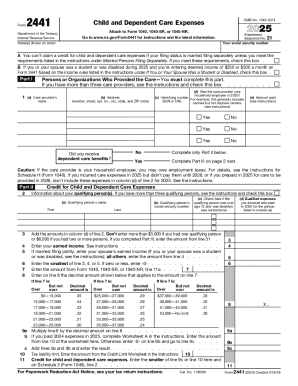

IRS 2441 2024 free printable template

Instructions and Help about IRS 2441

How to edit IRS 2441

How to fill out IRS 2441

Latest updates to IRS 2441

About IRS 2 previous version

What is IRS 2441?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 2441

What should I do if I realize I've made a mistake on my IRS 2441 after submission?

If you identify an error on your submitted IRS 2441, you'll need to file an amended form. To correct the mistake, use Form 1040-X, which allows you to revise your original submission. It's essential to act promptly to ensure your tax records are updated and avoid potential issues with the IRS.

How can I verify whether my IRS 2441 has been successfully received and processed?

To check the status of your IRS 2441 submission, you can use the IRS 'Where's My Refund?' tool or contact the IRS directly via their help line. Be prepared to provide your Social Security number, filing status, and the exact amount of your refund for verification purposes.

What should I do if my IRS 2441 submission is rejected when e-filing?

If your IRS 2441 is rejected during the e-filing process, review the rejection code provided by the e-filing software for specifics. Common reasons include issues with data entry or missing information. Correct the identified issue and resubmit your form to ensure timely processing.

Are there any legal considerations regarding the e-signature for filing IRS 2441?

When e-filing IRS 2441, the IRS accepts electronic signatures as valid, provided you follow the guidelines set forth in IRS publications. Ensure you meet the requirements for authentication to maintain compliance and avoid issues with your submission.

See what our users say