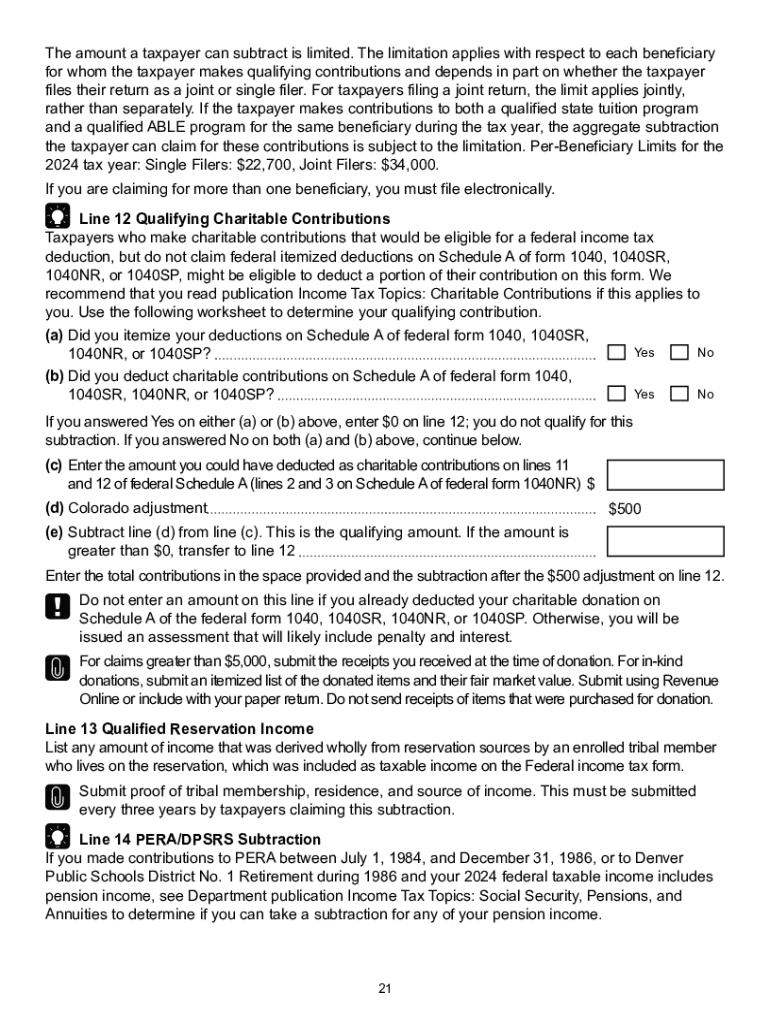

CO Income Tax Filing Guide 2024 free printable template

Instructions and Help about CO Income Tax Filing Guide

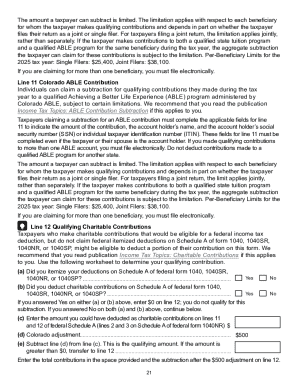

How to edit CO Income Tax Filing Guide

How to fill out CO Income Tax Filing Guide

Latest updates to CO Income Tax Filing Guide

About CO Income Tax Filing Guide 2024 previous version

What is CO Income Tax Filing Guide?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

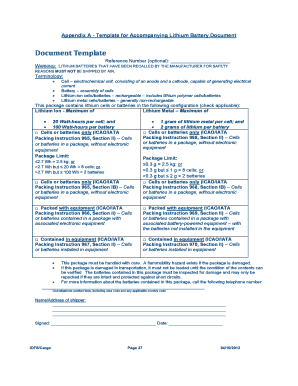

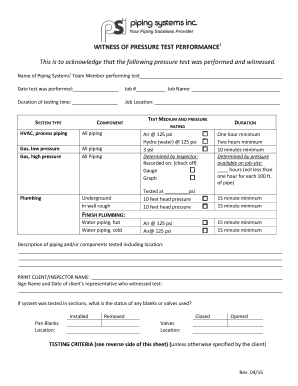

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

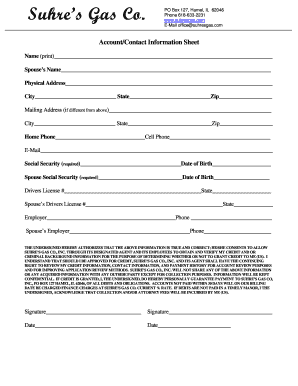

What information do you need when you file the form?

Where do I send the form?

FAQ about CO Income Tax Filing Guide

What should I do if I notice a mistake after filing my CO Income Tax Filing Guide?

If you find an error after submitting your CO Income Tax Filing Guide, you can correct it by filing an amended return. Use Form DR 0000-X, and make sure to indicate the changes and the reason for the correction to ensure proper processing.

How can I verify if my CO Income Tax Filing Guide has been received?

To check the status of your CO Income Tax Filing Guide, use the state's online tracking system. You can enter your details to see if your return has been received and is being processed; this is essential for peace of mind after you e-file or mail your return.

What should I consider regarding security when filing my CO Income Tax Filing Guide online?

When e-filing your CO Income Tax Filing Guide, ensure you are using secure and trusted internet connections. Look for software that complies with privacy regulations and offers data encryption to protect your sensitive information throughout the filing process.

What common errors should I avoid when submitting my CO Income Tax Filing Guide?

Common errors include incorrect Social Security Numbers, miscalculated deductions, and missing required signatures. Double-check all entries, use reliable tax software, and follow the provided guidelines carefully to minimize mistakes on your filing.