Get the free Senior Citizen/Disabled property tax deduction form

Show details

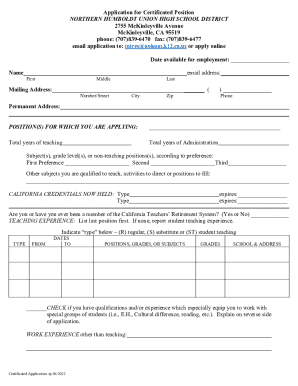

Township of Andover Municipal Offices 134 Newton-Sparta Rd. Newton NJ 07860 Dear Property Owner: Here you will find the application forms for a Senior Citizen/Disabled property tax deduction. Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign senior citizendisabled property tax

Edit your senior citizendisabled property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your senior citizendisabled property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit senior citizendisabled property tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit senior citizendisabled property tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out senior citizendisabled property tax

How to Fill Out Senior Citizen/Disabled Property Tax:

01

Obtain the necessary forms: Contact your local tax assessor's office to request the appropriate forms for senior citizens or individuals with disabilities seeking property tax relief. They will provide you with the necessary forms and instructions.

02

Gather required documentation: Before filling out the forms, gather all the required documentation. This may include proof of age or disability, income statements, property ownership documents, and any other relevant information. Make sure you have all the necessary paperwork in order to avoid delays or rejection of your application.

03

Complete the forms accurately: Take your time to read the instructions carefully and fill out the forms accurately. Double-check all the information you provide to ensure its correctness. If you are unsure about any sections, seek assistance from the tax assessor's office or a qualified tax professional.

04

Provide supporting evidence: In addition to completing the forms, you may need to provide supporting evidence to establish your eligibility for senior citizen or disabled property tax relief. This may include medical records, income statements, or any other documentation requested by the tax assessor's office. Ensure all supporting evidence is attached or submitted along with the forms.

05

Submit the completed forms: Once you have filled out the forms and gathered all the required documentation, submit the completed package to the tax assessor's office. Make sure to follow any specific submission instructions provided by the office. Keep copies of all the documents for your records.

Who needs senior citizen/disabled property tax?

01

Senior Citizens: Senior citizens who are of a certain age (usually 65 years or older) and meet the specified income requirements may be eligible for property tax relief. This program aims to assist seniors in managing their property tax burden, allowing them to age in place and remain in their homes.

02

Individuals with Disabilities: Individuals with disabilities may also qualify for property tax relief based on their disability status and income level. This type of tax relief provides financial assistance to disabled individuals, helping them cope with the expenses associated with owning a property.

It is essential to consult the specific guidelines and requirements set by your local tax assessor's office to determine if you are eligible for senior citizen or disabled property tax relief. The eligibility criteria may vary depending on the jurisdiction and the specific program in place. Reach out to the tax assessor's office for further clarification or seek advice from a tax professional.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is senior citizendisabled property tax?

Senior citizendisabled property tax is a special tax relief program for elderly and disabled homeowners.

Who is required to file senior citizendisabled property tax?

Elderly and disabled homeowners who meet certain eligibility requirements are required to file senior citizendisabled property tax.

How to fill out senior citizendisabled property tax?

Senior citizendisabled property tax forms can usually be obtained from the local tax assessor's office and must be completed with the required information.

What is the purpose of senior citizendisabled property tax?

The purpose of senior citizendisabled property tax is to provide tax relief to elderly and disabled homeowners who may have difficulty paying property taxes.

What information must be reported on senior citizendisabled property tax?

Information such as proof of age or disability, income documentation, and property details may need to be reported on senior citizendisabled property tax forms.

How can I manage my senior citizendisabled property tax directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your senior citizendisabled property tax as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an eSignature for the senior citizendisabled property tax in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your senior citizendisabled property tax right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit senior citizendisabled property tax on an Android device?

With the pdfFiller Android app, you can edit, sign, and share senior citizendisabled property tax on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your senior citizendisabled property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Senior Citizendisabled Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.