo without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your standard fha vs jumbo, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out standard fha vs jumbo on an Android device?

On an Android device, use the pdfFiller mobile app to finish your standard fha vs jumbo. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your standard fha vs jumbo online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standard Fha Vs Jumbo is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.