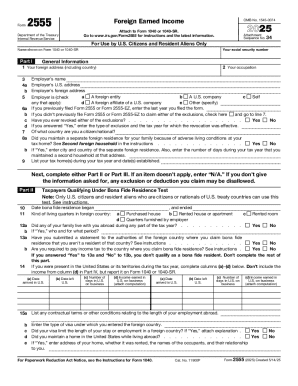

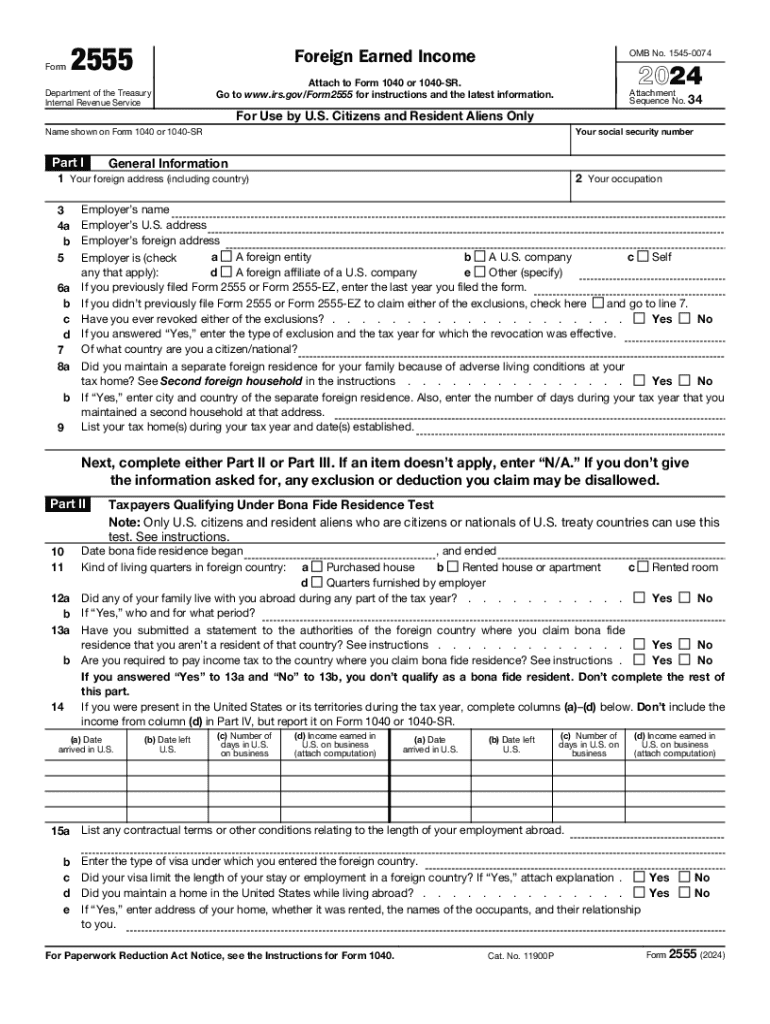

IRS 2555 2024 free printable template

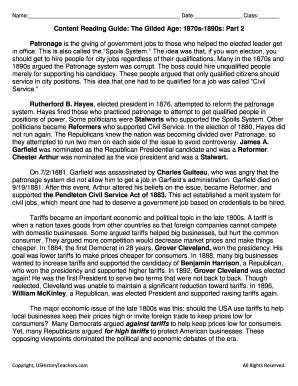

Instructions and Help about irs 2555 form

How to edit irs 2555 form

How to fill out irs 2555 form

Latest updates to irs 2555 form

All You Need to Know About irs 2555 form

What is irs 2555 form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 2555

How can I correct mistakes on the IRS 2555 form after filing?

If you realize an error after submitting your IRS 2555 form, you can file an amended return using Form 1040-X. Ensure you clearly indicate the corrections made and provide any necessary documentation. Remember, it’s crucial to address mistakes promptly to avoid potential penalties or issues.

What should I do if my e-filed IRS 2555 form gets rejected?

In case your e-filed IRS 2555 form is rejected, review the rejection codes provided by the IRS to identify the issue. Correct any errors and resubmit your form as soon as possible. Keeping track of your submission status online can also help in managing these situations effectively.

Can I use an e-signature when filing the IRS 2555 form?

Yes, the IRS allows e-signatures for the IRS 2555 form when filed electronically. Make sure to follow IRS guidelines for e-signatures and maintain records of your filing for privacy and data security purposes.

What common errors should I avoid when submitting the IRS 2555 form?

Common errors include incorrect calculations, forgetting to include required documentation, and not checking the eligibility for exclusions or deductions. Familiarize yourself with common pitfalls to ensure your IRS 2555 form is accurate and complete.

How do I track the status of my IRS 2555 form after submitting?

You can track the status of your IRS 2555 form by using the IRS's online 'Where's My Refund?' tool or by checking the e-filing software you used. This tool provides updates on the processing status and can help you determine if any issues have arisen.

See what our users say