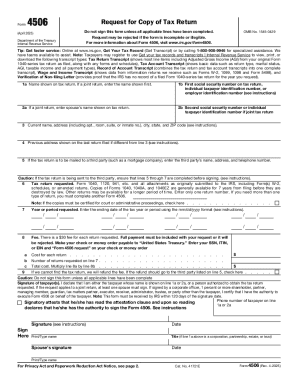

IRS 4506 2024 free printable template

Instructions and Help about IRS 4506

How to edit IRS 4506

How to fill out IRS 4506

Latest updates to IRS 4506

About IRS 4 previous version

What is IRS 4506?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 4506

What should I do if I need to correct an error on my IRS 4506?

If you've made a mistake on your IRS 4506 form, you can submit a corrected version. Make sure to clearly indicate that it is an amended submission, and include any necessary corrections. Retaining a copy of both the original and corrected forms is crucial for your records.

How can I verify the status of my submitted IRS 4506?

To check the status of your IRS 4506, you can contact the IRS directly or use their online tools. It’s essential to have your submission details ready, as this will help in tracking the processing of your request effectively.

What are some common mistakes to avoid when submitting the IRS 4506?

Common errors include incorrect social security numbers, missing signatures, and failing to match the name exactly as it appears on tax documents. Double-checking all information before final submission can help avoid delays or rejections.

Can someone else file an IRS 4506 on my behalf?

Yes, an authorized representative can file the IRS 4506 for you, provided they have the proper power of attorney documentation. Make sure that your representative understands the specifics of your tax situation to ensure accurate filing.

What should I do if my IRS 4506 is rejected during e-filing?

If your IRS 4506 is rejected when e-filing, review the rejection code provided, as it usually indicates the specific issue. Correct the error and resubmit your form promptly, ensuring all information is accurate to avoid further rejections.

See what our users say