Get the free Loan Servicing Set up Checklist

Show details

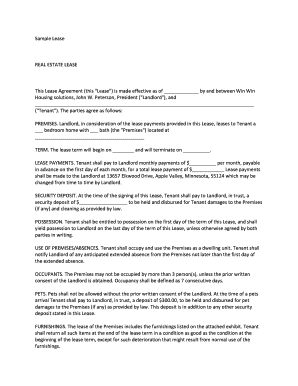

This document serves as a checklist for new clients of Provident Loan Servicing to start their loan servicing account. It outlines the necessary documentation required for borrowers and lenders, as well as the fees associated with the account setup and ongoing servicing. The document also contains important information regarding the terms and conditions of the loan servicing.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan servicing set up

Edit your loan servicing set up form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan servicing set up form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan servicing set up online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit loan servicing set up. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan servicing set up

How to fill out loan servicing set up

01

Gather necessary documents: Collect all required documentation related to the loan, including borrower information, loan terms, and payment schedules.

02

Set up an account: Create an account with a loan servicing platform or assign a loan servicing department within your organization.

03

Input borrower details: Enter borrower details such as name, address, contact information, and Social Security number into the system.

04

Define loan terms: Input the loan amount, interest rate, repayment terms, and any collateral information.

05

Establish payment schedule: Set up a payment schedule indicating due dates, payment amounts, and any grace periods.

06

Configure communication preferences: Decide how and when you will communicate with borrowers (e.g., email reminders, phone calls).

07

Test the system: Run a test transaction to ensure everything is set up correctly and that payments are processed accurately.

08

Provide borrower access: If applicable, give borrowers access to an online portal where they can view loan details and make payments.

09

Monitor and maintain: Regularly monitor loan accounts for accuracy and address any issues that arise after setup.

Who needs loan servicing set up?

01

Financial institutions that offer loans and need to manage the servicing of those loans effectively.

02

Small businesses that provide financing options to customers and require a platform to handle repayments.

03

Individuals who have provided personal loans to family or friends and want a systematic way to track payments.

04

Startups in the fintech industry that aim to offer loan products and need a structured loan servicing setup.

05

Real estate investors who need to manage mortgage loans for rental properties or investment properties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my loan servicing set up in Gmail?

Create your eSignature using pdfFiller and then eSign your loan servicing set up immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete loan servicing set up on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your loan servicing set up. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit loan servicing set up on an Android device?

The pdfFiller app for Android allows you to edit PDF files like loan servicing set up. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is loan servicing set up?

Loan servicing set up refers to the process of establishing the necessary administrative and financial structures to manage the servicing of a loan, including payment processing, account management, and customer communication.

Who is required to file loan servicing set up?

Entities that originate or service loans, such as banks, credit unions, and other financial institutions, are typically required to file loan servicing set up.

How to fill out loan servicing set up?

To fill out a loan servicing set up, gather the necessary information about the loan, complete the required forms accurately, and provide documentation to support the loan's terms and servicing details.

What is the purpose of loan servicing set up?

The purpose of loan servicing set up is to ensure that loans are serviced properly, payments are processed efficiently, and both the lender and borrower can maintain clear communication throughout the loan's lifecycle.

What information must be reported on loan servicing set up?

Information required in a loan servicing set up typically includes borrower details, loan terms, payment schedules, interest rates, and servicing policies.

Fill out your loan servicing set up online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Servicing Set Up is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.