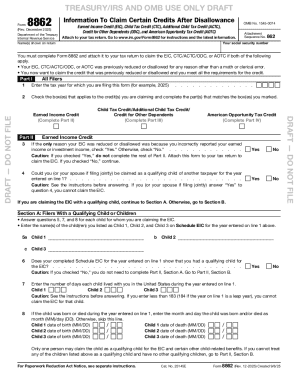

IRS 8862 2024 free printable template

Instructions and Help about 8862

How to edit 8862

How to fill out 8862

Latest updates to 8862

All You Need to Know About 8862

What is 8862?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8862

What should I do if I realize I made a mistake after filing Form 8862?

If you've filed Form 8862 and notice an error, you can submit a corrected version to amend your filing. It’s important to highlight the changes you've made and provide any necessary documentation. Be mindful of the timelines for amending, as they can vary based on the specific situation.

How can I verify the status of my Form 8862 after submission?

To check the status of Form 8862, utilize the IRS online tools designed for tracking submissions or contact IRS directly. Keep an eye out for common e-file rejection codes, which can provide insight into potential issues with your submission.

Are there any common mistakes that I should watch out for when filing Form 8862?

Yes, many filers overlook specific requirements, such as ensuring their personal information aligns with previous filings or missing supporting documentation. Double-checking the accuracy of all entries can help mitigate issues that may arise during processing.

What should I do if I receive a notice after submitting Form 8862?

Receiving a notice from the IRS after submitting Form 8862 can be concerning. Carefully review the notice's content and prepare to respond with the required documentation. It’s crucial to address the notice promptly to avoid further complications.

How does submitting Form 8862 electronically compare to paper filing in terms of tracking?

When filing Form 8862 electronically, you may benefit from more immediate feedback and tracking capabilities through IRS platforms compared to paper submissions, which can take longer to process. Ensure you meet the technical requirements and use compatible software to facilitate the e-filing process.

See what our users say