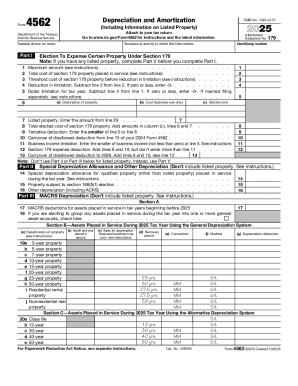

IRS 4562 2024 free printable template

Instructions and Help about IRS 4562

How to edit IRS 4562

How to fill out IRS 4562

Latest updates to IRS 4562

About IRS 4 previous version

What is IRS 4562?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 4562

What should I do if I realize I've made a mistake on my IRS 4562 after submission?

If you find an error on your IRS 4562 after filing, you should amend your form using IRS Form 1040-X for individuals or the appropriate method for businesses. Clearly indicate the corrections and provide a detailed explanation for each change to prevent any confusion during processing.

How can I confirm that my IRS 4562 has been received and is being processed?

To verify the status of your submitted IRS 4562, you can contact the IRS directly or check your e-file status if you submitted electronically. Keep your confirmation number handy, as it may be required for tracking purposes.

What are some common mistakes to avoid when filing the IRS 4562?

Common errors include miscalculating depreciation, providing incorrect taxpayer identification numbers, and omitting required information. To avoid these mistakes, review the form carefully before submission and consider consulting a tax professional for guidance.

Are there any specific security measures I should take when e-filing my IRS 4562?

When e-filing your IRS 4562, ensure you use reputable tax software that offers encryption and data protection features. Additionally, avoid public Wi-Fi networks during the submission process and always keep your tax documents secure to protect your personal information.

What should I do if I receive a notice from the IRS regarding my filed IRS 4562?

If you receive an IRS notice related to your IRS 4562, carefully read the communication to understand the issue. Gather any requested documentation, and respond promptly with the required information or corrections to avoid further complications.

See what our users say