NC Tax Return Prepared Food & Beverage Tax 2024-2026 free printable template

Show details

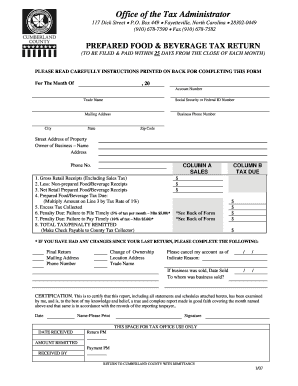

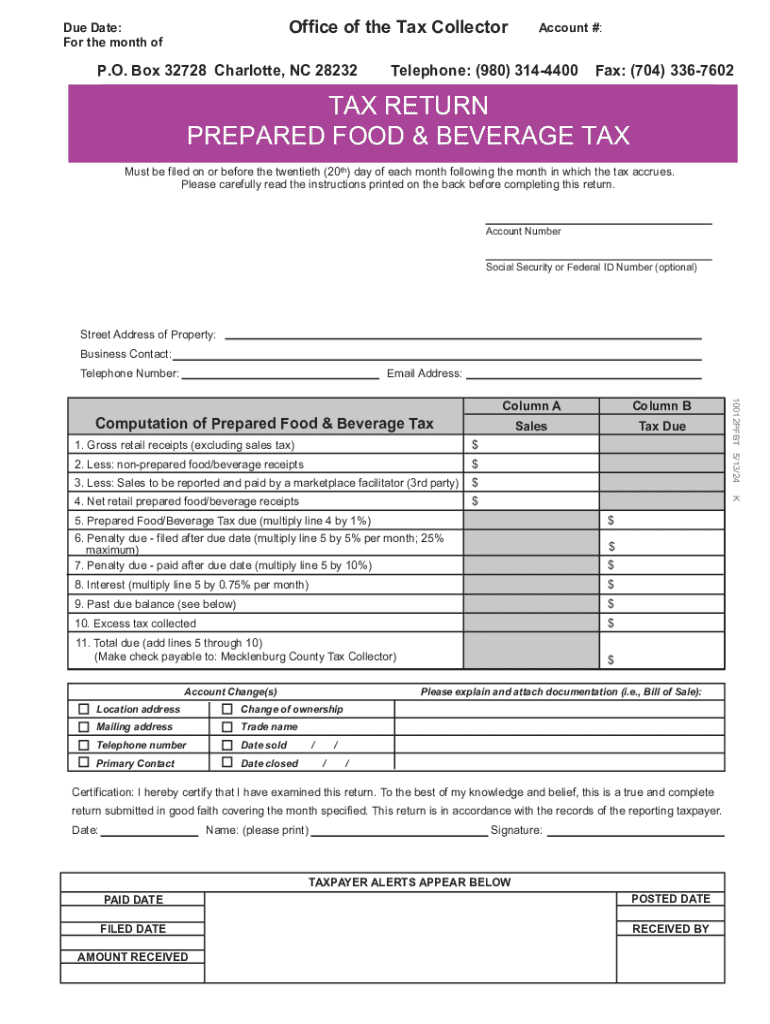

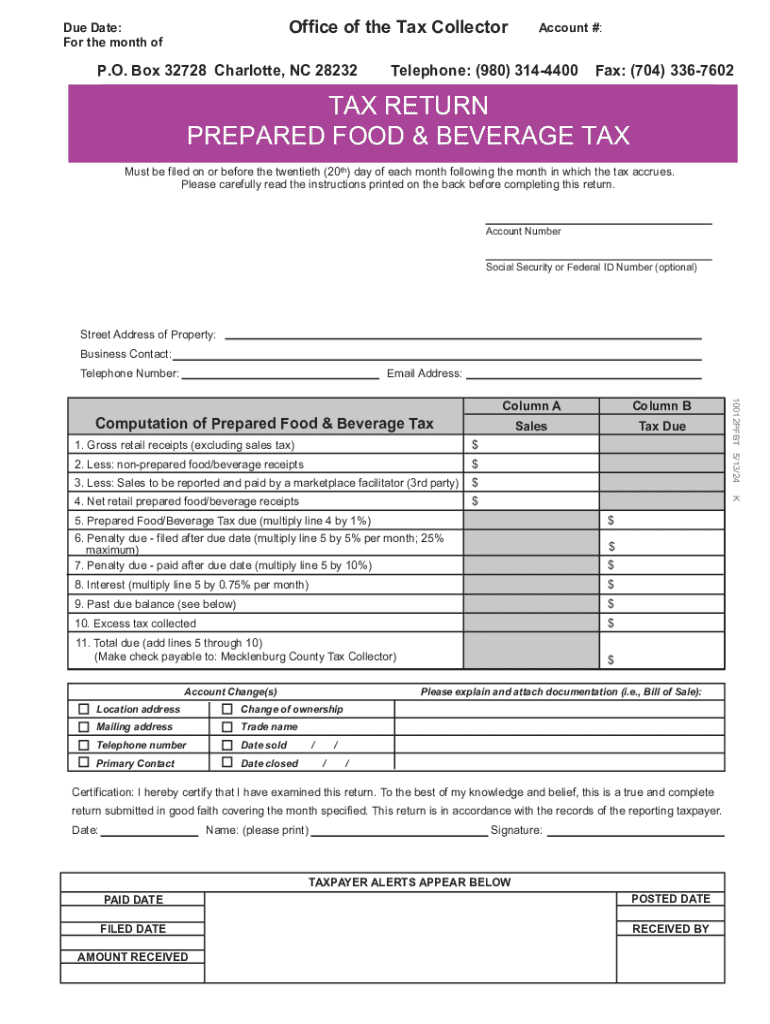

Office of the Tax CollectorDue Date:

For the month ofP.O. Box 32728 Charlotte, NC 28232Account #:Telephone: (980) 3144400Fax: (704) 3367602TAX RETURN

PREPARED FOOD & BEVERAGE TAX

Must be filed on

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign return prepared food tax mecklenburg county edit form

Edit your prepared food beverage tax mecklenburg county get form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC Tax Return Prepared Food Beverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NC Tax Return Prepared Food Beverage online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NC Tax Return Prepared Food Beverage. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC Tax Return Prepared Food & Beverage Tax Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC Tax Return Prepared Food Beverage

How to fill out NC Tax Return Prepared Food & Beverage

01

Gather all necessary documents including sales records and invoices.

02

Obtain the NC Tax Return form for Prepared Food & Beverage from the NC Department of Revenue website.

03

Fill out the personal information section at the top of the form accurately.

04

Report total sales by entering the gross receipts from sales of prepared food and beverage.

05

Calculate the applicable state and local sales tax based on your sales figures.

06

Complete any other required sections, such as deductions or exemptions if applicable.

07

Review the form for accuracy and completeness.

08

Sign and date the form before submission.

09

Submit the form either electronically or by mailing it to the appropriate NC Department of Revenue address.

Who needs NC Tax Return Prepared Food & Beverage?

01

Businesses that sell prepared food and beverages in North Carolina.

02

Restaurants, cafés, and catering services that are subject to NC sales tax.

03

Vendors or mobile food operators providing food services.

04

Any entity that is required to collect and remit sales tax on food sales in NC.

Fill

form

: Try Risk Free

People Also Ask about

Is prepared food taxable in California?

To-go sales of hot prepared food products are taxable, unless they are considered hot baked goods. Hot beverages such as coffee and tea are not taxable if sold to-go, but soda and alcoholic beverages are always taxable. For more information, see publication 22, Dining and Beverage Industry.

Why is cold food not taxable?

A cold food product is not “suitable for consumption on the premises” if it requires further processing by the customer, or is sold in a size not ordinarily consumed by one person. For example, the sale of a frozen pizza is not taxable because it requires further processing by the customer.

What is the prepared food tax in NC?

Prepared Meals Tax in North Carolina is a 1% tax that is imposed upon meals that are prepared at restaurants. The tax is only imposed by local jurisdictions upon the granting of approval by the North Carolina General Assembly. The provision is found in G.S. 105-164.3(28) and reads as follows: 28) Prepared food.

Is there sales tax on prepared food in Texas?

Food products are not taxable. Food products include flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries. Nontaxable food products also include food that is: typically reheated before eating; or.

Is cold food to-go taxable in California?

California Constitution, Article XIII, Section 34. (a) In General. Tax does not apply to sales of food products for human consumption except as provided in Regulations 1503, 1574, and 1603.

Is to-go food taxed in California?

Food Deliveries If you make deliveries of food, it is considered food sold "to-go". Hot prepared food is taxable including any delivery fees you may charge. However, if the food product is not taxable, such as cold sandwiches, then the delivery charge is also not taxable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NC Tax Return Prepared Food Beverage in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your NC Tax Return Prepared Food Beverage and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Where do I find NC Tax Return Prepared Food Beverage?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific NC Tax Return Prepared Food Beverage and other forms. Find the template you need and change it using powerful tools.

How do I complete NC Tax Return Prepared Food Beverage on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your NC Tax Return Prepared Food Beverage by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is NC Tax Return Prepared Food & Beverage?

The NC Tax Return Prepared Food & Beverage is a specific tax return form used in North Carolina to report sales and use tax collected on sales of prepared food and beverages.

Who is required to file NC Tax Return Prepared Food & Beverage?

Businesses and vendors that sell prepared food and beverages in North Carolina are required to file this tax return if they collect sales tax on these transactions.

How to fill out NC Tax Return Prepared Food & Beverage?

To fill out the NC Tax Return Prepared Food & Beverage, businesses must gather their sales records, complete the required fields on the form detailing their sales tax collected on food and beverage sales, and submit it by the due date.

What is the purpose of NC Tax Return Prepared Food & Beverage?

The purpose of the NC Tax Return Prepared Food & Beverage is to report and remit the sales and use tax collected on prepared food and beverages, ensuring compliance with state tax laws.

What information must be reported on NC Tax Return Prepared Food & Beverage?

The information that must be reported includes the total sales of prepared food and beverages, the amount of sales tax collected, relevant deductions, and any adjustments as required by North Carolina tax regulations.

Fill out your NC Tax Return Prepared Food Beverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC Tax Return Prepared Food Beverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.