MO DoR 149 2024 free printable template

Show details

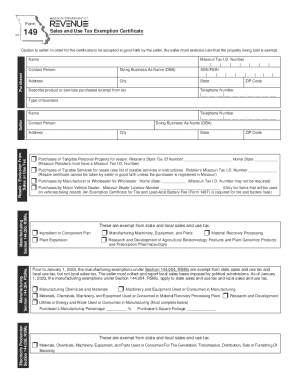

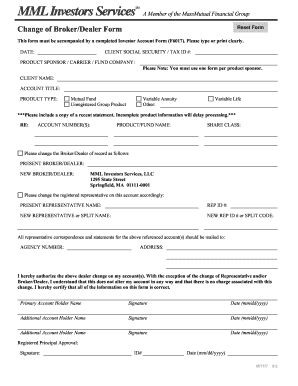

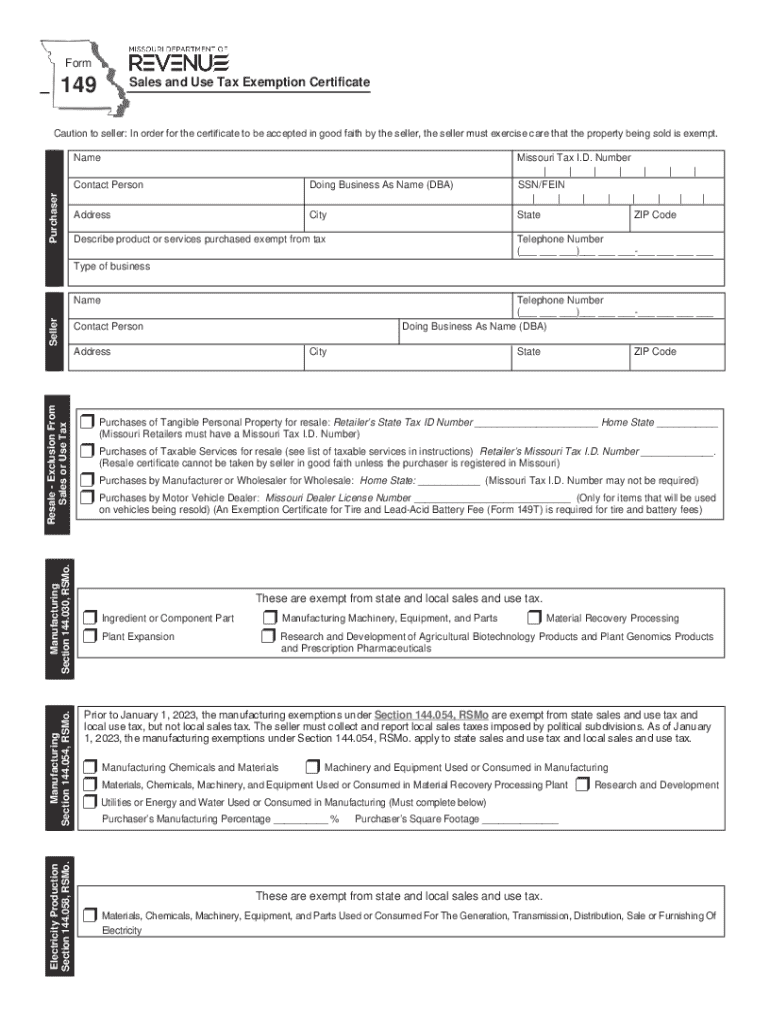

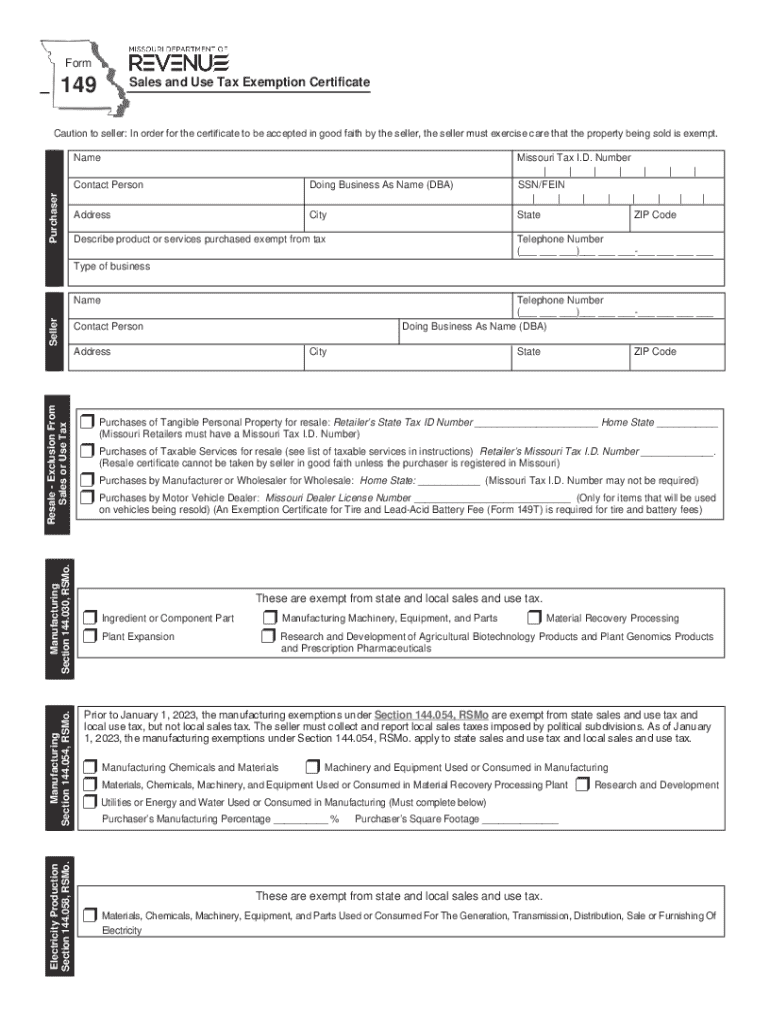

Mo. gov/state-benefits/. Form 149 Revised 08-2024 Select the appropriate box for the type of exemption to be claimed and complete any additional information requested. from sales or use tax. Reset Form Form Print Form Sales and Use Tax Exemption Certificate Caution to seller In order for the certificate to be accepted in good faith by the seller the seller must exercise care that the property being sold is exempt. Purchaser Name Contact Person Doing Business As Name DBA Address City Missouri...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mo form 149

Edit your missouri form 149 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your missouri 149 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mo 149 tax form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form exemption certificate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR 149 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out mo form 149 fillable

How to fill out MO DoR 149

01

Obtain the MO DoR 149 form from the official Department of Revenue website or a local office.

02

Read the instructions carefully to understand what information is required.

03

Fill in your personal details including name, address, and contact information.

04

Provide the necessary financial information as requested, including income and deductions.

05

Attach any required supporting documents, such as tax forms or identification.

06

Double-check all information for accuracy before submission.

07

Sign and date the form at the specified location.

08

Submit the completed form either online, by mail, or in person as instructed.

Who needs MO DoR 149?

01

Individuals filing personal income taxes in Missouri.

02

Business owners reporting business income or deductions.

03

Tax preparers and accountants handling clients' tax submissions.

04

Anyone requesting certain tax credits or deductions available in Missouri.

Fill

mo sales tax form 149

: Try Risk Free

People Also Ask about form 149 missouri

How do I become tax exempt in NY?

Exemptions from Withholding You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and. You do not expect to have a New York income tax liability for this year.

How much is a seller's permit in Louisiana?

How Much Does a Business License Cost in Louisiana? There is no cost to apply for a Louisiana resale certificate.

How do I get a US sales tax exemption certificate?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

What is Missouri form 149 for?

local sales and use tax under Section 144.030, RSMo. Ingredient or Component Parts: This exemption includes materials, manufactured goods, machinery, and parts that become a part of the final product. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in Missouri or other states.

What is the tax exempt form for NYC?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find business exemptions form pdf?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific pdffiller and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my form 149 sales tax exemption in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your mo 149 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit mo 149 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign mo 149 form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is MO DoR 149?

MO DoR 149 is a form used in the state of Missouri for reporting certain tax-related information to the Department of Revenue.

Who is required to file MO DoR 149?

Individuals or entities that are subject to specific taxation requirements in Missouri need to file MO DoR 149.

How to fill out MO DoR 149?

To fill out MO DoR 149, applicants should provide accurate information as required in the form's sections, ensuring all fields are completed clearly and correctly.

What is the purpose of MO DoR 149?

The purpose of MO DoR 149 is to collect essential tax information to ensure compliance with Missouri tax laws.

What information must be reported on MO DoR 149?

Reported information on MO DoR 149 typically includes identifying details about the taxpayer, such as name, address, and the specific tax-related data required by the Department of Revenue.

Fill out your MO DoR 149 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Form 149 is not the form you're looking for?Search for another form here.

Keywords relevant to missouri tax form 149

Related to missouri tax exempt form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.