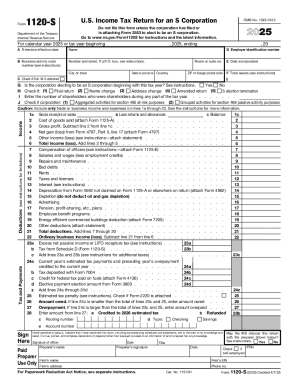

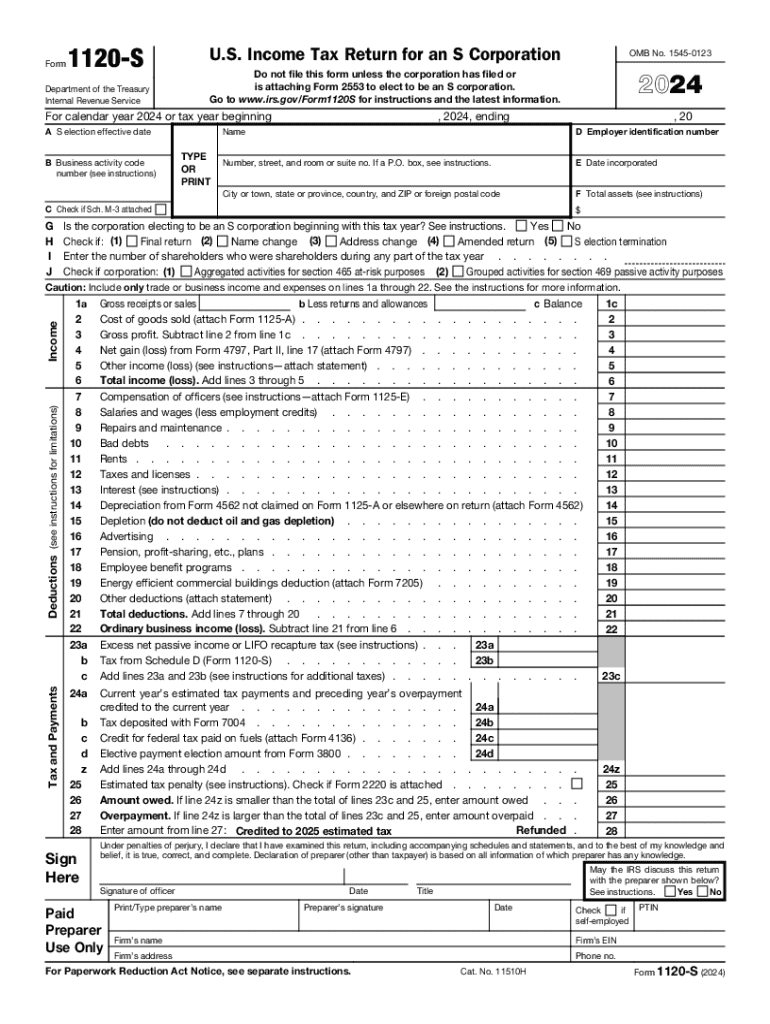

IRS 1120S 2024 free printable template

Instructions and Help about IRS 1120S

How to edit IRS 1120S

How to fill out IRS 1120S

Latest updates to IRS 1120S

About IRS 1120S 2024 previous version

What is IRS 1120S?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1120S

What should I do if I need to amend my IRS 1120S after filing?

If you need to amend your IRS 1120S, you must file Form 1120S-X, the Amended U.S. Income Tax Return for an S Corporation. Ensure that you clearly indicate the changes you are making and provide any additional documentation required. Keep a copy of your amended return for your records.

How can I verify the status of my IRS 1120S filing?

To verify the status of your IRS 1120S filing, you can use the IRS's online tools or contact them directly. Be prepared with your business's identifying information, such as the Employer Identification Number (EIN), to help facilitate the inquiry. Tracking your filing can prevent potential issues with receipts or processing times.

What are some common errors to avoid when submitting IRS 1120S?

Common errors when filing IRS 1120S include incorrect EIN entries, missing signatures, and failing to attach necessary schedules or forms. Carefully review your return for mathematical errors and ensure all required sections are filled out completely to minimize the risk of rejection or processing delays.

Is an electronically filed IRS 1120S treated differently than a paper filed one?

Yes, an electronically filed IRS 1120S may be processed more quickly than a paper-filed return. Ensure that you confirm compatibility with e-filing software to avoid technical issues and potential rejection. Keep records of your electronic submission to track the filing status efficiently.

What should I do if I receive a notice from the IRS regarding my IRS 1120S?

If you receive an IRS notice regarding your IRS 1120S, carefully read the notice to understand the issue addressed. You may need to gather relevant documentation and respond promptly by the deadline indicated in the notice. If unsure, it's advisable to consult a tax professional for further assistance.

See what our users say