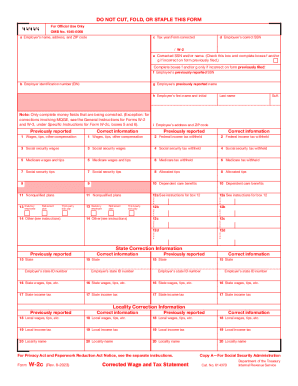

IRS W-2c 2024-2025 free printable template

Show details

Attention: You may file Forms W2 and W3 electronically on the SSAs Employer W2 Filing Instructions and Information web page, which is also accessible at www.socialsecurity.gov/employer. You can create

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-2c

How to edit IRS W-2c

How to fill out IRS W-2c

Instructions and Help about IRS W-2c

How to edit IRS W-2c

To edit an IRS W-2c form, first download the form from the IRS website or access it through your tax software. Check the accuracy of the information present and make the necessary corrections directly on the form. After completing the edits, ensure to save a copy or print it for your records. Using tools like pdfFiller can facilitate the editing process, allowing you to input information directly onto the form.

How to fill out IRS W-2c

Filling out the IRS W-2c involves the following steps:

01

Obtain the correct version of the W-2c form from the IRS.

02

Input the pertinent employee information, including name, address, and Social Security number.

03

Correct any prior-year errors in the original W-2 form by providing accurate figures.

04

Ensure all boxes applicable to the correction are marked correctly.

05

Sign and date the form before submitting it to the IRS.

Latest updates to IRS W-2c

Latest updates to IRS W-2c

The IRS regularly updates forms to reflect changes in tax law or reporting requirements. As of late 2023, there have been no significant changes to the W-2c form itself, but filers should always check for updates that may affect filing procedures.

All You Need to Know About IRS W-2c

What is IRS W-2c?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS W-2c

What is IRS W-2c?

IRS W-2c, also known as the “Corrected Wage and Tax Statement,” is a form used to correct errors on previously filed W-2 forms. Employers use this form to report any discrepancies in wages, tips, or taxes withheld that need rectification. This ensures that employees have an accurate record for tax purposes.

What is the purpose of this form?

The primary purpose of the IRS W-2c is to amend the information reported on the original W-2 form. This could include corrections related to the employee's earnings, Social Security numbers, or tax withholdings. By issuing a W-2c, employers can provide accurate tax information to their employees and the IRS, which is crucial for tax filings.

Who needs the form?

Employers who discover errors in previously submitted W-2 forms must file a W-2c. This includes all types of employers, such as businesses, non-profits, and government agencies. Employees should receive a W-2c from their employer whenever corrections are made to their wage or tax information.

When am I exempt from filling out this form?

Filers are exempt from submitting a W-2c if no errors were found on the original W-2 form. Additionally, if the W-2 form accurately reflects the employee's earnings and tax withholding as of the filing deadline, a correction is unnecessary.

Components of the form

The IRS W-2c contains several essential components, including the employee’s name, address, Social Security number, and the corrected wage and tax figures. Each box corresponds to specific information that needs to be reported accurately. It also includes the employer’s information and the appropriate correction boxes that indicate which entries have been amended.

Due date

The due date for filing the W-2c varies depending on the filing method. If submitted paper forms, it must be postmarked by the last day of February following the year of the correction. For electronic submissions, the due date is the last day of March. Employers are encouraged to file the corrections as soon as possible to ensure accurate records.

What are the penalties for not issuing the form?

Failure to issue a W-2c when required may result in significant penalties imposed by the IRS. These penalties can vary based on the delay in issuing the correction. Employers risk fines that range from $50 to $270 per form, depending on how late the correction is submitted, with a maximum penalty per calendar year.

What information do you need when you file the form?

When filing the W-2c, you need the original W-2 information, the corrected values for wages and withholding, and accurate identification details for both the employer and employee. This information is crucial for processing and ensuring that both parties maintain accurate tax records.

Is the form accompanied by other forms?

The W-2c is generally filed alone, without the need for additional forms. However, if the W-2c is issued to correct multiple W-2 forms, it may be accompanied by explanations or additional documentation that clarifies the reasons for the corrections.

Where do I send the form?

Employers should send the completed W-2c to the IRS at the address specified in the form instructions. If sending multiple forms, consolidation may be necessary, and they should verify the correct submission procedures to avoid processing delays.

See what our users say