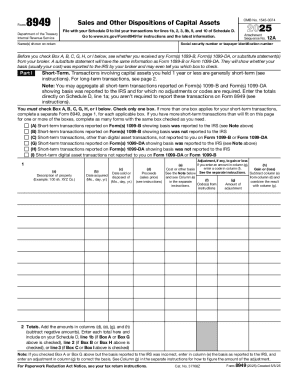

IRS 8949 2024 free printable template

Instructions and Help about 8949 form

How to edit 8949 form

How to fill out 8949 form

Latest updates to 8949 form

All You Need to Know About 8949 form

What is 8949 form?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8949

What should I do if I discover an error after submitting my 8949 form?

If you find an error on your submitted 8949 form, you can submit an amended return using Form 1040-X. Be sure to include the corrected information and any necessary documentation. It's important to address mistakes promptly, as the IRS may contact you for clarification or corrections.

How can I verify if my 8949 form was received and processed by the IRS?

To verify the status of your 8949 form submission, check the IRS 'Where’s My Refund?' tool for e-filed returns or contact the IRS directly if you mailed your documents. Keep a copy of your submission and any confirmation for your records.

Are there any common mistakes to watch out for when filing the 8949 form?

Common errors include incorrect cost basis calculations, misreporting sale dates, and failing to account for all transactions. To avoid these mistakes, double-check your entries, ensure accuracy in figures presented, and reconcile your records against brokerage statements.

What should I do if my 8949 form submission is rejected?

If your 8949 form is rejected, review the error codes provided by the IRS and correct any issues detailed. After fixing the errors, resubmit your form electronically if possible, as this is usually the fastest method for processing.

Is it acceptable to use an e-signature on my 8949 form?

Yes, electronic signatures are generally accepted for e-filed forms, including the 8949 form, provided that the electronic filing process adheres to IRS guidelines. It's advisable to retain any electronic filing confirmations for your records to ensure compliance.

See what our users say