Get the free Dsa-ss-5 guidelines on accounting for utar societies and clubs

Show details

UNIVERSITY TUN KU ABDUL RAHMAN DEPARTMENT OF STUDENT AFFAIRS A BRIEF GUIDE ON ACCOUNTING OF UNIVERSITY STUDENT SOCIETY 1. PURPOSE AND SCOPE The University Student Society means a club or society formed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dsa-ss-5 guidelines on accounting

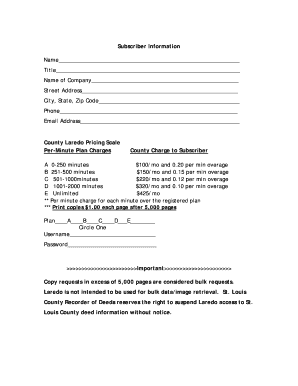

Edit your dsa-ss-5 guidelines on accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dsa-ss-5 guidelines on accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dsa-ss-5 guidelines on accounting online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit dsa-ss-5 guidelines on accounting. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dsa-ss-5 guidelines on accounting

How to Fill Out DSA-SS-5 Guidelines on Accounting:

01

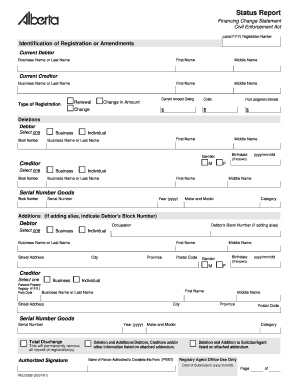

Fill out personal information: Start by providing your name, address, and contact information. This ensures that the authorities can reach you if any clarification is required.

02

Include company details: If you're filling out the guidelines on accounting for a company, specify the company name, address, and contact information. This helps identify the business entity for which the guidelines apply.

03

Describe accounting practices: Detail the accounting methods and practices used by the company. Include information about the software or systems utilized, the frequency of financial reporting, and any unique procedures or policies followed.

04

Explain financial statements preparation: Outline how financial statements are prepared within the company. This may involve describing the process for creating balance sheets, income statements, cash flow statements, and other reports required for accurate financial documentation.

05

Document internal controls: Provide information on the internal controls in place to ensure accurate and reliable financial reporting. This could include describing the segregation of duties, review processes, and the implementation of accounting controls to prevent fraud or errors.

06

Include information on auditing practices: If the company undergoes regular audits, specify how these are conducted. Include details about the audit process, the frequency of audits, and the external auditors used (if applicable).

07

Discuss accounting software and technology: If the company utilizes accounting software or technology solutions to streamline its accounting processes, mention the specific tools used and how they contribute to accuracy and efficiency.

08

Explain compliance with accounting standards: Address how the company complies with accounting standards and regulations applicable to its industry. This demonstrates that the company follows recognized guidelines to ensure accurate and reliable financial reporting.

09

Provide any additional necessary information: Include any other relevant details about accounting practices within the company that would aid in understanding and evaluating the guidelines accurately.

Who Needs DSA-SS-5 Guidelines on Accounting?

01

Small business owners: Small business owners who handle their own accounting or have an in-house accounting team can benefit from using DSA-SS-5 guidelines to ensure accurate financial reporting and compliance with accounting standards.

02

Accountants and bookkeepers: Professionals responsible for managing accounting practices for businesses or organizations can refer to DSA-SS-5 guidelines to understand best practices and ensure compliance with industry standards.

03

Auditors and compliance officers: Auditors and compliance officers can utilize DSA-SS-5 guidelines to assess the adequacy of a company's accounting practices and identify any areas of improvement or non-compliance.

04

Regulatory authorities: Government agencies or regulatory bodies responsible for monitoring financial reporting and compliance within specific industries may refer to the DSA-SS-5 guidelines while evaluating the accounting practices of companies under their jurisdiction.

05

Financial advisors and consultants: Financial advisors and consultants can use DSA-SS-5 guidelines to assess the financial health and accuracy of accounting practices within a business they are working with, providing valuable insights and recommendations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is dsa-ss-5 guidelines on accounting?

The dsa-ss-5 guidelines on accounting provide standardized guidelines for accounting practices.

Who is required to file dsa-ss-5 guidelines on accounting?

All companies or organizations that fall under the dsa-ss-5 guidelines are required to file their accounting information.

How to fill out dsa-ss-5 guidelines on accounting?

Fill out the dsa-ss-5 guidelines by providing accurate financial information following the guidelines provided.

What is the purpose of dsa-ss-5 guidelines on accounting?

The purpose of dsa-ss-5 guidelines is to ensure consistency and transparency in financial reporting.

What information must be reported on dsa-ss-5 guidelines on accounting?

Information such as income statements, balance sheets, cash flow statements, and other financial data must be reported.

How can I manage my dsa-ss-5 guidelines on accounting directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign dsa-ss-5 guidelines on accounting and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify dsa-ss-5 guidelines on accounting without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your dsa-ss-5 guidelines on accounting into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete dsa-ss-5 guidelines on accounting on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your dsa-ss-5 guidelines on accounting by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your dsa-ss-5 guidelines on accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dsa-Ss-5 Guidelines On Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.