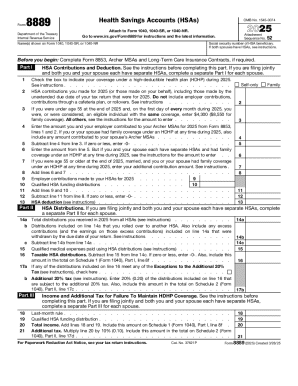

IRS 8889 2024 free printable template

Instructions and Help about tax form 8889 for

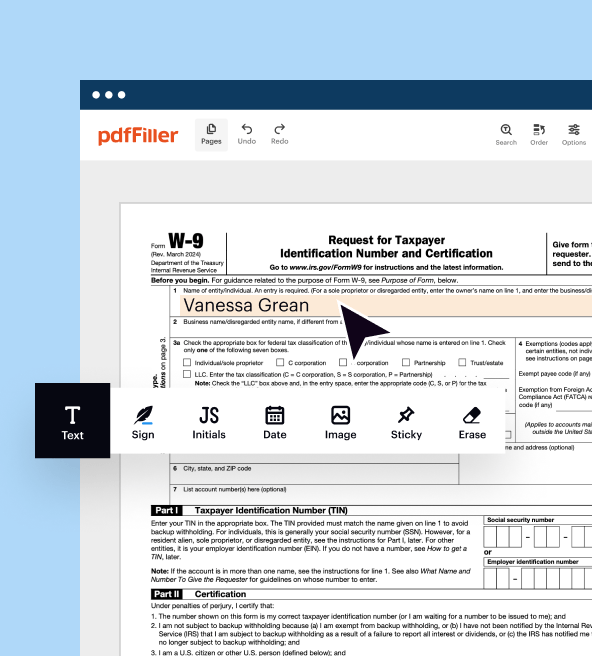

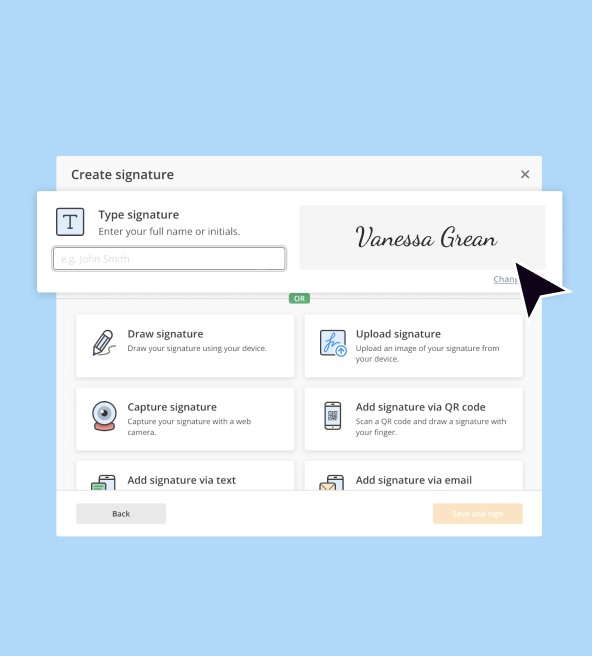

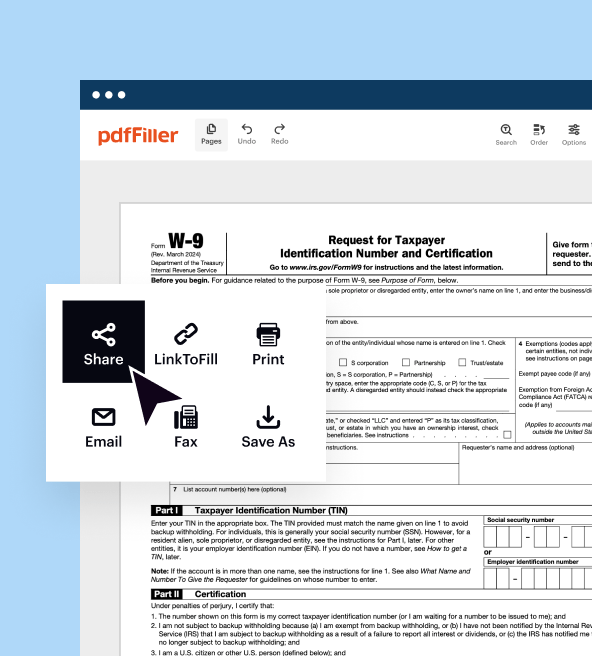

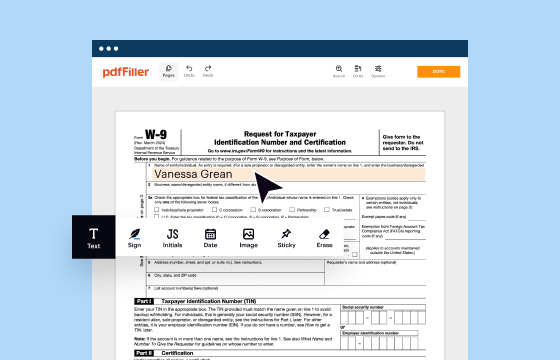

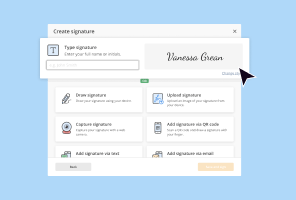

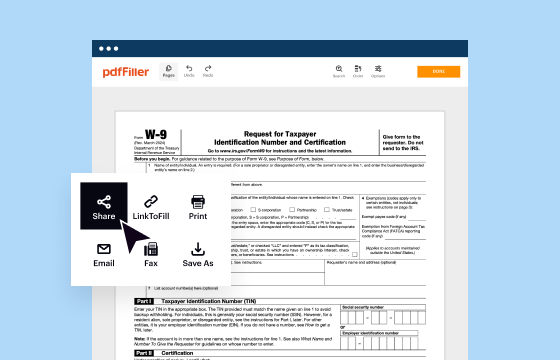

How to edit tax form 8889 for

How to fill out tax form 8889 for

Latest updates to tax form 8889 for

All You Need to Know About tax form 8889 for

What is tax form 8889 for?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8889

What should I do if I realize I made a mistake on my tax form 8889 for?

If you made an error on your tax form 8889 for, you can submit an amended return using Form 1040-X. It’s essential to include the corrected information related to your Health Savings Account (HSA) contributions or distributions. Keep thorough documentation of the changes you are making, as well as any correspondence with the IRS.

How can I track the status of my tax form 8889 for submission?

To verify the receipt and processing of your tax form 8889 for, use the IRS 'Where's My Refund?' tool if you filed for a refund, or you may call the IRS directly for updates. Be sure to have your Social Security number and filing status on hand to quickly access your information.

What common mistakes should I avoid when filling out my tax form 8889 for?

When completing your tax form 8889 for, ensure all entries are accurate and legible. Common errors include incorrect HSA contribution amounts, failure to include all eligible distributions, and neglecting to check your calculations. Double-check your entries and consider using tax software that flags these issues.

Are there any special considerations for filing tax form 8889 for on behalf of someone else?

If you are filing tax form 8889 for someone else, ensure you have their consent and a signed Power of Attorney (POA) on file. Additionally, you'll need to include their information such as Social Security number and any relevant details about their HSA accounts. Be cautious to protect their privacy and sensitive information.

See what our users say