MN Sauk Rapids Tax Solutions Farm Income and Expense Worksheet 2022-2025 free printable template

Show details

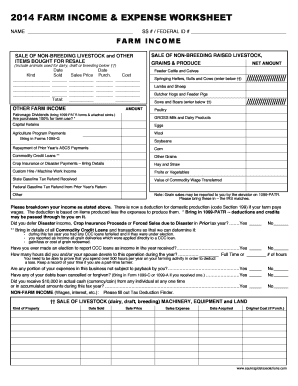

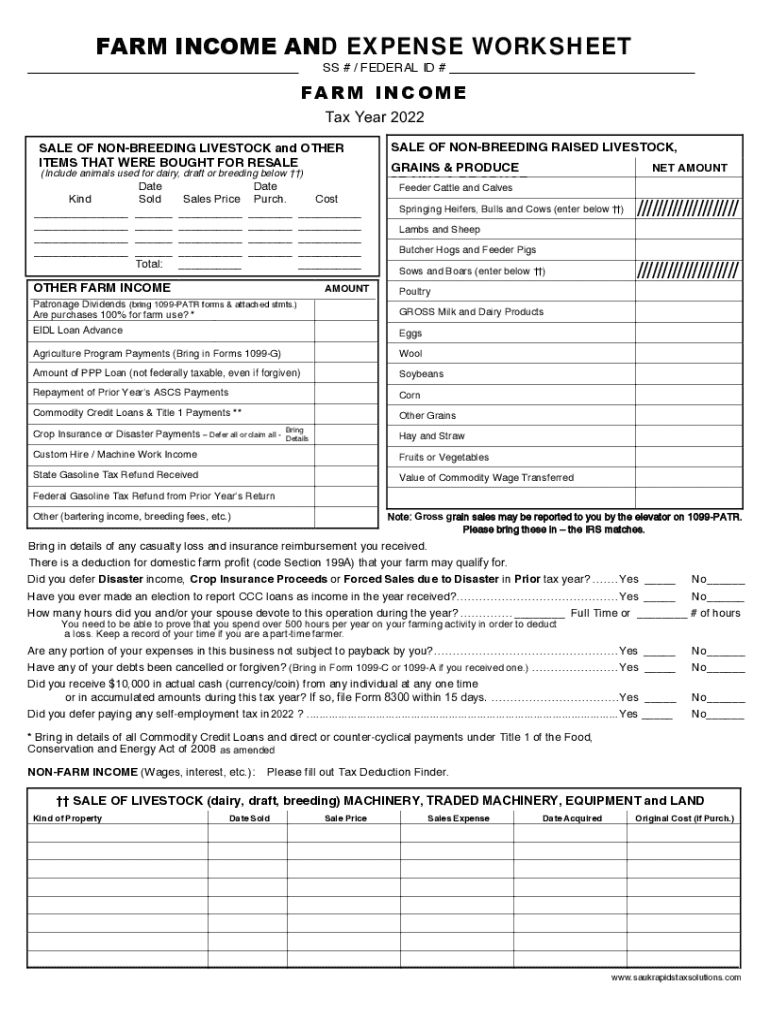

2021 FARM INCOME AND EXPENSE WORKSHEET___SS # / FEDERAL ID # ___FA R M IN C O ME

Tax Year 2022

SALE OF INBREEDING LIVESTOCK and OTHER

ITEMS THAT WERE BOUGHT FOR RESALE

(Include animals used for dairy,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN Sauk Rapids Tax Solutions Farm

Edit your MN Sauk Rapids Tax Solutions Farm form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN Sauk Rapids Tax Solutions Farm form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MN Sauk Rapids Tax Solutions Farm online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MN Sauk Rapids Tax Solutions Farm. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN Sauk Rapids Tax Solutions Farm Income and Expense Worksheet Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN Sauk Rapids Tax Solutions Farm

How to fill out 2023 farm income amp

01

Gather all necessary financial documents related to your farm income, including sales receipts, expense records, and any subsidy payments.

02

Fill out the appropriate sections of the 2023 farm income amp form, providing accurate and detailed information for each category.

03

Double-check your entries to ensure accuracy and completeness before submitting the form.

04

Submit the completed 2023 farm income amp form to the appropriate government agency or tax authority by the specified deadline.

Who needs 2023 farm income amp?

01

Farmers who earn income from agricultural activities such as crop production, livestock raising, or poultry farming.

02

Individuals or businesses that receive subsidies or grants related to farming operations.

Fill

form

: Try Risk Free

People Also Ask about

What is the average farm income in Alberta?

“Farm families in Alberta earned the highest average total income nationally for a second consecutive year in 2019,” the federal agency said in a recent report. “However, their average total income was down 2.7 per cent to $172,721.”

What is a farm expense?

: an expense incurred for whatever is used or kept for use in the family whether necessaries or luxuries. used in statutes making both husband and wife legally liable for such an expense.

How much does a farmer make per acre in Canada?

For example: A farm with an average wheat yield of 50 bushels and three-year average price of $7 would make the average gross revenue $350 per acre. Fair market land rental should be about $66 per acre (the range is usually about $63 to $77 per acre).

How much money does the average Canadian farmer make?

Average NOI per farm is forecasted to have increased to approximately $136,000 in 2022 - up 2.9% from 2021 and 43.9% higher than the 5-year average.

Is owning a farm profitable in Canada?

Despite the numerous challenges, farms in Canada were 4.0 cents per dollar more profitable on average in 2020 than in 2015. Data from the 2021 Census of Agriculture show that the expense-to-revenue ratio for farms in Canada averaged 82.9 cents per dollar in 2020, down from 86.9 cents per dollar in 2015.

How much do Canadian farm owners make?

The average total income of farm families operating a single farm in Canada was $163,098 in 2019, down 1.3% from 2018, ing to taxation records. Average off-farm income increased 1.1% to $105,032 from 2018 to 2019, while average net operating income declined 5.4% to $58,067.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MN Sauk Rapids Tax Solutions Farm in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your MN Sauk Rapids Tax Solutions Farm and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit MN Sauk Rapids Tax Solutions Farm from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including MN Sauk Rapids Tax Solutions Farm, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I edit MN Sauk Rapids Tax Solutions Farm on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing MN Sauk Rapids Tax Solutions Farm right away.

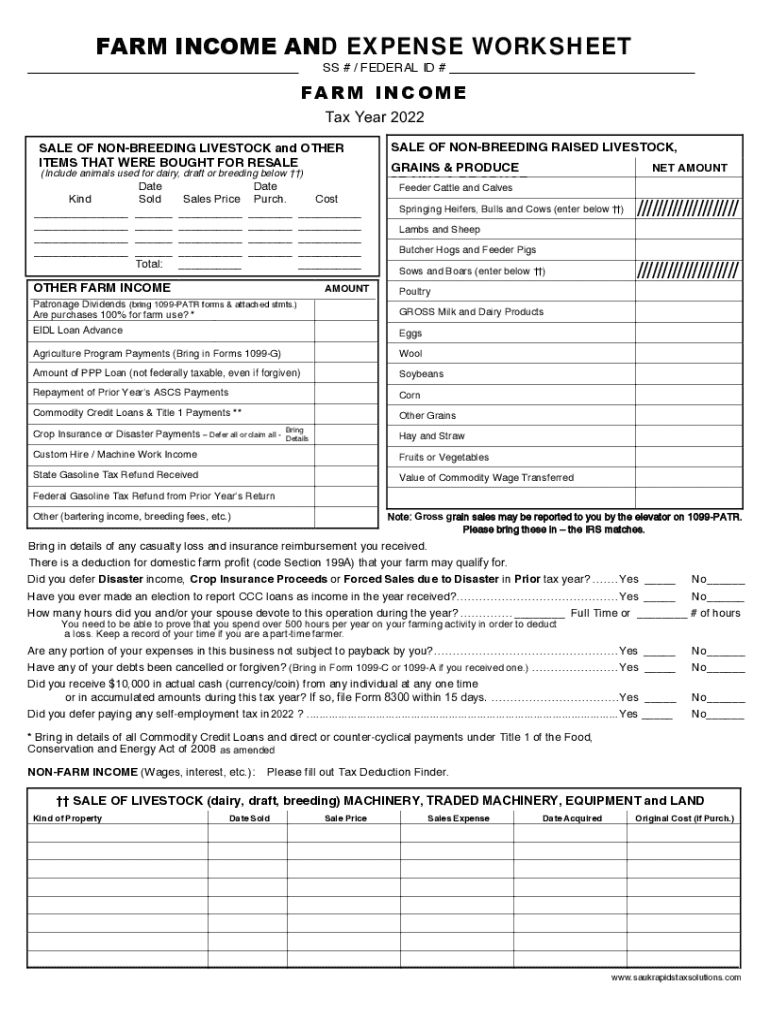

What is farm income amp expense?

Farm income and expense refers to the financial records and transactions related to agricultural activities, including revenue generated and costs incurred.

Who is required to file farm income amp expense?

Individuals or businesses engaged in farming activities are required to file farm income and expense.

How to fill out farm income amp expense?

Farm income and expense can be filled out by recording all financial transactions related to agricultural activities, including income from sales and expenses for inputs and operations.

What is the purpose of farm income amp expense?

The purpose of farm income and expense is to track the financial performance of farming activities, analyze profitability, and make informed business decisions.

What information must be reported on farm income amp expense?

Information that must be reported on farm income and expense includes revenue from sales of agricultural products, expenses for inputs such as seeds and fertilizers, and other operating costs.

Fill out your MN Sauk Rapids Tax Solutions Farm online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN Sauk Rapids Tax Solutions Farm is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.