Get the free Corporate Tax Software & ServicesONESOURCE

Show details

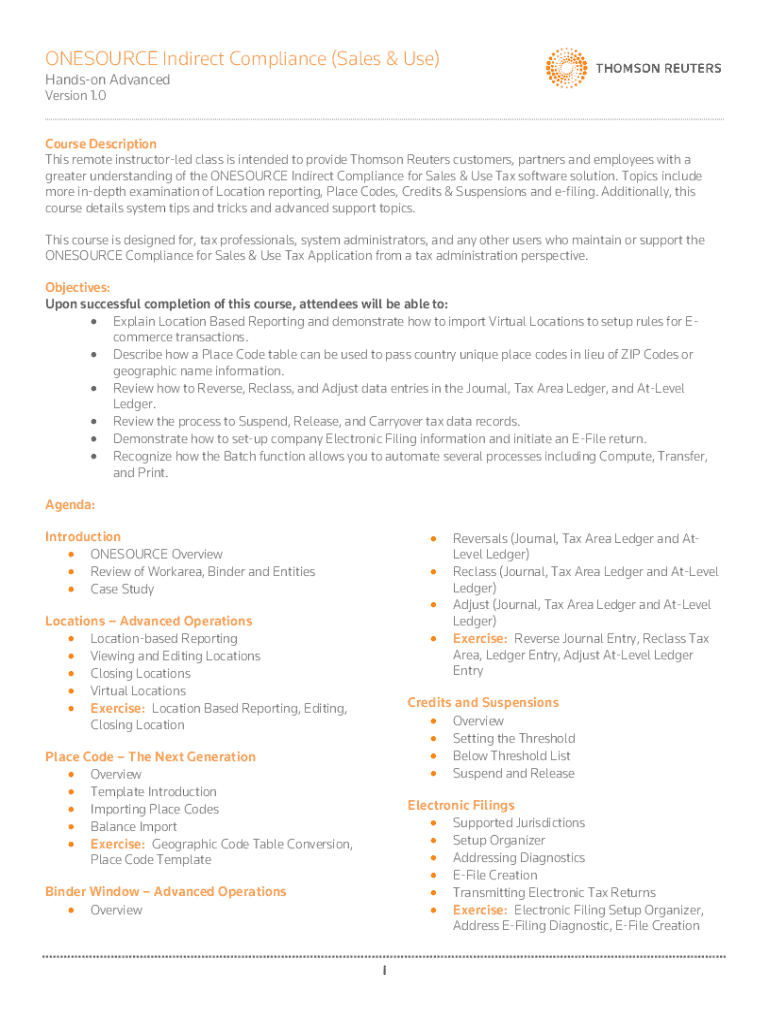

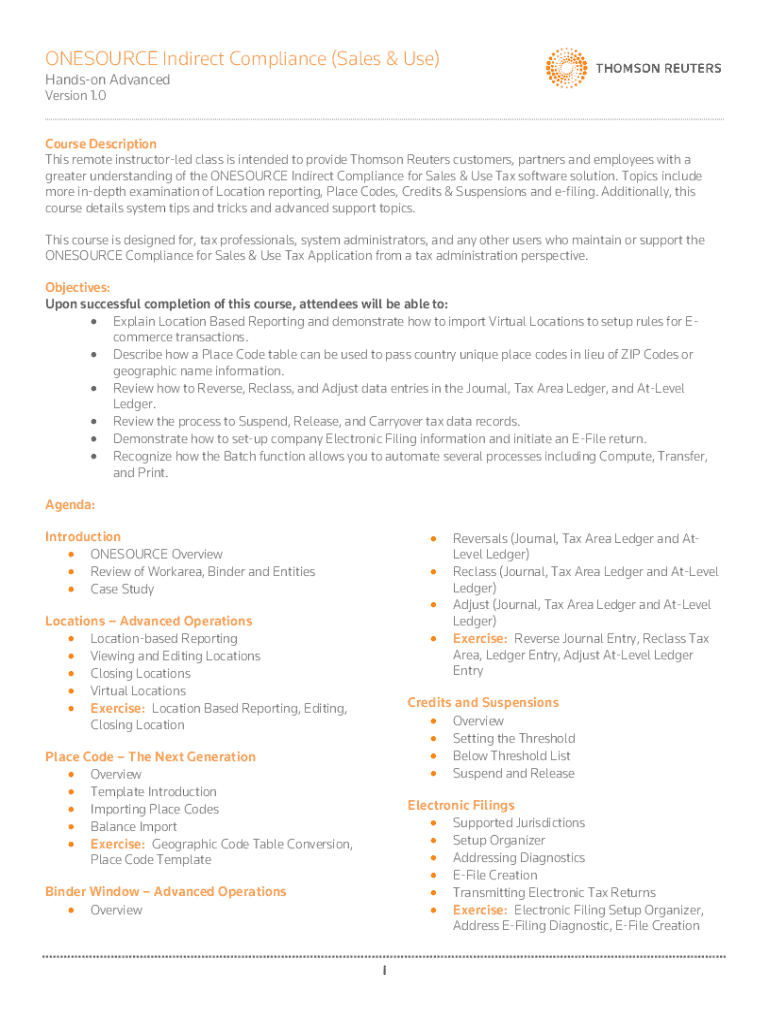

ONESOURCE Indirect Compliance (Sales & Use) Handson Advanced Version 1.0Course Description This remote instructorled class is intended to provide Thomson Reuters customers, partners and employees

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate tax software amp

Edit your corporate tax software amp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate tax software amp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate tax software amp online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit corporate tax software amp. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate tax software amp

How to fill out corporate tax software amp

01

Gather all relevant financial documents including income statements, balance sheets, and expense records.

02

Enter corporate identification details such as the business name, address, and Tax ID number.

03

Input financial data into the appropriate fields in the software, ensuring accuracy.

04

Use the software's built-in features to calculate tax liabilities based on the entered data.

05

Review and verify all information for correctness before proceeding.

06

Select any applicable deductions and credits that your corporation may qualify for.

07

Finalize the entries and generate the tax forms required for submission.

08

Follow the software prompts to e-file or print the tax return for mailing.

Who needs corporate tax software amp?

01

Corporations and businesses that must file corporate income tax returns.

02

Accountants and tax professionals assisting clients with corporate tax filings.

03

Financial managers or CFOs in charge of tax compliance for their organizations.

04

Small business owners seeking to simplify the tax filing process.

05

Startups looking to ensure accurate and efficient handling of their tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit corporate tax software amp from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like corporate tax software amp, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send corporate tax software amp to be eSigned by others?

When you're ready to share your corporate tax software amp, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I get corporate tax software amp?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific corporate tax software amp and other forms. Find the template you want and tweak it with powerful editing tools.

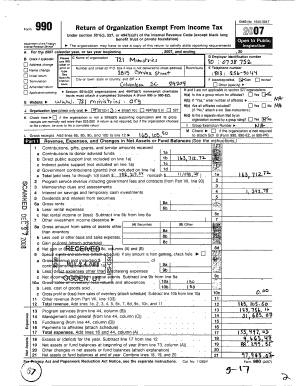

What is corporate tax software amp?

Corporate tax software amp is a digital tool designed to assist businesses in preparing, filing, and managing their corporate tax returns efficiently and accurately.

Who is required to file corporate tax software amp?

Corporations and certain types of organizations that generate taxable income are required to file corporate tax software amp, including C corporations, S corporations, and limited liability companies taxed as corporations.

How to fill out corporate tax software amp?

To fill out corporate tax software amp, users typically enter their financial data, such as income, expenses, and deductions, into the software, which then generates the necessary forms and calculations for submission.

What is the purpose of corporate tax software amp?

The purpose of corporate tax software amp is to streamline the tax preparation process for corporations, ensuring compliance with tax regulations, minimizing errors, and maximizing eligible deductions.

What information must be reported on corporate tax software amp?

Information that must be reported on corporate tax software amp includes revenue, expenses, deductions, credits, and other financial data relevant to the corporation's tax situation.

Fill out your corporate tax software amp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Tax Software Amp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.