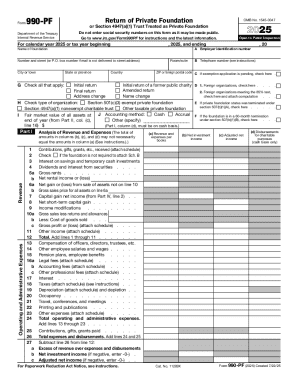

IRS 990-PF 2024 free printable template

Instructions and Help about form 990pf

How to edit form 990pf

How to fill out form 990pf

Latest updates to form 990pf

All You Need to Know About form 990pf

What is form 990pf?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 990-PF

What should I do if I notice an error on my submitted form 990pf?

If you find a mistake on your filed form 990pf, you need to submit an amended form. Prepare a new version of the form, mark it as amended, and clearly indicate the corrections made. This ensures that the IRS has the most accurate information and avoids potential penalties.

How can I verify if my form 990pf has been processed by the IRS?

To check the status of your filed form 990pf, you can contact the IRS directly or utilize their online services. Keep your submission details handy, as they may ask for specifics to locate your filing and confirm its processing status.

What common mistakes should I avoid when filing form 990pf?

When completing form 990pf, ensure that all information is accurate and fully filled. Common pitfalls include miscalculating financial figures, failing to attach necessary schedules, and not signing the form. Double-checking entries can help prevent these issues.

What privacy concerns should I be aware of when filing form 990pf electronically?

When e-filing form 990pf, it's crucial to protect sensitive data. Ensure you use secure internet connections and trusted software. Additionally, understand the data retention policies and how your information may be stored or shared, especially when dealing with third-party e-file service providers.

See what our users say