Comprehensive Guide to Articles of Incorporation of Form

Understanding articles of incorporation

Articles of Incorporation serve as the foundation for your business, forming its legal identity and structure. They are formal documents that establish a corporation's existence, filed with the state government. This document is crucial because it delineates essential information about your corporation, setting the groundwork for its operations.

The importance of Articles of Incorporation cannot be overstated; they not only pave the way for your business to operate legally but also protect your personal assets from corporate liabilities. By formally declaring your company’s purposes and structure, these articles ensure compliance with state requirements and provide necessary details that establish transparency with the state and potential investors.

It’s vital to differentiate Articles of Incorporation from other business documents like bylaws, operating agreements, and business licenses. While Articles of Incorporation provide an overview of a company’s structure and purpose, bylaws will outline its internal operational rules. This distinction is essential for any entrepreneur looking to navigate corporate governance effectively.

Key components of articles of incorporation

The structure of your Articles of Incorporation typically includes essential components that provide clarity and direction. These components vary by state, but a comprehensive set is standard across most jurisdictions.

The chosen name must be unique and meet state-specific guidelines to avoid confusion with existing corporations.

Specify if the corporation is perpetual or has a defined timeframe.

General or specific description of the business purpose is included here.

Legal authority granted to the corporation to conduct business activities.

This designates a person or entity responsible for receiving legal documents on behalf of the corporation.

Confirms the acceptance of the designated registered agent.

Details the primary location of business operations.

Outlines the types and total number of shares the corporation may issue.

List of initial directors responsible for the management.

Notes the relationship with internal governing rules.

Conditions under which the corporation may be dissolved.

Specifies protections for directors and officers against legal liabilities.

Identifies the person(s) who are creating the corporation and their responsibilities.

Process for filing articles of incorporation

Filing your Articles of Incorporation is a pivotal step in forming your corporation; however, the process may seem overwhelming. It's essential to follow a structured approach to ensure accuracy and compliance.

Gather necessary information, including your business name, purpose, registered agent details, and any other essential information.

Ensure that you locate your state’s corporate filing office, as this is where your Articles must be submitted.

Each state has different fee requirements; ensure you check these in advance.

Once filed, keep a copy for your records as proof of your corporation's existence.

Common challenges and solutions

Navigating the complexities of filing Articles of Incorporation often comes with challenges. You may face issues when selecting a name for your corporation, ensuring compliance with specific state regulations, or experiencing delays in processing.

To overcome naming issues, conduct a thorough search in your state’s business registry. It's also essential to consult with your legal advisor to ensure your chosen name complies with local laws. For compliance concerns, familiarize yourself with your state's requirements, potentially seeking the guidance of a legal professional who specializes in corporate law. If you encounter delays, stay in contact with the filing office to expedite your application and address any outstanding questions they might have.

Modifying articles of incorporation

Throughout a corporation's lifecycle, situations may arise that require modifications to the Articles of Incorporation. This can happen due to changes in business structure, ownership, or regulatory compliance.

Consider amendments when there’s a significant change in ownership, purpose, or corporate structure.

Follow a structured process similar to initial filing: draft the amendment, gather necessary approvals, and submit to the state.

Frequent amendments include changes in business name, address alterations, and adjustments in the number of authorized shares.

Articles of incorporation vs. other corporate documents

Understanding the relationship between Articles of Incorporation and other vital corporate documents is crucial for any business. Each plays its unique role in the corporate structure.

Operating agreements are more detailed guides governing the operations of LLCs, while Articles of Incorporation are broader for corporations.

Bylaws serve as internal rules, while Articles of Incorporation outline the corporation’s structure and purpose.

Licenses permit operations in regulated industries, while Articles establish the business legally.

Articles of Organization pertain specifically to LLCs, whereas Articles of Incorporation are for corporations.

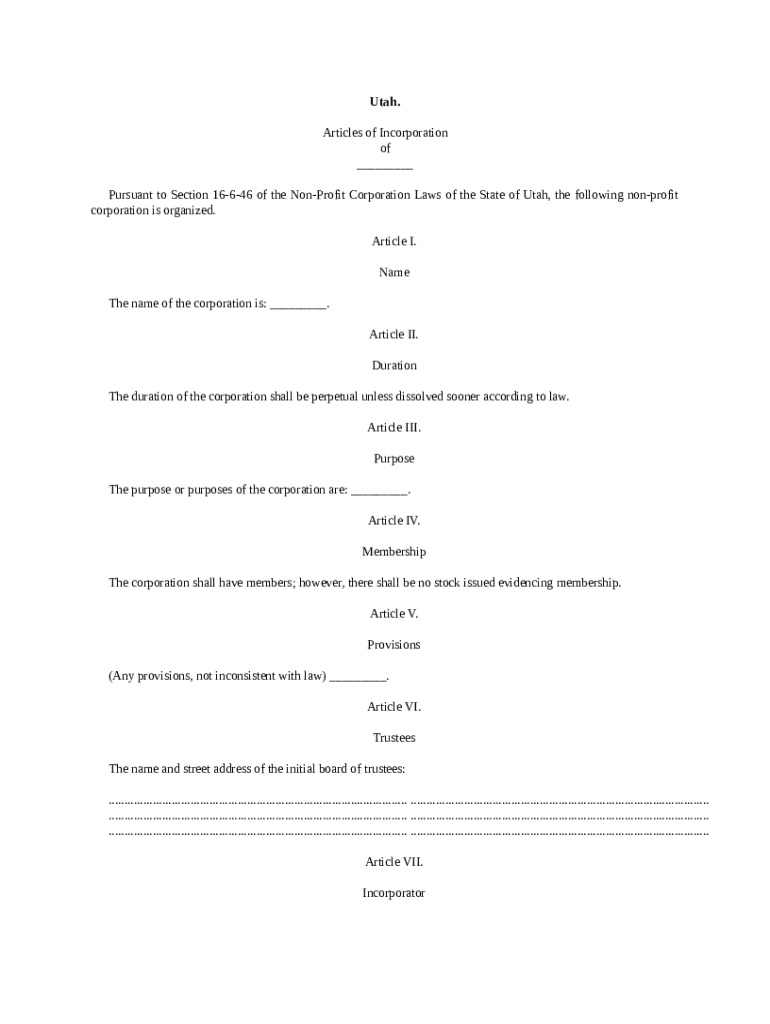

Sample articles of incorporation

Examining a sample template of Articles of Incorporation helps deepen your understanding of how to effectively draft your articles. A well-structured example can serve as an invaluable reference.

Learn the typical sections included in a sample and how they function together.

Identify critical components that align with your corporation's needs.

Utilize a template as a starting point, adapting it according to your corporation’s specific information.

Utilizing pdfFiller for your articles of incorporation

pdfFiller provides a user-friendly platform that simplifies the creation and management of your Articles of Incorporation. This digital solution enhances your ability to handle important documents efficiently.

Access templates, make revisions in real-time, and collaborate with team members remotely.

Follow these steps to create and manage your Articles of Incorporation:

Start by locating the Articles of Incorporation template on pdfFiller.

Input your corporation's specific details into the template.

Utilize pdfFiller’s tools to edit and electronically sign your documents.

Organize and store your Articles securely within pdfFiller’s cloud system.

Incorporating pdfFiller into your document management process promotes better collaboration across your team, making it easier to gather feedback and finalize essential documentation.

Best practices for articles of incorporation

Ensuring the clarity and compliance of your Articles of Incorporation is pivotal for your business's success. Following a few best practices can aid in enhancing the quality of your document and its acceptance by state authorities.

Be clear and concise in outlining each article while adhering to state guidelines.

Thoroughly review your documents for accuracy before filing to avoid unnecessary delays.

Consult with a lawyer who specializes in corporate law to ensure your Articles meet all legal requirements.

Specific state requirements for articles of incorporation

The requirements for Articles of Incorporation may vary significantly across different states. Understanding these variations is critical for successful filing.

Each state has unique nuances regarding necessary information, filing fees, and submission processes. Resources like the state’s Secretary of State website can provide detailed guidelines on what is required specifically for your location. Additionally, consulting local business advisors can ensure that you stay compliant with state-specific regulations.

Frequently asked questions about articles of incorporation

Frequently, individuals new to the world of corporate startups have pressing questions about Articles of Incorporation. Addressing these can demystify some common misconceptions.

Failing to file means your business does not have legal recognition, leading to personal liability.

Processing times vary by state but can typically range from a few days to several weeks.

Yes, amendments can be made as your business evolves, following specific state procedures.