What is IRS 1095-B?

IRS 1095-B is a tax form used by health insurance providers to report information about individuals who are covered by minimum essential health coverage. This form assists the Internal Revenue Service (IRS) in verifying compliance with the Affordable Care Act (ACA) requirements regarding health coverage.

Who needs the form?

Individuals who received minimum essential health coverage through a government program, employer-sponsored plan, or marketplace coverage will receive an IRS 1095-B form. Health insurance providers are responsible for issuing this form to eligible individuals, ensuring that everyone has documentation of their health coverage for tax purposes.

Components of the form

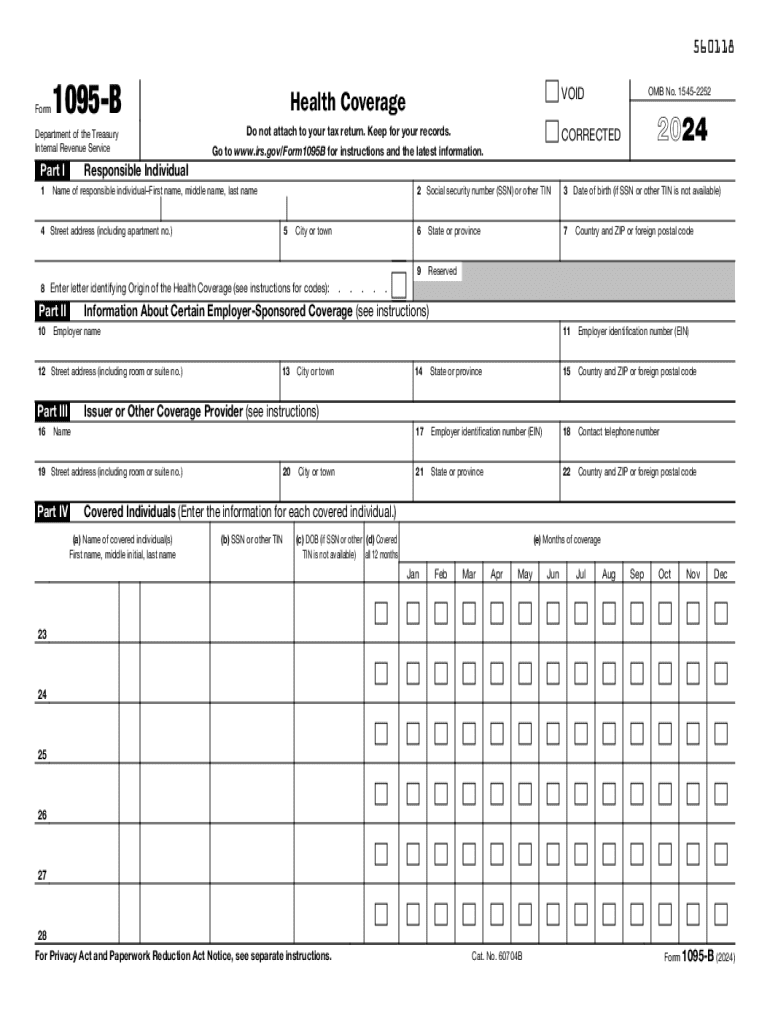

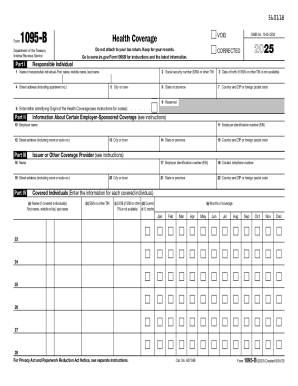

IRS 1095-B consists of several key components:

01

Part I: Information about the insured individual, including name and Social Security number.

02

Part II: Details regarding the issuing insurance provider, along with their Employer Identification Number (EIN).

03

Part III: Coverage information, including the months of coverage for each individual listed on the form.

Each part of the form must be completed accurately to ensure proper reporting and compliance with IRS regulations.

What information do you need when you file the form?

When filing IRS 1095-B, you will need various pieces of information, including:

01

Your full name and address.

02

Your Social Security number or Individual Taxpayer Identification Number (ITIN).

03

The name, address, and EIN of the insurance provider.

04

Details regarding covered individuals, including their names and Social Security numbers.

Having this information on hand will streamline the filing process and ensure all necessary details are included.

What is the purpose of this form?

The primary purpose of IRS 1095-B is to provide information about health coverage to both the taxpayer and the IRS. It confirms that the taxpayer had health coverage during the tax year, which may exempt them from the Shared Responsibility Payment for not having insurance. This form helps individuals maintain proper records of their healthcare and assists the IRS in enforcing health coverage mandates.

When am I exempt from filling out this form?

You are generally exempt from filling out the IRS 1095-B if you did not have health coverage at any point during the tax year, or if you qualify for an exemption under the Affordable Care Act. Additionally, individuals who have employer-sponsored health insurance typically do not need to file this form if their employer provides IRS 1095-C instead. Always verify your unique circumstances, as exemptions can vary.

What are the penalties for not issuing the form?

Failure to issue IRS 1095-B when required can result in penalties for the health insurance provider. The IRS imposes fines for noncompliance, which can accumulate based on the number of employees and the duration of the non-filing period. Additionally, individuals may face complications during tax filing if they lack proof of health coverage.

Is the form accompanied by other forms?

IRS 1095-B can be submitted alongside IRS 1040 when filing your individual tax return; however, it is not necessarily accompanied by additional forms. It may also complement IRS 1095-A or 1095-C if applicable based on your health coverage situation.

Where do I send the form?

The IRS 1095-B form does not need to be sent to the IRS directly unless requested. Instead, you should keep it with your tax records. In case you are filing electronically, you may not need to submit the form to the IRS at all, as long as you have received it for your records. Always check the IRS guidelines for any changes related to the submission of this form.