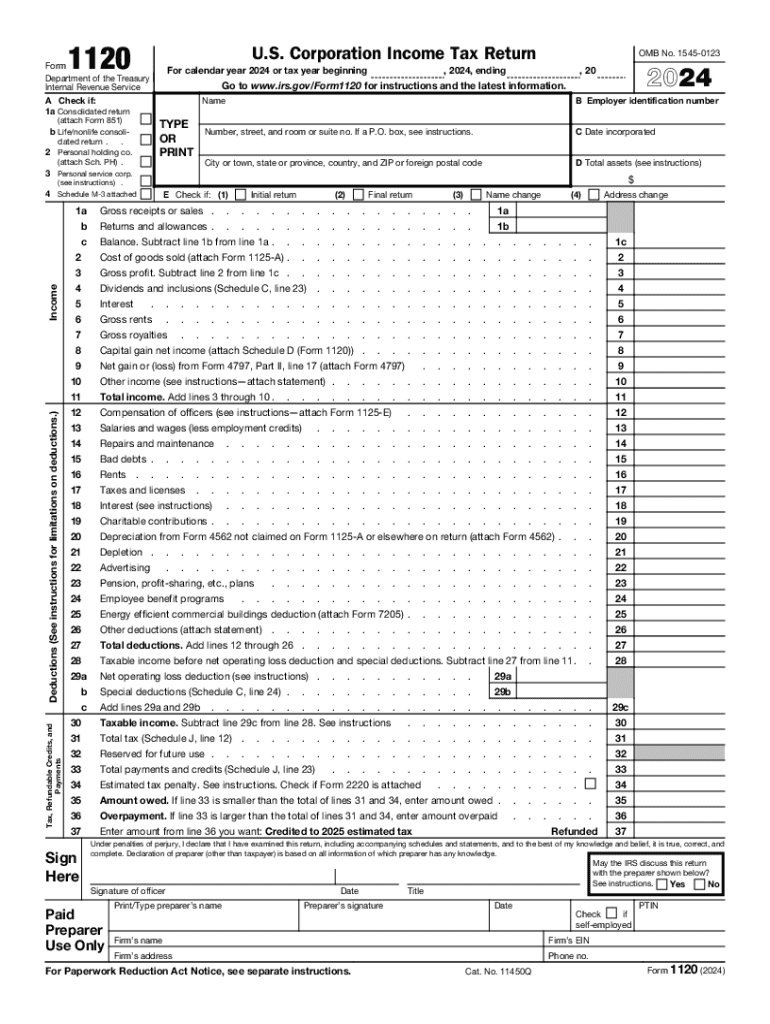

IRS 1120 2024 free printable template

Instructions and Help about IRS 1120

How to edit IRS 1120

How to fill out IRS 1120

Latest updates to IRS 1120

About IRS previous version

What is IRS 1120?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Is the form accompanied by other forms?

FAQ about IRS 1120

What should I do if I need to correct an error on my IRS 1120?

If you discover an error after submitting your IRS 1120, you can file an amended return using Form 1120X. Clearly indicate the changes made and include any supporting documentation. It's essential to retain records of the original submission and corrections for your files.

How can I verify if my IRS 1120 has been received and processed?

To check the status of your IRS 1120, you can use the IRS e-file status tool available on their website. Additionally, you will receive a confirmation when your return is processed, so keep an eye out for any related correspondence.

Are there specific legal requirements for electronically signing my IRS 1120?

Yes, e-signatures are generally accepted for IRS 1120 filings, but they must comply with IRS standards for electronic submissions. Ensure that your e-filing software meets the electronic signature requirements outlined by the IRS for legitimacy.

What common mistakes should I avoid when filing my IRS 1120?

Common mistakes include incorrect calculations, missing signatures, or failing to report all income. To avoid issues, double-check all entries, ensure proper documentation, and confirm your tax identification numbers are accurate before submission.

What should I do if I receive a notice or letter from the IRS after submitting my 1120?

If you receive a notice or letter from the IRS regarding your IRS 1120, carefully read the communication for instructions. Gather any requested documentation and respond promptly to avoid penalties or issues related to your filing.

See what our users say