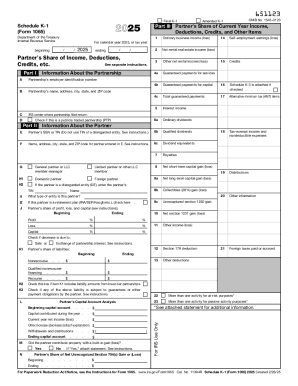

IRS 1065 - Schedule K-1 2024 free printable template

Instructions and Help about IRS 1065 - Schedule K-1

How to edit IRS 1065 - Schedule K-1

How to fill out IRS 1065 - Schedule K-1

Latest updates to IRS 1065 - Schedule K-1

About IRS 1065 - Schedule K-1 previous version

What is IRS 1065 - Schedule K-1?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1065 - Schedule K-1

What should I do if I need to correct an error on my IRS 1065 - Schedule K-1?

If you discover an error on your IRS 1065 - Schedule K-1 after submitting it, you need to file an amended return. Use Form 1065X to correct your submission and indicate the changes made. Ensure you follow the instructions closely to avoid further mistakes, and keep copies of both the original and amended forms for your records.

How can I verify the status of my IRS 1065 - Schedule K-1 after filing?

To verify the status of your IRS 1065 - Schedule K-1, you can check with the IRS’s online tools or contact them directly. Common e-file rejection codes can impact the processing, so it’s important to be aware of them; refer to the IRS website for a guide on handling rejections effectively.

What should I know about retaining records after submitting my IRS 1065 - Schedule K-1?

After submitting your IRS 1065 - Schedule K-1, it's crucial to maintain records for at least three years. This retention period is necessary should the IRS request information or if an audit occurs. Make sure your records are secure and easily accessible, as privacy and data security are paramount.

Are there specific service fees associated with e-filing IRS 1065 - Schedule K-1?

Yes, when e-filing your IRS 1065 - Schedule K-1, many tax software programs may charge service fees. It's important to review these costs upfront. In cases where a submission is rejected, some services might offer a refund; check the terms of your chosen e-filing service for details.

What steps should I take if I receive a notice or letter regarding my IRS 1065 - Schedule K-1?

If you receive a notice or letter from the IRS concerning your IRS 1065 - Schedule K-1, carefully read the communication for specific instructions. Depending on the issue, you may need to provide additional documentation or correct your filing. Always respond promptly and keep a record of your correspondence with the IRS.

See what our users say