IRS 1040 - Schedule C 2024-2025 free printable template

Show details

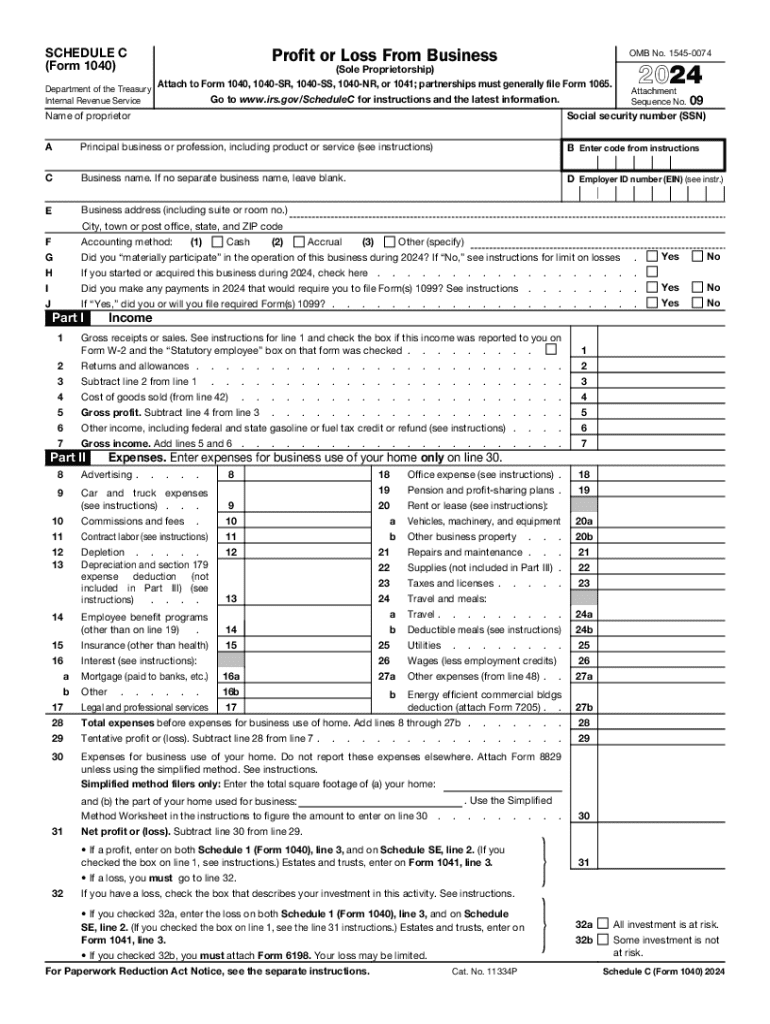

SCHEDULE C Form 1040 Profit or Loss From Business Department of the Treasury Internal Revenue Service OMB No. 1545-0074 Sole Proprietorship Attach to Form 1040 1040-SR 1040-SS 1040-NR or 1041 partnerships must generally file Form 1065. Cat. No. 11334P 32a 32b All investment is at risk. Some investment is not at risk. Schedule C Form 1040 2024 Page 2 Method s used to value closing inventory Was there any change in determining quantities costs or valuations between opening and closing inventory If...Yes attach explanation. Go to www*irs*gov/ScheduleC for instructions and the latest information* Attachment Sequence No* 09 Name of proprietor Social security number SSN A Principal business or profession including product or service see instructions B Enter code from instructions C Business name. If no separate business name leave blank. D Employer ID number EIN see instr* E Business address including suite or room no. F G City town or post office state and ZIP code Cash Accrual Other specify...Accounting method Did you materially participate in the operation of this business during 2024 If No see instructions for limit on losses. Yes No H I J If you started or acquired this business during 2024 check here. Did you make any payments in 2024 that would require you to file Form s 1099 See instructions. If Yes did you or will you file required Form s 1099. Part I Income Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2...and the Statutory employee box on that form was checked. Returns and allowances. Subtract line 2 from line 1. Cost of goods sold from line 42. Gross profit. Subtract line 4 from line 3. Other income including federal and state gasoline or fuel tax credit or refund see instructions. Gross income. Add lines 5 and 6. Advertising. Car and truck expenses see instructions. Commissions and fees. Contract labor see instructions Office expense see instructions. Pension and profit-sharing plans. Rent or...lease see instructions Vehicles machinery and equipment Other business property. 20a 20b Repairs and maintenance. Supplies not included in Part III. Taxes and licenses. a b Travel and meals Travel. Deductible meals see instructions 24a 24b 27a Utilities. Wages less employment credits Other expenses from line 48. Other. 16b b Energy efficient commercial bldgs Legal and professional services deduction attach Form 7205. Total expenses before expenses for business use of home. Add lines 8 through...27b. 27b Tentative profit or loss. Subtract line 28 from line 7. Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method. See instructions. Simplified method filers only Enter the total square footage of a your home Expenses. Enter expenses for business use of your home only on line 30. Depletion. Depreciation and section 179 expense deduction not included in Part III see. Employee benefit programs other than on line 19...Insurance other than health Interest see instructions Mortgage paid to banks etc* 16a and b the part of your home used for business Method Worksheet in the instructions to figure the amount to enter on line 30.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule C

How to edit IRS 1040 - Schedule C

How to fill out IRS 1040 - Schedule C

Instructions and Help about IRS 1040 - Schedule C

How to edit IRS 1040 - Schedule C

To edit IRS 1040 - Schedule C, obtain a blank form from the IRS website or use a tax preparation tool like pdfFiller. Open the form in the editing tool and make necessary adjustments. After editing, ensure that all changes reflect your current financial situation accurately.

How to fill out IRS 1040 - Schedule C

Filling out IRS 1040 - Schedule C involves a few key steps. Start by gathering all relevant financial documents, such as income statements and expense receipts. Then, follow these steps:

01

Enter your business name and location at the top of the form.

02

Report your gross receipts from sales or services performed.

03

Detail all business expenses, ensuring you categorize them correctly.

04

Calculate your net profit or loss by subtracting total expenses from gross income.

05

Sign and date the form before submitting.

Latest updates to IRS 1040 - Schedule C

Latest updates to IRS 1040 - Schedule C

The IRS regularly updates the Schedule C form to reflect changes in tax laws and reporting requirements. For the latest updates, check the IRS website, as they provide the most current forms and instructions. Notably, any tax changes that affect deductions or credits can impact how you complete this form.

All You Need to Know About IRS 1040 - Schedule C

What is IRS 1040 - Schedule C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS 1040 - Schedule C

What is IRS 1040 - Schedule C?

IRS 1040 - Schedule C is a tax form used by sole proprietors to report income and expenses related to their business. The form allows business owners to calculate their net profit or loss, which is then transferred to their personal tax return. It is an essential document for self-employed individuals in the United States.

What is the purpose of this form?

The purpose of IRS 1040 - Schedule C is to provide the IRS with a detailed report of a business's profit or loss. This form helps determine the amount of income tax owed based on the business's performance. Additionally, it enables calculation of self-employment tax for those engaged in self-employment.

Who needs the form?

Any individual operating a business as a sole proprietor or single-member LLC must file IRS 1040 - Schedule C. This includes freelancers, consultants, and tradespeople who earn income from self-employment. Corporations and partnerships do not use this form; they have separate filing requirements.

When am I exempt from filling out this form?

You are exempt from filling out IRS 1040 - Schedule C if your business only generated temporary or one-time income. Additionally, if you operated as a corporation or partnership, you would not use this form. It's important to check specific IRS guidelines for particular exemptions.

Components of the form

IRS 1040 - Schedule C consists of sections for reporting gross income, business expenses, and net profit or loss. Main components include:

01

Part I: Income - details of gross sales, cost of goods sold, and gross income.

02

Part II: Expenses - lists categorized expenses, like advertising and insurance.

03

Part III: Cost of Goods Sold - needed if you sell products.

04

Part IV: Information on your vehicle if used for business purposes.

05

Part V: Other Expenses - to report additional necessary costs.

What payments and purchases are reported?

IRS 1040 - Schedule C requires reporting all business income including sales, services, and any other forms of revenue. Payments made for business-related expenses, such as rent, utilities, purchases, and supplies, should also be recorded. Accurate reporting of these figures is crucial for correct tax liability calculations.

What are the penalties for not issuing the form?

Failure to file IRS 1040 - Schedule C when required may result in penalties, including fines and interest on unpaid taxes. Additionally, the IRS can impose a late filing penalty based on the amount of tax due and the duration of the delay. Frequent non-compliance could lead to future audits or more severe legal repercussions.

What information do you need when you file the form?

When filing IRS 1040 - Schedule C, gather essential information such as your business name, financial records showing income and expenses, and relevant details about your deductions. Ensure to have your tax ID number (EIN) if applicable, and any other necessary documentation that supports your reported figures.

Is the form accompanied by other forms?

Typically, IRS 1040 - Schedule C must accompany your personal income tax return, Form 1040. In some cases, you may also need to include other forms, such as Schedule SE for self-employment tax or other relevant schedules that correspond to specific deductions or credits.

Where do I send the form?

IRS 1040 - Schedule C should be submitted along with your Form 1040 to the IRS. The mailing address may vary depending on whether you are enclosing payment or filing without payment. It's essential to check the IRS instructions for the correct mailing address based on your location.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Paul was great and I'm very happy with PDF Filler.

I AM A NEW CUSTOMER. after A WHILE I AM ABLE TO DO SURVEY

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.