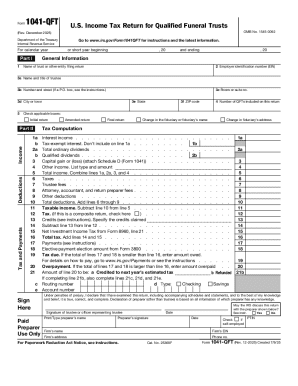

IRS 1041-QFT 2024 free printable template

Instructions and Help about IRS 1041-QFT

How to edit IRS 1041-QFT

How to fill out IRS 1041-QFT

Latest updates to IRS 1041-QFT

About IRS 1041-QFT 2024 previous version

What is IRS 1041-QFT?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1041-QFT

What should I do if I need to correct a mistake on my IRS 1041-QFT?

If you've made an error on your IRS 1041-QFT, the best approach is to file an amended return using Form 1041-X. Ensure that you explain the changes clearly and provide any necessary documentation to support your amendments.

How can I verify if my IRS 1041-QFT has been received by the IRS?

To check the status of your IRS 1041-QFT filing, you can use the IRS 'Where's My Refund?' tool if you filed electronically. For paper submissions, consider contacting the IRS directly for confirmation, and ensure you have your details handy.

What should I do if my electronic submission of IRS 1041-QFT is rejected?

If your electronic IRS 1041-QFT submission is rejected, review the error codes provided to identify the issue. Correct the identified problems and resubmit your form, ensuring that all data meets the required standards to avoid further rejections.

Are e-signatures accepted for IRS 1041-QFT?

Yes, the IRS accepts e-signatures for the IRS 1041-QFT, provided that the e-filing software you use complies with IRS standards for electronic submissions. Check with your software provider for specific guidelines on using e-signatures.

What should I do if I receive an audit notice related to my IRS 1041-QFT?

If you receive an audit notice concerning your IRS 1041-QFT, review the notice carefully to understand its context. Prepare the necessary documentation as outlined in the notice and consider consulting a tax professional for guidance on how to respond appropriately.