NY DTF ST-100-ATT 2012 free printable template

Show details

14 Utilities used directly and exclusively in manufacturing. 15 Other explain ST-100 Insert Form ST-100-ATT inside Form ST-100 5220102130094 ST-100-ATT 12/12 Page 1 of 1. Quarterly Credit Worksheet New York State Department of Taxation and Finance New York State and Local Quarterly Sales and Use Tax Credit Worksheet File as an attachment to Form ST-100 CW For tax period December 1 2012 through February 28 2013 Include with Form ST-100 Due date Wednesday March 20 2013 Sales tax identification...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF ST-100-ATT

Edit your NY DTF ST-100-ATT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF ST-100-ATT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF ST-100-ATT online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY DTF ST-100-ATT. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF ST-100-ATT Form Versions

Version

Form Popularity

Fillable & printabley

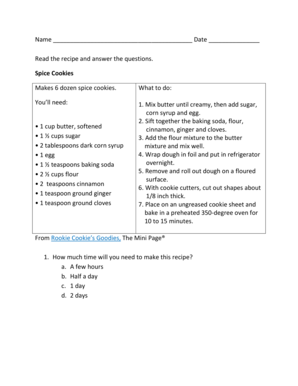

How to fill out NY DTF ST-100-ATT

How to fill out NY DTF ST-100-ATT

01

Begin by downloading the NY DTF ST-100-ATT form from the New York State Department of Taxation and Finance website.

02

Fill in the top section with your name, address, and taxpayer identification number.

03

Indicate the type of exemption you are claiming by checking the appropriate box.

04

If applicable, provide details regarding the reason for the exemption in the designated section.

05

Complete the sales tax information section, including any amounts and relevant dates.

06

Sign and date the form at the bottom.

07

Submit the completed form to your vendor or seller.

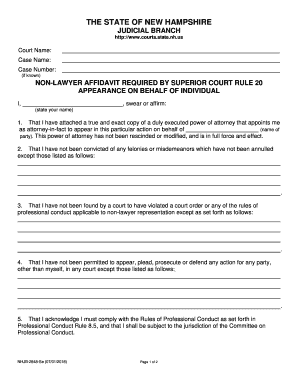

Who needs NY DTF ST-100-ATT?

01

Any individual or business entity that is claiming an exemption from sales tax in New York for specific purchases.

02

Those eligible for tax-exempt status under the applicable regulations, such as certain nonprofit organizations or government entities.

Instructions and Help about NY DTF ST-100-ATT

Fill

form

: Try Risk Free

People Also Ask about

What is NYS st100?

Department of Taxation and Finance. Quarterly ST-100. Sales tax identification number.

What is the address for NYS sales tax return?

Mailing Address - If you need to write, address your letter to: NYS Tax Department, Taxpayer Assistance Bureau, W A Harriman Campus, Albany NY 12227.

How do I pay my business sales tax in NY?

Log in to (or create) your Business Online Services account. Select the ≡ Services menu in the upper-left corner of your Account Summary homepage. Select Sales tax - file and pay, then select Sales tax web file from the expanded menu.

What are the quarters for NYS sales tax?

The reporting periods covered by quarterly returns are March 1 through May 31, June 1 through August 31, September 1 through November 30, and December 1 through February 28/29.

Where do I mail my NY ST 100?

Mailing Address - If you need to write, address your letter to: NYS Tax Department, Taxpayer Assistance Bureau, W A Harriman Campus, Albany NY 12227.

Where do I mail my NYS sales tax payment?

STATE PROCESSING CENTER 575 BOICES LANE KINGSTON NY 12401-1083.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY DTF ST-100-ATT in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign NY DTF ST-100-ATT and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete NY DTF ST-100-ATT online?

Filling out and eSigning NY DTF ST-100-ATT is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I complete NY DTF ST-100-ATT on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your NY DTF ST-100-ATT. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

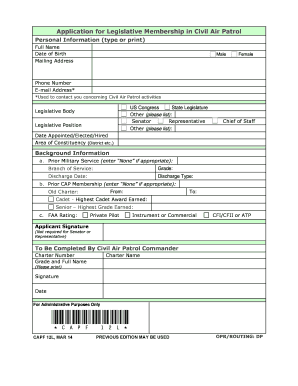

What is NY DTF ST-100-ATT?

NY DTF ST-100-ATT is an attachment form used in New York for reporting additional information related to the sales tax return ST-100.

Who is required to file NY DTF ST-100-ATT?

Businesses that are requesting certain sales tax exemptions or deductions, such as exempt organizations or resellers, are required to file NY DTF ST-100-ATT.

How to fill out NY DTF ST-100-ATT?

To fill out NY DTF ST-100-ATT, collect the necessary sales and exemption information, complete the form by entering relevant details such as type of exemption, amount of sales, and any supporting documentation, then submit it along with the ST-100 return.

What is the purpose of NY DTF ST-100-ATT?

The purpose of NY DTF ST-100-ATT is to provide detailed information regarding sales tax exemptions and deductions that cannot be summarized on the main sales tax return.

What information must be reported on NY DTF ST-100-ATT?

Information that must be reported on NY DTF ST-100-ATT includes the type of exemption claimed, the amount of exempt sales, the reason for the exemption, and any relevant identification numbers or documentation.

Fill out your NY DTF ST-100-ATT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF ST-100-ATT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.