Get the free tax increment financing (tif) assistance

Show details

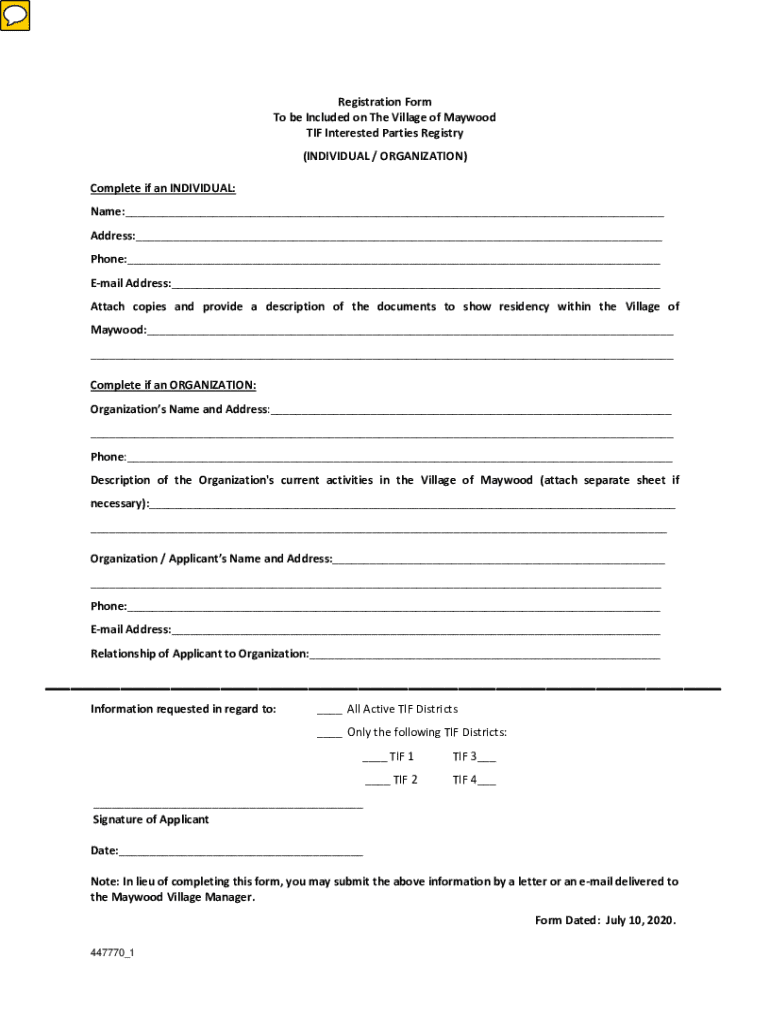

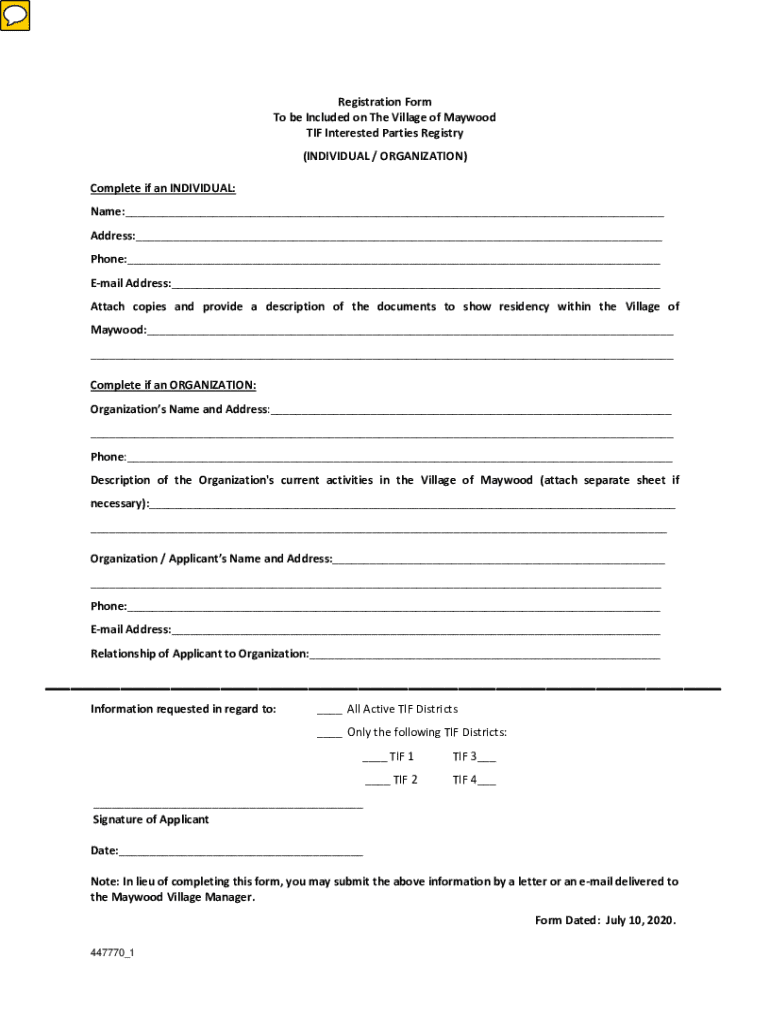

Registration Form To be Included on The Village of Maywood TIF Interested Parties Registry (INDIVIDUAL / ORGANIZATION) Complete if an INDIVIDUAL: Name:___ Address:___ Phone:___ Email Address:___ Attach

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax increment financing tif

Edit your tax increment financing tif form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment financing tif form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax increment financing tif online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax increment financing tif. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment financing tif

How to fill out tax increment financing tif

01

Identify the area that will benefit from tax increment financing (TIF).

02

Conduct a feasibility study to assess the potential economic impact of the TIF.

03

Prepare a TIF district plan that includes the goals and objectives of the financing.

04

Submit the TIF district plan for review by local government and stakeholders.

05

Hold a public hearing to gather input from the community about the TIF plan.

06

Obtain approval from the local government or relevant authority for the TIF district.

07

Calculate the base property tax value before improvements.

08

Establish the time frame for the TIF (usually 20-30 years).

09

Begin projects that will generate increased property values and tax revenue.

10

Monitor and report on the effectiveness of the TIF in achieving its goals.

Who needs tax increment financing tif?

01

Municipal governments seeking to promote urban development and revitalization.

02

Developers looking for financial support to kickstart projects in underdeveloped areas.

03

Businesses planning to invest in new facilities that will increase local tax revenue.

04

Community organizations advocating for economic growth and job creation in their areas.

05

Investors interested in opportunities in neighborhoods needing revitalization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax increment financing tif from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your tax increment financing tif into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I edit tax increment financing tif on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit tax increment financing tif.

How do I complete tax increment financing tif on an Android device?

Use the pdfFiller mobile app to complete your tax increment financing tif on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is tax increment financing tif?

Tax Increment Financing (TIF) is a public financing method used to subsidize redevelopment, infrastructure, and other community improvement projects. It captures the future tax benefits generated from increased property values within a designated district to fund the initial projects.

Who is required to file tax increment financing tif?

Entities such as municipalities, redevelopment authorities, and other local governments that establish a TIF district and wish to utilize the financing mechanism are required to file for tax increment financing.

How to fill out tax increment financing tif?

To fill out the TIF documentation, agencies must provide details on the TIF district's boundaries, estimated future tax revenues, description of the project, and anticipated costs associated with the improvements.

What is the purpose of tax increment financing tif?

The purpose of TIF is to promote economic development and revitalization in designated areas by financing public infrastructure improvements, attracting private investment, and boosting property values.

What information must be reported on tax increment financing tif?

Information that must be reported includes the TIF district's designation, financial data (e.g., revenues, expenditures), project descriptions and timelines, and assessments of how the TIF has impacted the area.

Fill out your tax increment financing tif online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Financing Tif is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.