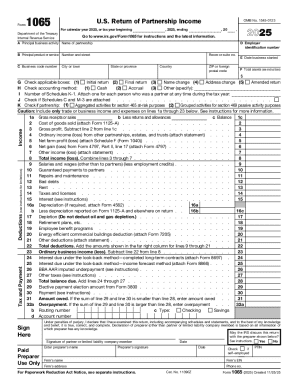

IRS 1065 2024 free printable template

Instructions and Help about IRS 1065

How to edit IRS 1065

How to fill out IRS 1065

Latest updates to IRS 1065

About IRS previous version

What is IRS 1065?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1065

What should I do if I need to correct a mistake on my IRS 1065?

If you discover an error in your filed IRS 1065, you'll want to amend the form immediately. You can do this by filing Form 1065-X, which allows you to report any corrections needed. Keep in mind that prompt action can help mitigate any potential penalties or interest that might arise from the error.

How can I check the status of my submitted IRS 1065?

To verify the status of your IRS 1065 submission, you can use the IRS online filing tool, which allows you to check the processing status. Additionally, if you filed electronically, you may receive confirmation via email, or you can call the IRS directly for updates.

What are the common errors that can occur when filing the IRS 1065 electronically?

Common errors when e-filing the IRS 1065 include incorrect data entry, failure to include required information, and issues with the software compatibility. To minimize these issues, double-check all entries and ensure that your e-filing software is up to date and compliant with IRS requirements.

Is it acceptable to use an e-signature when filing the IRS 1065?

Yes, the IRS accepts e-signatures on the IRS 1065 as long as specific criteria are met. This includes using a process that complies with IRS e-signature guidelines. It's essential to check these requirements to ensure your submission is valid and carries the necessary legal weight.

What should I do if I receive a notice from the IRS regarding my 1065 filing?

If you receive an IRS notice related to your 1065, carefully read the document for instructions. It will outline any required actions, such as responding with additional information or clarification. Always keep a record of your correspondence and documentation when responding to IRS inquiries.

See what our users say