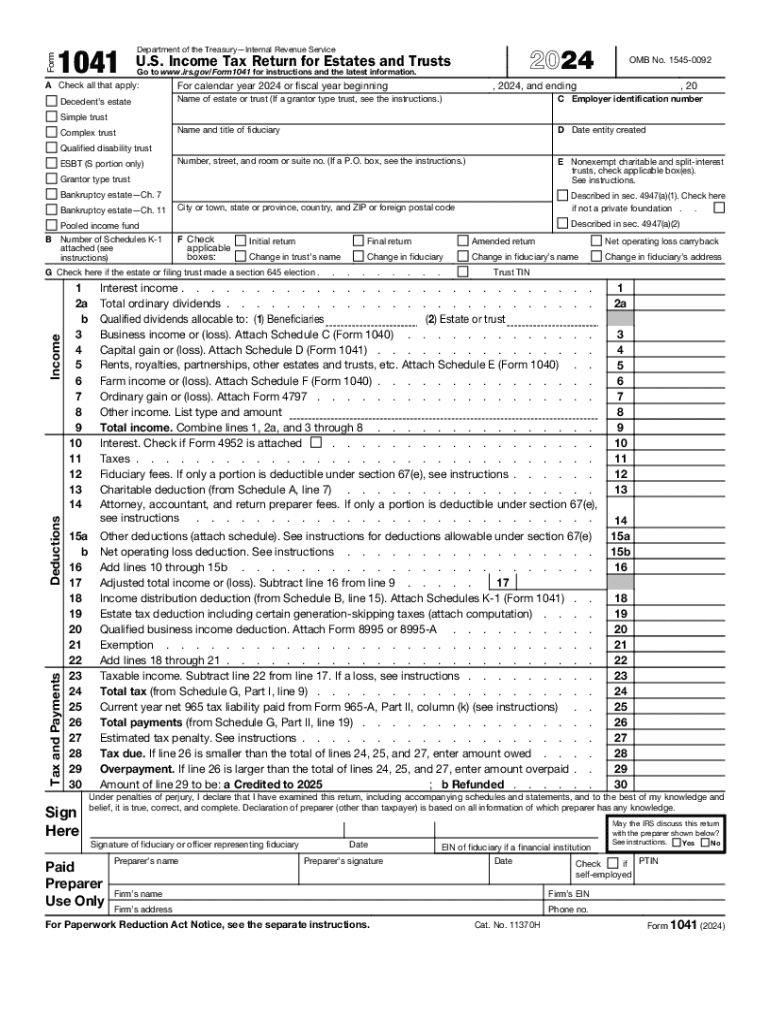

IRS 1041 2024 free printable template

Instructions and Help about IRS 1041

How to edit IRS 1041

How to fill out IRS 1041

Latest updates to IRS 1041

About IRS previous version

What is IRS 1041?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1041

What should I do if I discover an error on my filed IRS 1041?

If you find a mistake on your IRS 1041 after it has been filed, you need to file an amended return using Form 1041-X. This form allows you to correct any errors and make necessary adjustments to the information reported. Make sure to include a detailed explanation of the changes when submitting your amended form.

How can I check the status of my IRS 1041 after submission?

To verify the status of your filed IRS 1041, you can use the IRS 'Where's My Refund?' tool if you expect a refund. For processing updates, it's advisable to allow a few weeks before checking, as the IRS typically takes time to process returns. If there are issues, contacting the IRS directly may provide clarity.

What types of common errors occur when filing an IRS 1041?

Common errors when filing the IRS 1041 include incorrect taxpayer identification numbers, misreported income amounts, and failure to include all required schedules. To avoid these errors, double-check all entries against documentation and ensure that all forms are correctly filled out before submission.

Are there any specific privacy concerns I should be aware of when filing IRS 1041?

When filing IRS 1041, it's crucial to ensure that all information submitted is securely protected. Use secure connections when e-filing, and ensure your documents are stored safely. It's also important to understand the IRS's policies on data retention to know how long your information will be kept.

See what our users say