Fidelity Investments Instructions for Completing IRS Section 83(b) Form 2022-2025 free printable template

Show details

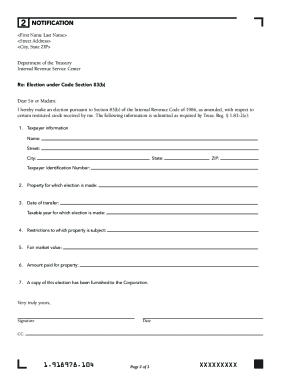

This document provides detailed instructions for making an 83(b) election regarding restricted stock, including how to fill out the IRS form and mailing instructions.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fillable irs form 83b

Edit your 83b form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 83b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 83 b online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 83b form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fidelity Investments Instructions for Completing IRS Section 83(b) Form Form Versions

Version

Form Popularity

Fillable & printabley

4.5 Satisfied (37 Votes)

4.8 Satisfied (185 Votes)

4.7 Satisfied (55 Votes)

How to fill out irs form 83b download

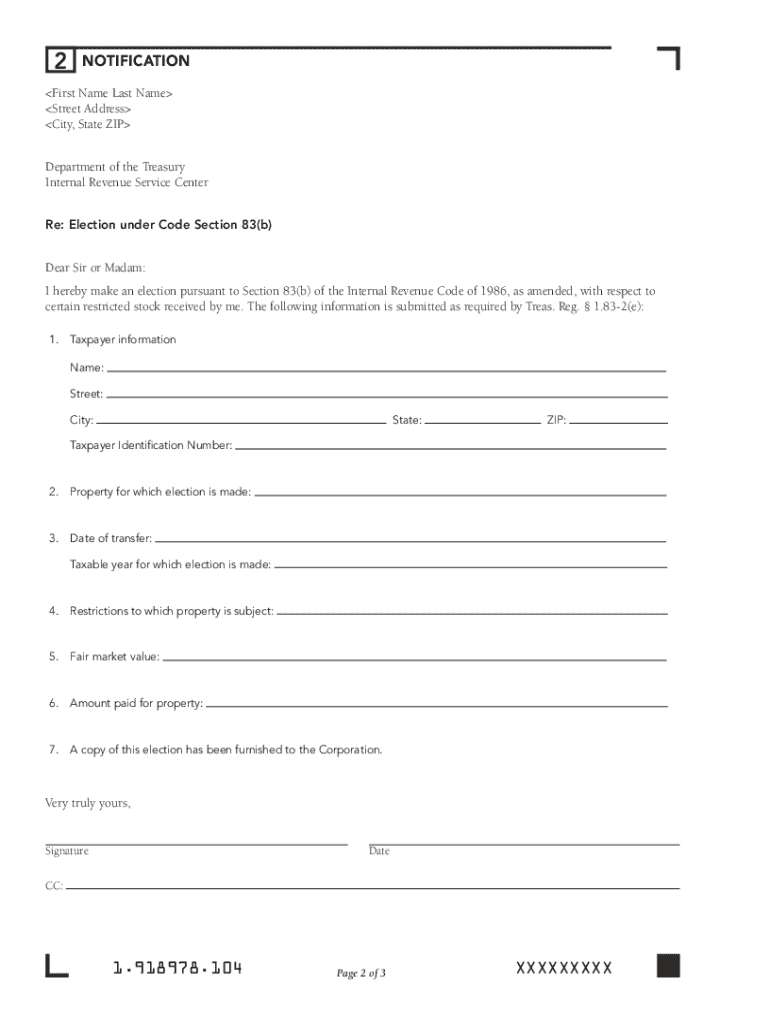

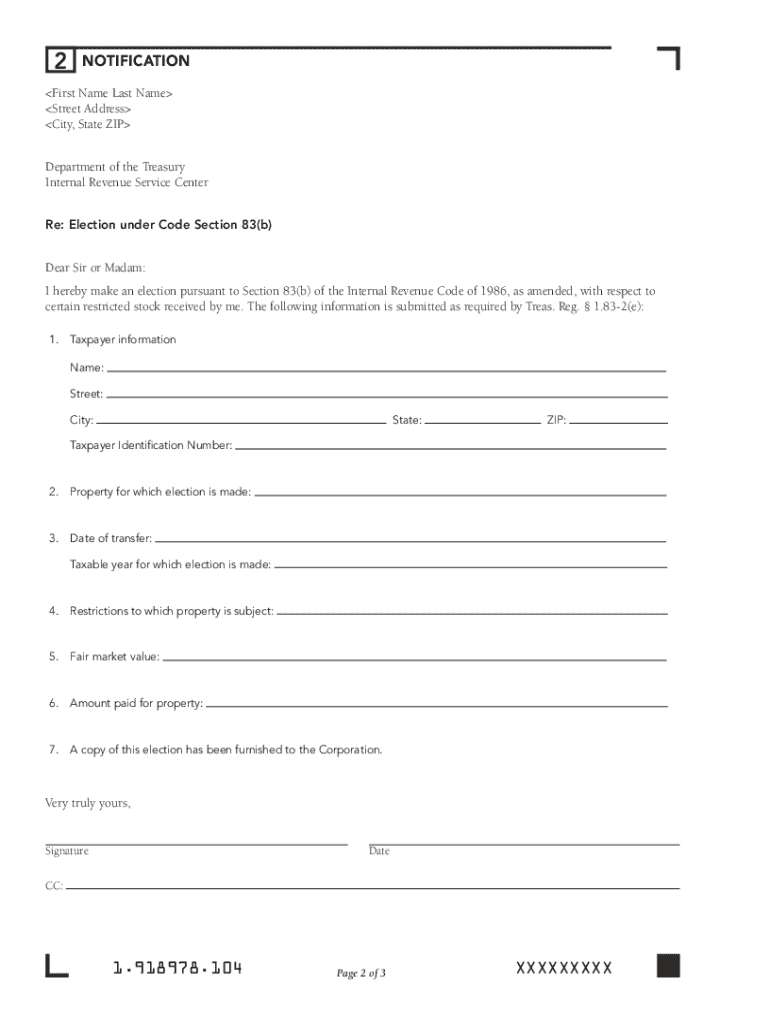

How to fill out Fidelity Investments Instructions for Completing IRS Section 83(b)

01

Obtain the Fidelity Investments Instructions for Completing IRS Section 83(b) form.

02

Read through the introductory section to understand the purpose of the 83(b) election.

03

Gather necessary information, including details about the stock received and the fair market value at the time of transfer.

04

Fill out your name, address, and Social Security number in the appropriate sections.

05

Provide the description of the property (e.g., number of shares) and the date of transfer.

06

Detail the fair market value of the property at the time of transfer, indicating the amount paid, if applicable.

07

Sign and date the form to verify all information is accurate and complete.

08

Make photocopies of the completed form for your records.

09

Send the original form to the IRS within 30 days of the transfer to ensure the election is valid.

Who needs Fidelity Investments Instructions for Completing IRS Section 83(b)?

01

Individuals who have received restricted stock or stock options that are subject to vesting.

02

Employees or contractors who want to elect to include the value of restricted property in their income at the time of transfer rather than at the time of vesting.

03

Taxpayers wishing to understand their tax implications regarding equity compensation.

Fill

irs form 83 b

: Try Risk Free

People Also Ask about form 83b irs

How long does it take to file 83b?

To qualify for preferential tax treatment, your 83(b) election form must be postmarked and mailed to the appropriate IRS office within 30 days of purchasing your stock grant or the date of your early exercise.

How does 83b affect tax?

An 83(b) election allows the employee to pay income taxes earlier, often before the company shares have climbed in value. Thus, when you sell shares for a gain later on (at least a year), you will pay capital gains tax instead of ordinary income tax, which is taxed at a higher rate.

How do I know if IRS received my 83b?

The certified mail with the return receipt will help you confirm that the IRS received the 83(b) form. Keep a copy of the completed form, the return receipt, and the mailing envelope with the 83(b) filing address for your records.

How do I know if the IRS got my 83b?

The certified mail with the return receipt will help you confirm that the IRS received the 83(b) form. Keep a copy of the completed form, the return receipt, and the mailing envelope with the 83(b) filing address for your records.

How to file 83b election electronically?

Sign your 83(b) election form electronically Choose shares that are eligible for early exercise in Carta. Access the digital 83(b) election form. Fill out the form and provide a digital signature. Submit your form for Carta to mail on your behalf. Track the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the form 83b pdf form on my smartphone?

Use the pdfFiller mobile app to fill out and sign 83b. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit irs section 83 b form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign 83b irs form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I fill out 83 b election form on an Android device?

Complete 83 b filing instructions and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is Fidelity Investments Instructions for Completing IRS Section 83(b)?

Fidelity Investments provides guidance for individuals who have received stock or other property subject to vesting and want to make an 83(b) election to be taxed on the value of the property at the time of transfer, rather than when it vests.

Who is required to file Fidelity Investments Instructions for Completing IRS Section 83(b)?

Any individual who receives stock or other property as part of their compensation and wishes to elect 83(b) treatment must file the instructions, which typically applies to employees and contractors receiving restricted stock or options.

How to fill out Fidelity Investments Instructions for Completing IRS Section 83(b)?

To fill out the 83(b) election form, the individual must provide their name, address, the description of the property, the date of transfer, the fair market value at the time of transfer, and a statement affirming the election.

What is the purpose of Fidelity Investments Instructions for Completing IRS Section 83(b)?

The purpose of the instructions is to inform individuals of their rights to make the 83(b) election, enabling them to recognize income at the time of transfer instead of at vesting, potentially leading to tax advantages.

What information must be reported on Fidelity Investments Instructions for Completing IRS Section 83(b)?

The information that must be reported includes the name and address of the taxpayer, the description of the property received, the date of transfer, the fair market value of the property on the date of transfer, and details regarding any amounts paid for the property.

Fill out your irs form 83b 2022-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 83b Fillable is not the form you're looking for?Search for another form here.

Keywords relevant to irs 83 b election form pdf

Related to 83b election form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.