TX Comptroller AP-201 2024 free printable template

Show details

PRINT FORM

CLEAR FIELDS

*AP20110F062427*

*AP20110F062427*

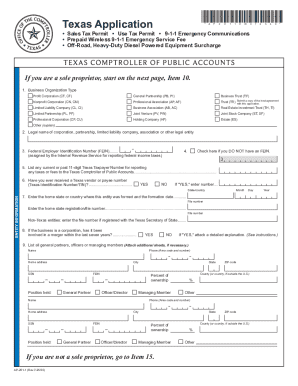

Instructions in EnglishTexas Application*AP20110W072428 Sales Tax Permit Use Tax Permit 911 Emergency Communications

Prepaid Wireless 911

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller AP-201

Edit your TX Comptroller AP-201 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller AP-201 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller AP-201 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX Comptroller AP-201. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller AP-201 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller AP-201

How to fill out TX Comptroller AP-201

01

Obtain the TX Comptroller AP-201 form from the official website or local tax office.

02

Fill in your business name and address in the designated fields at the top of the form.

03

Enter your Texas taxpayer number in the appropriate box.

04

Indicate the type of exemption you are claiming by checking the relevant box.

05

Provide details about the items or services for which you are claiming the exemption.

06

Complete the certification section by signing and dating the form.

07

Submit the completed AP-201 form to the appropriate local tax office or authority.

Who needs TX Comptroller AP-201?

01

Businesses and organizations in Texas that qualify for a sales tax exemption on certain purchases.

02

Entities such as non-profits, educational institutions, or government agencies that need to claim sales tax exemptions.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a Texas sales tax exemption certificate?

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

How do I get a Texas sales and use tax exemption certificate?

An exemption certificate must be in substantially the form of a Texas Sales and Use Tax Exemption Certification, Form 01-339 (Back). Copies of the form may be obtained from the Comptroller of Public Accounts, Tax Policy Division or by calling 1-800-252-5555.

Do I need a Texas sales tax permit?

You must obtain a Texas sales and use tax permit if you are an individual, partnership, corporation or other legal entity engaged in business in Texas and you: Sell tangible personal property in Texas; Lease or rent tangible personal property in Texas; Sell taxable services in Texas; or.

How do you get a seller's permit in Texas?

You can apply for a Texas seller's permit online through the Texas Online Tax Registration Application or by filling out the Texas Application for Sales and Use Tax Permit (Form AP-201) and mailing it to the comptroller's office at the address listed on the form.

What is the difference between a sellers permit and a resale certificate in Texas?

Texas Resale License vs. Where the resale license allows businesses to purchase inventory without paying sales tax, the sales and use tax permit authorizes a Texas business to collect sales tax from the products and services it sells to its customers.

Do I need an EIN or a sales tax permit in Texas?

You must obtain a Texas sales and use tax permit if you are an individual, partnership, corporation or other legal entity engaged in business in Texas and you: Sell tangible personal property in Texas; Lease or rent tangible personal property in Texas; Sell taxable services in Texas; or.

How much is a sales tax permit in Texas?

There is no cost for a sales tax permit in the state of Texas, however, some businesses are required to post a security bond.

What is the difference between Texas sales and use tax resale certificate and Texas sales and use tax exemption certification?

Exempt certificates and resale certificates are very similar documents with the major difference being that an exemption certificate does not require a taxpayer ID number to be legally valid.

Is a sales and use tax permit the same as a resale certificate in Texas?

While resale certificates require the purchaser's Texas taxpayer number, the customer's sales tax permit number or a copy of the customer's permit is not a substitute for a resale certificate and does not relieve a seller's responsibility for collecting sales tax.

How do I get a copy of my Texas sales and use tax permit?

Duplicate Sales Tax Permits Look on the Sales and Use tax menu under Account Self-Service and select "Request a Duplicate Sales Tax Permit". Follow the prompts validating address, location and approval. Please note: Permits are typically printed and mailed out on the following business day.

How do I fill out a Texas sales and use tax exemption certificate?

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

How do I use my Texas sales tax permit?

As a permit holder, you are required to: Post your permit at your place of business; Collect sales tax on all taxable sales; Pay sales and use tax on all taxable purchases; Timely report and pay sales and use taxes; and. Keep adequate records.

Is Texas taxpayer number the same as sales tax permit?

(4) All sales and use tax permits of the seller will have the same taxpayer account number; however, each place of business will have a different outlet number.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete TX Comptroller AP-201 online?

pdfFiller makes it easy to finish and sign TX Comptroller AP-201 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit TX Comptroller AP-201 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing TX Comptroller AP-201 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out TX Comptroller AP-201 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign TX Comptroller AP-201 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is TX Comptroller AP-201?

TX Comptroller AP-201 is a form used by the Texas Comptroller of Public Accounts for reporting Texas franchise tax status and information.

Who is required to file TX Comptroller AP-201?

Businesses that are subject to franchise tax in Texas, including corporations and limited liability companies (LLCs) meeting certain criteria, are required to file TX Comptroller AP-201.

How to fill out TX Comptroller AP-201?

To fill out TX Comptroller AP-201, you should provide your business information, report revenue figures, detail deductions, and indicate the tax amount due, following the instructions provided on the form.

What is the purpose of TX Comptroller AP-201?

The purpose of TX Comptroller AP-201 is to report the annual franchise tax due from businesses operating in Texas and ensure compliance with state tax regulations.

What information must be reported on TX Comptroller AP-201?

TX Comptroller AP-201 requires reporting of the business name, address, revenues, total assets, deductions, and the computed franchise tax amount.

Fill out your TX Comptroller AP-201 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller AP-201 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.