NY DTF ST-100-ATT 2015 free printable template

Show details

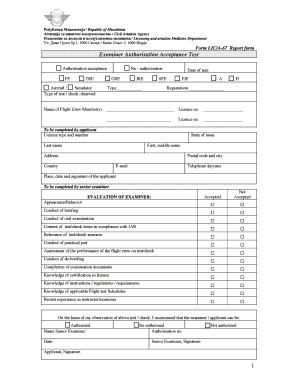

Quarterly Credit Worksheet Department of Taxation and Finance New York State and Local Quarterly Sales and Use Tax Credit Worksheet CW File as an attachment to Form ST-100 For 2nd quarter tax period:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF ST-100-ATT

Edit your NY DTF ST-100-ATT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF ST-100-ATT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF ST-100-ATT online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY DTF ST-100-ATT. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF ST-100-ATT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF ST-100-ATT

How to fill out NY DTF ST-100-ATT

01

Obtain a copy of the NY DTF ST-100-ATT form, either online or from your local tax office.

02

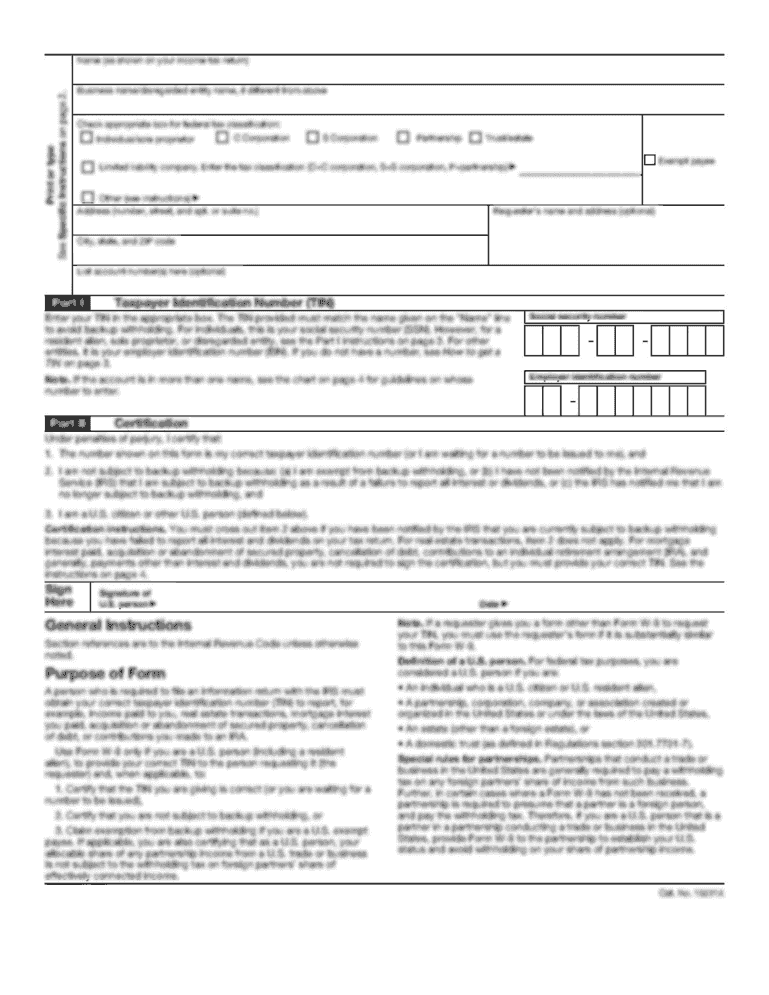

Fill in the 'Taxpayer Information' section including your name, address, and identification number.

03

Indicate the 'Type of Return' you are filing by checking the appropriate box.

04

Provide the details of the transactions or activities that necessitate the use of the form.

05

Calculate the amount of tax owed or the amount you are claiming as a refund.

06

Attach any required documentation that supports your entries on the form.

07

Review the form for accuracy and completeness.

08

Sign and date the form.

09

Submit the completed form by mail or electronically as instructed.

Who needs NY DTF ST-100-ATT?

01

Individuals or businesses that are required to file a sales tax return in New York.

02

Taxpayers claiming exemptions or adjustments related to sales tax.

03

Those conducting certain types of sales or transactions that require documentation for sales tax purposes.

Instructions and Help about NY DTF ST-100-ATT

Fill

form

: Try Risk Free

People Also Ask about

Can NY state taxes be mailed?

Pay all of your NY income taxes online at New York Tax Online Service. Complete Form IT-370 with your Check or Money Order and mail both to the address on Form IT-370. Even if you filed an extension, you will still need to file your NY tax return either via eFile or by paper by Oct. 16, 2023.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

How do you record purchases with tax?

To record received sales tax from customers, debit your Cash account, and credit your Sales Revenue and Sales Tax Payable accounts. When you remit the sales tax to the government, you can reverse your initial journal entry. To do this, debit your Sales Tax Payable account and credit your Cash account.

What is subject to NYS use tax?

Sales tax applies to retail sales of certain tangible personal property and services. Use tax applies if you buy tangible personal property and services outside the state and use it within New York State.

What are examples of taxable purchases?

Examples of taxable tangible personal property, services, and transactions that are subject to sales tax are: furniture, appliances, and light fixtures; certain clothing and footwear; machinery and equipment, parts, tools, and supplies; computers;

Does New York charge sales tax?

Sales and use tax rates in New York State reflect a combined statewide rate of 4%, plus the local rate in effect in the jurisdiction (city, county, or school district) where the sale or other transaction or use occurs.

Where can I get NY State tax forms?

You can order forms using our automated forms order telephone line: 518-457-5431.

What are the NYS sales tax quarters?

The reporting periods covered by quarterly returns are March 1 through May 31, June 1 through August 31, September 1 through November 30, and December 1 through February 28/29.

What is st100?

Form ST-100, New York State and Local Quarterly Sales and Use Tax Return.

Where do I mail my NYS sales tax?

Mailing Address - If you need to write, address your letter to: NYS Tax Department, Taxpayer Assistance Bureau, W A Harriman Campus, Albany NY 12227.

How do I know if I owe use tax California?

You May Owe Use Tax. You may owe “use tax” if you made a purchase from an out-of-state retailer and were not charged California tax on the purchase. If you have not saved your receipts, you may calculate and pay estimated use tax on your 2021 California Income Tax return, based upon your income.

How do I pay NYS sales tax?

Log in to (or create) your Business Online Services account. Select the ≡ Services menu in the upper-left corner of your Account Summary homepage. Select Sales tax - file and pay, then select Sales tax web file from the expanded menu.

What does purchases subject to tax mean?

Generally, if the item would have been taxable if purchased from a California retailer, it is subject to use tax. For example, purchases of clothing, appliances, toys, books, furniture, or CDs would be subject to use tax.

Where do I mail my NYS sales tax payment?

Mailing Address - If you need to write, address your letter to: NYS Tax Department, Taxpayer Assistance Bureau, W A Harriman Campus, Albany NY 12227.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY DTF ST-100-ATT to be eSigned by others?

Once you are ready to share your NY DTF ST-100-ATT, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out NY DTF ST-100-ATT using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign NY DTF ST-100-ATT and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit NY DTF ST-100-ATT on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign NY DTF ST-100-ATT right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

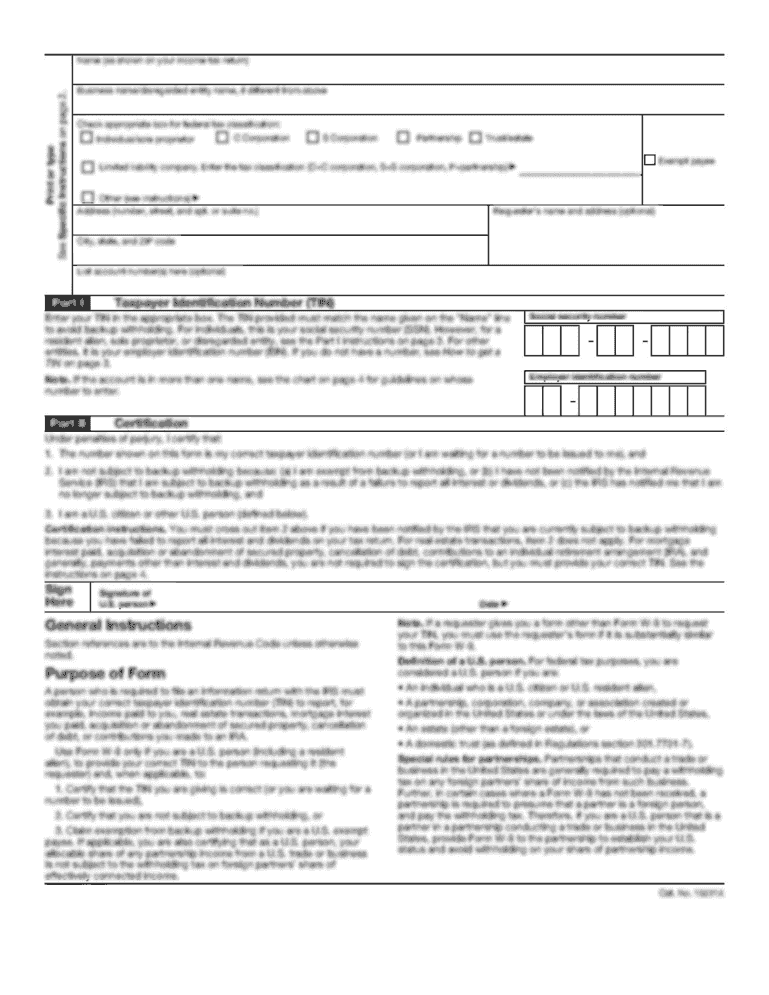

What is NY DTF ST-100-ATT?

NY DTF ST-100-ATT is a form used by businesses in New York State to report certain sales tax information as part of their tax compliance obligations.

Who is required to file NY DTF ST-100-ATT?

Businesses that are registered to collect sales tax in New York State and are claiming an exemption or credit for certain transactions are typically required to file NY DTF ST-100-ATT.

How to fill out NY DTF ST-100-ATT?

To fill out NY DTF ST-100-ATT, businesses must provide their identification information, detail the transactions subject to exemption, and provide any necessary supporting documentation.

What is the purpose of NY DTF ST-100-ATT?

The purpose of NY DTF ST-100-ATT is to provide the New York State Department of Taxation and Finance with the necessary information to evaluate sales tax exemptions and ensure compliance with tax laws.

What information must be reported on NY DTF ST-100-ATT?

The information that must be reported includes the business's identification information, descriptions of the transactions being exempted, the amounts involved, and any relevant exemption certificates.

Fill out your NY DTF ST-100-ATT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF ST-100-ATT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.