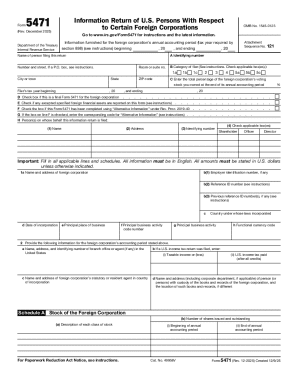

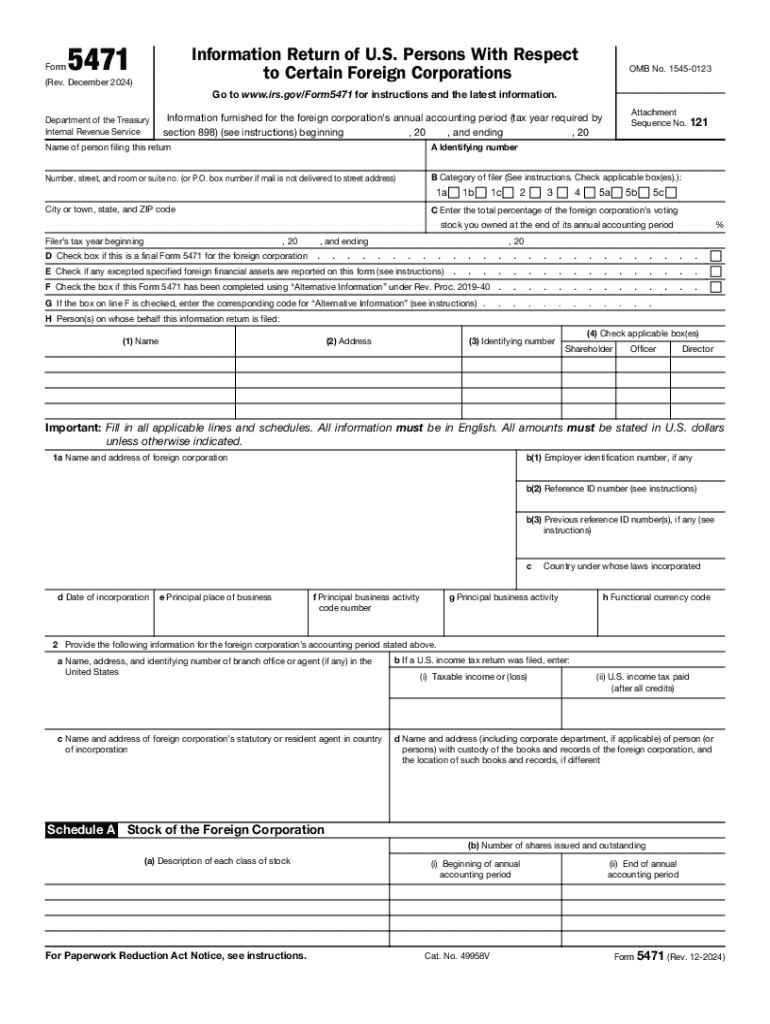

IRS 5471 2024 free printable template

Instructions and Help about IRS 5471

How to edit IRS 5471

How to fill out IRS 5471

Latest updates to IRS 5471

About IRS 5 previous version

What is IRS 5471?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 5471

What should I do if I realize there is an error in my submitted IRS 5471?

If you discover an error after submitting your IRS 5471, you should file an amended return using the correct form. Ensure that you indicate the specific corrections made and clearly label the amended form. It's also advisable to retain documentation that supports your corrections for future reference.

How can I check the status of my IRS 5471 filing?

To verify the status of your IRS 5471 filing, you can use the IRS e-file system. Common rejection codes may signal issues that need correction, so it’s essential to keep track of communication from the IRS. If no issues arise, processing typically takes a few weeks after submission.

Are there specific privacy measures I should take when e-filing IRS 5471?

When e-filing the IRS 5471, ensure that you are using secure internet connections and trusted devices. Additionally, be mindful of digital storage practices to protect sensitive information, including ensuring that you keep records for the required retention period.

What happens if my IRS 5471 filing is rejected?

If your IRS 5471 is rejected, the IRS will typically provide a reason for the rejection. It’s crucial to address the specific issue highlighted, make the necessary corrections, and resubmit the form promptly to avoid penalties.

Can I e-file IRS 5471 using my mobile device?

While some software allows for e-filing on mobile devices, it's important to check compatibility with the IRS e-file system ahead of time. Using a desktop or laptop may offer a smoother experience, especially for complex forms like the IRS 5471.