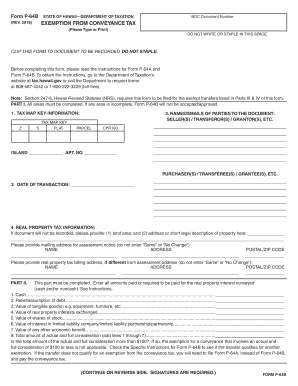

HI DoT P-64B 2024-2025 free printable template

Get, Create, Make and Sign hawaii form p 64b

How to edit hawaii p 64b blank online

Uncompromising security for your PDF editing and eSignature needs

HI DoT P-64B Form Versions

How to fill out hawaii tax p64b form

How to fill out HI DoT P-64B

Who needs HI DoT P-64B?

Video instructions and help with filling out and completing hawaii p 64b fillable

Instructions and Help about hawaii p64b fillable

But in this series of lectures we are going to begin the topic of the exterior calculus and algebra I don't know how far we'll get through it all I don't know how far we need to get we definitely need to cover the exterior calculus pretty thoroughly and it's related very closely to the algebra the algebra has got some interesting advanced topics in it but to begin to study the exterior calculus we need to discuss the concept of end forms because end forms are the basic elements that are used in both the exterior calculus and the exterior algebra and end forms begin with zero forms and zero forms are simply functions on the space-time so f of X is a zero form and remember we have a space-time with a coordinate system right we've established a coordinate system on our space-time in four dimensions and so f is a function of x0 x1 x2 and x3 so the partial derivatives of F with respect to any of those exist we presume F is smooth enough that these partial derivatives always exist so a zero form is simply a function on the space-time and and it really is it's it's a degenerate form of the N form so it doesn't have any unique it doesn't exemplify any of the important properties of the exterior algebra exterior calculus but it is a place we have to start because we are going to introduce an operator D and D we are going to learn is called the exterior derivative and it should be a very interesting animal we'll spend a lot of time talking about it but the exterior derivative of a zero form can only be understood through definition you have to just define it at the exterior derivative of a zero form is going to be given by a partial derivative of F with respect to X I times D X i where this guy well this guy is the basis of a stock which of course is just the basis of Co vectors and and of course it's all in the coordinate basis just as we've talked about before so now we have a definition of the differential of a function we call that the differential of a function or DF it's also the exterior derivative of a one form well approach that idea a little later we've we've talked about two types of derivatives this is the third one this is the third one so we're gonna have to spend a little bit of time focusing on that but we know at a zero form is and we know what a one form is so now with this idea of one form we can talk about the one form it's still a map it's this is a co vector right so it's still a map in fact it is a it is a 0 1 tensor I guess we've been doing it this way 0 1 tensor and it will it will act on a vector V and it does so in exactly the way you always would which is DF DX I D X I comma let's say V J partial J which is partial F partial X I the J Delta I J which is partial F partial X I V I okay which is really the same prescription as we've done before and this has a bunch of different notations right so this could be partial eye if VI like that or it's f comma I VI right we had that common notation for for D by D X I of F is f comma PI...

People Also Ask about hawaii p64b blank

How much does a deed cost in Hawaii?

How does a quit claim deed work in Hawaii?

How do I look up a deed in Hawaii?

Does a quit claim deed need to be notarized Hawaii?

How do I transfer property in Hawaii?

What is a fee conveyance Hawaii?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my hawaii p 64 b printable directly from Gmail?

How can I modify hawaii form p 64 b without leaving Google Drive?

How do I edit hawaii p 64b exemption in Chrome?

What is HI DoT P-64B?

Who is required to file HI DoT P-64B?

How to fill out HI DoT P-64B?

What is the purpose of HI DoT P-64B?

What information must be reported on HI DoT P-64B?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.