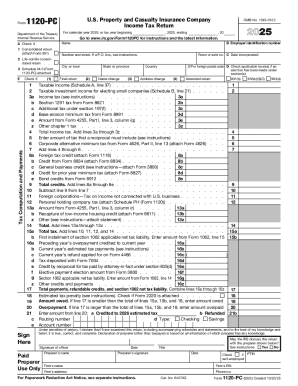

IRS 1120-PC 2024 free printable template

Instructions and Help about IRS 1120-PC

How to edit IRS 1120-PC

How to fill out IRS 1120-PC

Latest updates to IRS 1120-PC

About IRS 1120-PC 2024 previous version

What is IRS 1120-PC?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1120-PC

How can I correct errors on the IRS 1120-PC?

To correct mistakes on the IRS 1120-PC, you should file an amended return using Form 1120X. This allows you to address any discrepancies without incurring penalties for incorrect information. Ensure that all corrections are clearly noted to avoid confusion during processing.

What should I do if my IRS 1120-PC submission gets rejected?

If your IRS 1120-PC is rejected, review the feedback for common e-file rejection codes. Make the necessary adjustments and resubmit your form as soon as possible. It's crucial to monitor the resubmission to ensure it is accepted.

Are e-signatures acceptable for the IRS 1120-PC?

Yes, e-signatures are acceptable for the IRS 1120-PC as long as they meet the IRS requirements for electronic submissions. Ensure that proper authentication procedures are followed to maintain the integrity and privacy of your filing.

What should I do if I receive an audit notice after filing the IRS 1120-PC?

If you receive an audit notice, first read the notification carefully to understand the issues being raised. Gather necessary documentation to support your filing and consider seeking advice from a tax professional to navigate the audit process effectively.