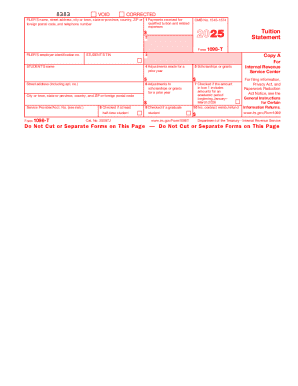

IRS 1098-T 2024 free printable template

Instructions and Help about form 1098 t

How to edit form 1098 t

How to fill out form 1098 t

Latest updates to form 1098 t

All You Need to Know About form 1098 t

What is form 1098 t?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

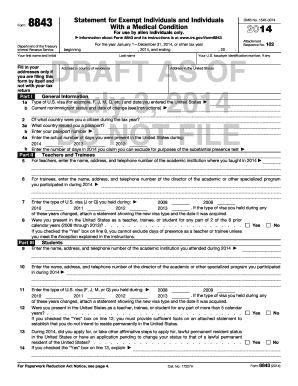

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1098-T

What should I do if I realize I've made a mistake on my filed form 1098 T?

If you've discovered an error in your filed form 1098 T, you can correct it by filing an amended return. This typically involves submitting a new form with the correct information and clearly indicating that it is a correction. Make sure to keep detailed records of any correspondence related to the amendment for future reference.

How can I verify if my electronically filed form 1098 T has been accepted?

To verify the acceptance of your e-filed form 1098 T, you should check the status through the e-filing platform you used. Most platforms provide a status tracker that can confirm whether the form has been processed successfully or if there are any issues that need addressing. Additionally, watch for any confirmation emails or notifications related to your submission.

What should I consider for privacy and data security when submitting my form 1098 T?

When filing your form 1098 T, ensure that you are using secure methods of submission, particularly when e-filing. This includes using encrypted sites and two-factor authentication if available. It's also crucial to keep a record of how long you retain copies of the form to protect sensitive information.

Are there any errors I should specifically watch out for when completing form 1098 T?

Common errors to avoid include incorrect Social Security Numbers or Employer Identification Numbers, mismatched names and addresses, and inaccurate reporting of amounts. Double-checking these fields against official records can help prevent rejections or delays in processing your form 1098 T.

What should I do if I receive a notice regarding my submitted form 1098 T?

If you receive a notice about your form 1098 T, it’s important to respond promptly. Review the notice to understand the issue, and gather any required documentation that supports your case. If necessary, consider consulting with a tax professional to ensure your response is accurate and complete.

See what our users say