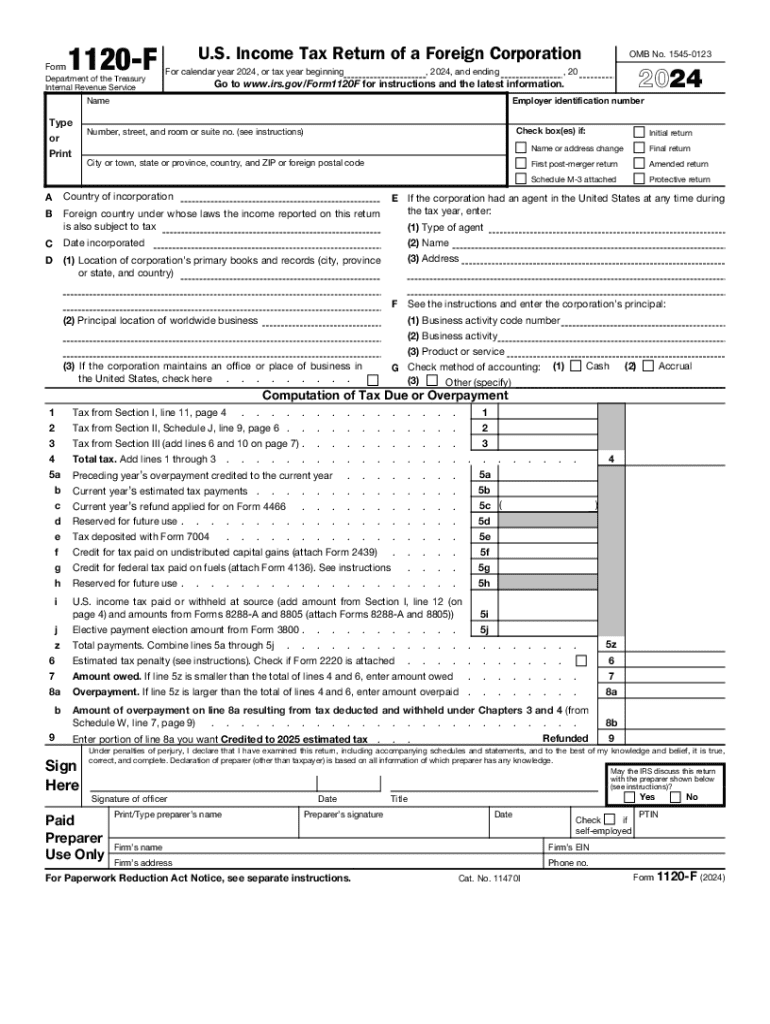

What is 1120 f?

Form 1120-F is the U.S. Income Tax Return of a Foreign Corporation. This form is essential for foreign corporations that earn income in the United States, as it allows them to declare their income and pay any taxes owed to the IRS.

Who needs the form?

Foreign corporations that are doing business in the United States or receiving U.S.-source income must file Form 1120-F. This includes corporations that are engaged in any trade or business activities in the U.S. or have effectively connected income.

Components of the form

Form 1120-F consists of various sections where corporations report their income, deductions, and taxes owed. Essential components include the corporation's identifying information, income effectively connected with a U.S. business, branch profits tax, and other necessary schedules to provide a full tax picture.

What payments and purchases are reported?

Form 1120-F requires reporting on U.S.-source income and various transactions, including sales of goods or services, rental income, and interest or dividends received. It is critical for corporations to accurately report these earnings to ensure compliance with U.S. tax laws.

What are the penalties for not issuing the form?

Failing to file Form 1120-F can result in penalties and interest on unpaid taxes. The IRS imposes specific fines for late returns, inaccuracies, or non-compliance, significantly impacting a corporation's financial standing and operations in the U.S.

Is the form accompanied by other forms?

Form 1120-F may need to be accompanied by additional forms or schedules, such as Schedule C to report additional income details. Depending on the corporation's specific circumstances, other forms might also be necessary to provide a complete tax return.

What is the purpose of this form?

The primary purpose of Form 1120-F is to report the income of a foreign corporation that has engaged in business operations or received income from U.S. sources. It assesses how much tax is owed to the U.S. government based on the corporation's earnings during the tax year.

When am I exempt from filling out this form?

Exemptions from filing Form 1120-F can occur if a foreign corporation meets specific criteria, such as not engaging in any U.S. trade or business, or if it qualifies for certain treaty benefits that exempt it from U.S. taxation. Consulting tax regulations or a tax advisor can clarify eligibility for exemptions.

Due date

Form 1120-F is generally due on the 15th day of the 6th month after the end of the corporation's tax year. If the corporation operates on a calendar year basis, the due date would typically be June 15. Extensions for filing may be available, but tax payments must still be made by the original due date to avoid penalties.

How many copies of the form should I complete?

Generally, a foreign corporation must complete one original Form 1120-F for IRS submission. Additional copies may be required for state tax submissions or other regulatory purposes, depending on the nature of business activities. Always check local requirements.

What information do you need when you file the form?

When filing Form 1120-F, you will need the corporation's identifying information (name, address, EIN), detailed income and expense data, information regarding tax credits and deductions, and any supporting documentation for items reported on the form. This ensures accurate assessment and compliance with IRS requirements.

Where do I send the form?

Form 1120-F must be sent to the address specified in the form instructions, typically determined by whether the corporation is filing a return or claiming an exemption. Checking the IRS guidelines is essential to ensure proper submission and to avoid delays in processing.