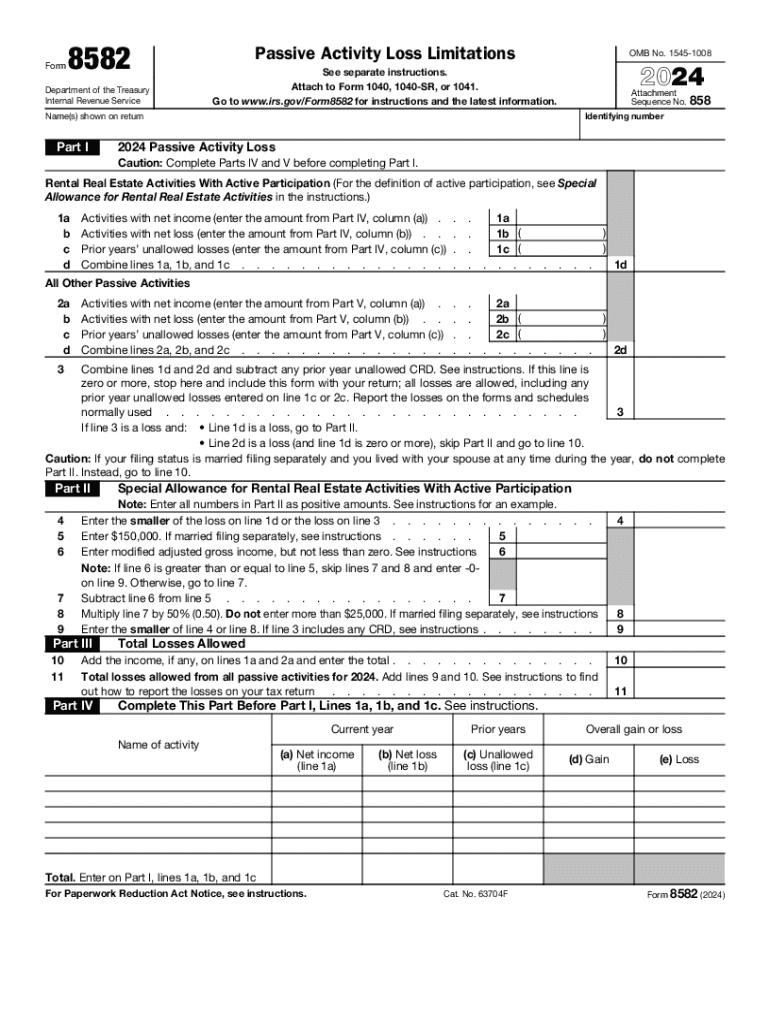

IRS 8582 2024 free printable template

Instructions and Help about form 8582

How to edit form 8582

How to fill out form 8582

Latest updates to form 8582

All You Need to Know About form 8582

What is form 8582?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8582

What should I do if I make an error on form 8582 after submission?

If you discover a mistake after submitting form 8582, you can submit an amended form. Make sure to indicate that it is a corrected version and include any necessary explanations. It's essential to address errors promptly to avoid delays in processing your tax matters.

How can I track the status of my form 8582 after filing?

To verify the receipt and processing status of your form 8582, you can use the IRS online tools or contact their support. Look for common e-file rejection codes, which can help you understand if there were issues with your submission that need to be addressed.

What should I do if I receive a notice related to my form 8582?

If you receive a notice or a letter regarding your form 8582, read it carefully to understand the requirements. Prepare any necessary documentation to respond appropriately, and if needed, consult a tax professional for guidance on how to handle the situation.

Are there any common issues that arise when filing form 8582 electronically?

Many taxpayers encounter issues like incorrect information or mismatch errors when filing form 8582 electronically. To reduce the likelihood of errors, double-check all entries and ensure compatibility with the software or browser you are using, as these factors can impact the e-filing process.

What is the legal requirement for storing records related to form 8582?

You are required to retain records related to form 8582 for a specific period, typically three years after the due date of the return. This period ensures that documentation is available for any future audits or inquiries, and it is important to safeguard this information to comply with data security practices.

See what our users say