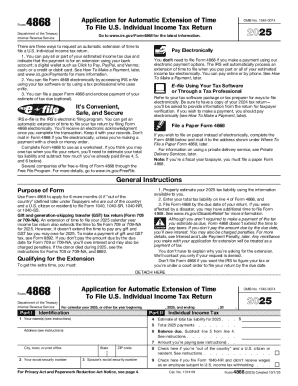

IRS 4868 2024 free printable template

Instructions and Help about IRS 4868

How to edit IRS 4868

How to fill out IRS 4868

Latest updates to IRS 4868

About IRS 4 previous version

What is IRS 4868?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 4868

What should I do if I realize I made a mistake on my filed IRS 4868?

If you discover an error after submitting your IRS 4868, you should file an amended version of the form. Ensure you complete the corrections accurately and submit it to the IRS as soon as possible. Retain a copy of both the original and the amended forms for your records.

How can I verify that my IRS 4868 was received and processed?

To check the status of your IRS 4868, you can use the IRS online tool designed for tracking your filings. If you filed electronically, you might also receive an email confirmation. If you mailed your form, consider calling the IRS for confirmation, though this may require you to wait for processing times to elapse.

What are common errors to avoid when filing IRS 4868?

Common errors when filling out IRS 4868 include incorrect amounts, failing to sign the form, or submitting it past the due date. Double-checking calculations and ensuring all information is complete can help prevent these mistakes. Additionally, keeping documentation handy can expedite the correction process if needed.

Are there specific technical requirements for e-filing IRS 4868?

To successfully e-file IRS 4868, ensure your software is compatible with the IRS’s e-filing system and check that you have a stable internet connection. Also, make sure to use an up-to-date browser to avoid compatibility issues during submission.

See what our users say