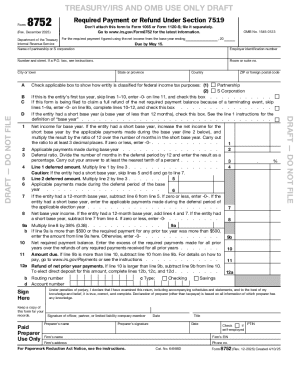

IRS 8752 2024 free printable template

Instructions and Help about IRS 8752

How to edit IRS 8752

How to fill out IRS 8752

Latest updates to IRS 8752

About IRS 8 previous version

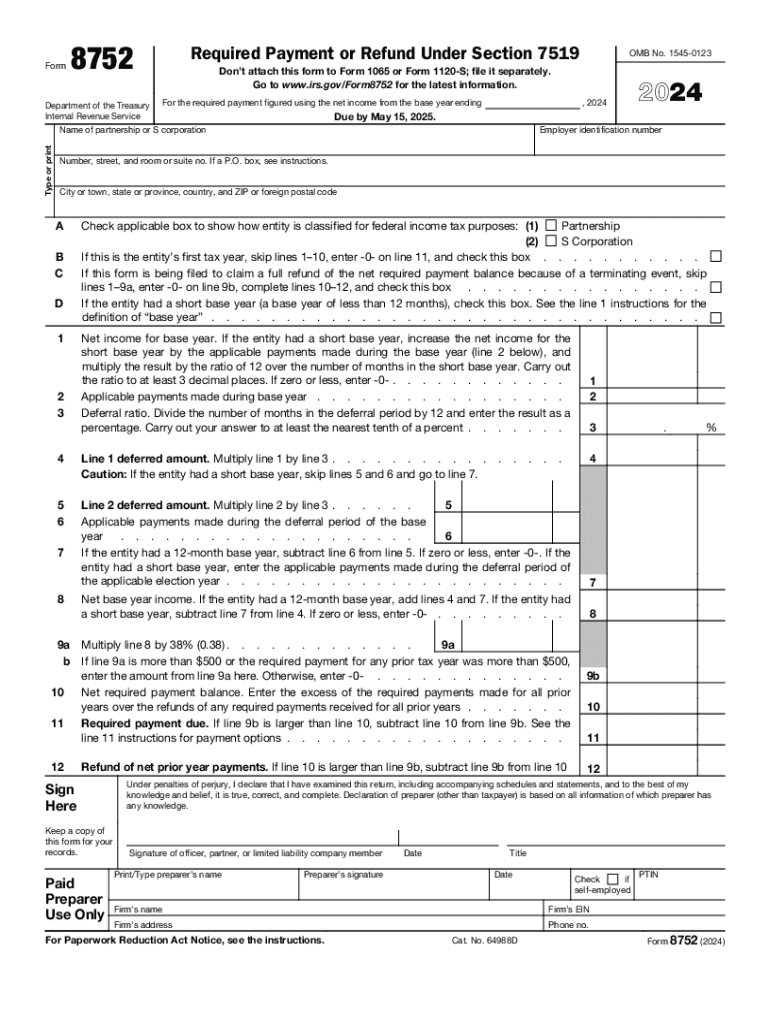

What is IRS 8752?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8752

How can I correct a mistake on my IRS 8752 after filing?

To correct mistakes after submitting your IRS 8752, you should file an amended version of the form. Clearly indicate the corrected information and include a brief explanation of the changes made. It's advisable to maintain a copy of the amended form for your records.

How can I verify if my IRS 8752 has been received and processed?

You can verify the status of your IRS 8752 by checking the IRS online tools or contacting their support for assistance. If you e-filed, be aware of common rejection codes and follow up accordingly if you suspect issues with your submission.

What should I do if I receive a notice regarding my IRS 8752?

If you receive a notice or audit related to your IRS 8752, carefully read the correspondence to understand what is being requested. Collect the necessary documentation to respond and ensure that you adhere to any deadlines specified in the notice.

Are there legal considerations when filing an IRS 8752 for someone else?

When filing an IRS 8752 on behalf of another individual, ensure you have the appropriate power of attorney (POA) in place. This document should authorize you to act on their behalf. Keep in mind that privacy and data security are paramount when handling sensitive information.

What are some common errors to avoid when filing IRS 8752?

Common errors when completing IRS 8752 include incorrect personal information, miscalculating figures, and overlooking required signatures. Double-check all details before submission and consider using software that integrates with IRS guidelines to minimize mistakes.

See what our users say