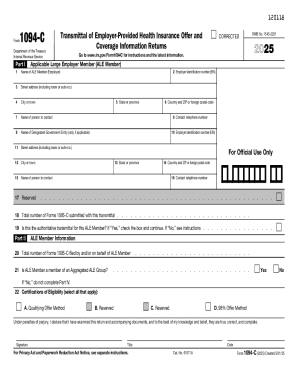

IRS 1094-C 2024 free printable template

Instructions and Help about IRS 1094-C

How to edit IRS 1094-C

How to fill out IRS 1094-C

Latest updates to IRS 1094-C

About IRS 1094-C 2024 previous version

What is IRS 1094-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1094-C

What should you do if you realize you've made a mistake on your IRS 1094-C after filing?

If you notice an error on your IRS 1094-C after submission, you should file an amended return. This involves submitting a new Form 1094-C with the correct information and marking it as 'corrected.' It's essential to submit this amendment as soon as the mistake is discovered to ensure compliance.

How can you track the status of your submitted IRS 1094-C?

To verify the receipt and processing status of your submitted IRS 1094-C, you can use the IRS e-file tracking system if filed electronically. It’s crucial to keep a record of your submission confirmation number if filing online, as this will aid in tracking your file.

What are some common errors to avoid when preparing your IRS 1094-C?

Common errors include incorrect employee counts, misplaced attachments, and clerical errors in the employer identification number. Double-checking the information entered and using validation tools offered by e-filing software can help mitigate these mistakes.

What should you do if your IRS 1094-C submission is rejected?

If your IRS 1094-C is rejected, you will receive a notification detailing the reason for rejection. Review the errors outlined, make necessary corrections, and resubmit the form as soon as possible to avoid potential penalties.