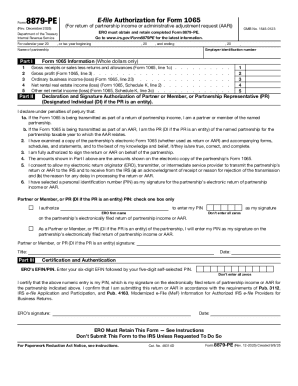

IRS 8879-PE 2024 free printable template

Instructions and Help about IRS 8879-PE

How to edit IRS 8879-PE

How to fill out IRS 8879-PE

Latest updates to IRS 8879-PE

About IRS 8879-PE 2024 previous version

What is IRS 8879-PE?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8879-PE

What should I do if I realize there's a mistake on my IRS 8879-PE after submission?

If you discover an error on your IRS 8879-PE after it has been submitted, you should file a corrected version as soon as possible. Keep documentation that explains the mistake and the corrections made. It's important to ensure the correction is timely to avoid potential penalties or issues with your e-filed tax return.

How can I verify if my IRS 8879-PE has been received and processed?

To verify the receipt and processing status of your IRS 8879-PE, you can check the IRS e-file status page or contact the IRS customer service line. Having your confirmation number from the submission will facilitate the inquiry. This is important to ensure your e-file is complete and under processing correctly.

What should I do if I receive a notice from the IRS regarding my IRS 8879-PE?

If you receive a notice from the IRS concerning your IRS 8879-PE, it's crucial to read the notice carefully for specific instructions. Prepare any requested documentation and respond within the timeframe specified in the notice to resolve any issues efficiently. Consider consulting a tax professional for guidance on handling the notice.

Are there any common errors to avoid when submitting the IRS 8879-PE?

Yes, some common errors on the IRS 8879-PE include incorrect signatures, mismatches with the principal's personal information, and failure to include all necessary identifiers. To reduce errors, double-check the entered information, and ensure all parties involved review the document before submission.

See what our users say