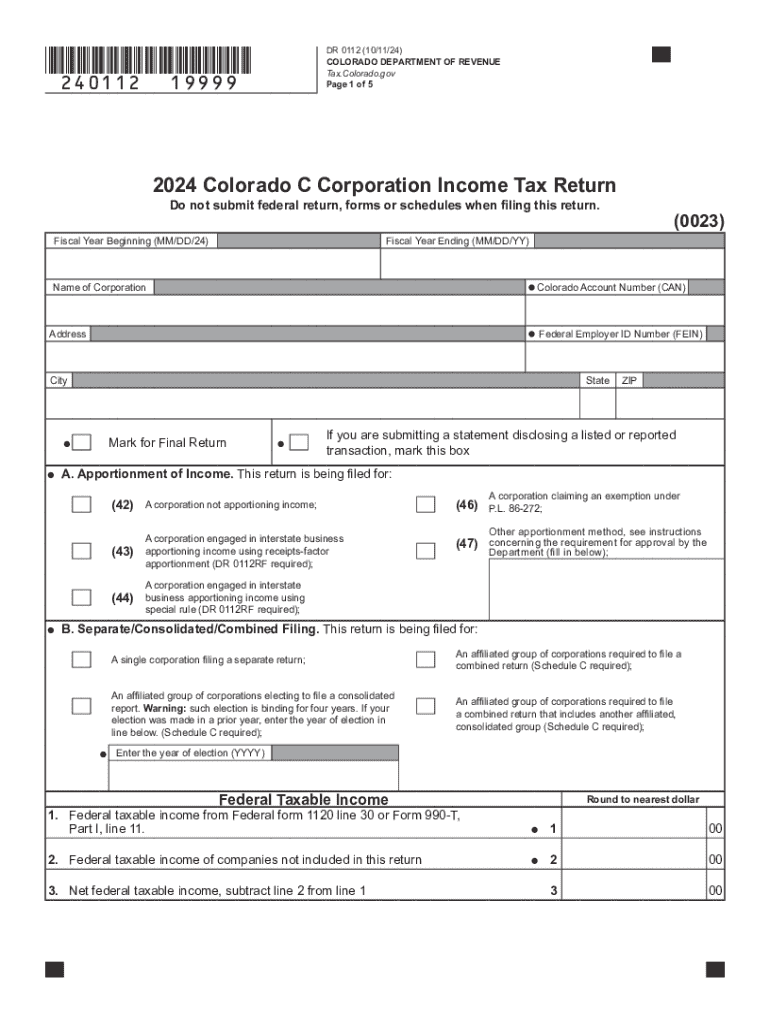

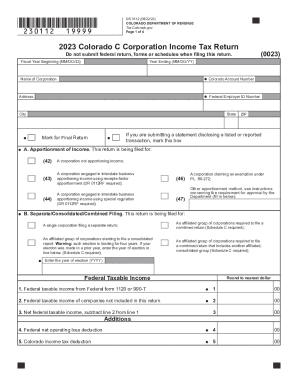

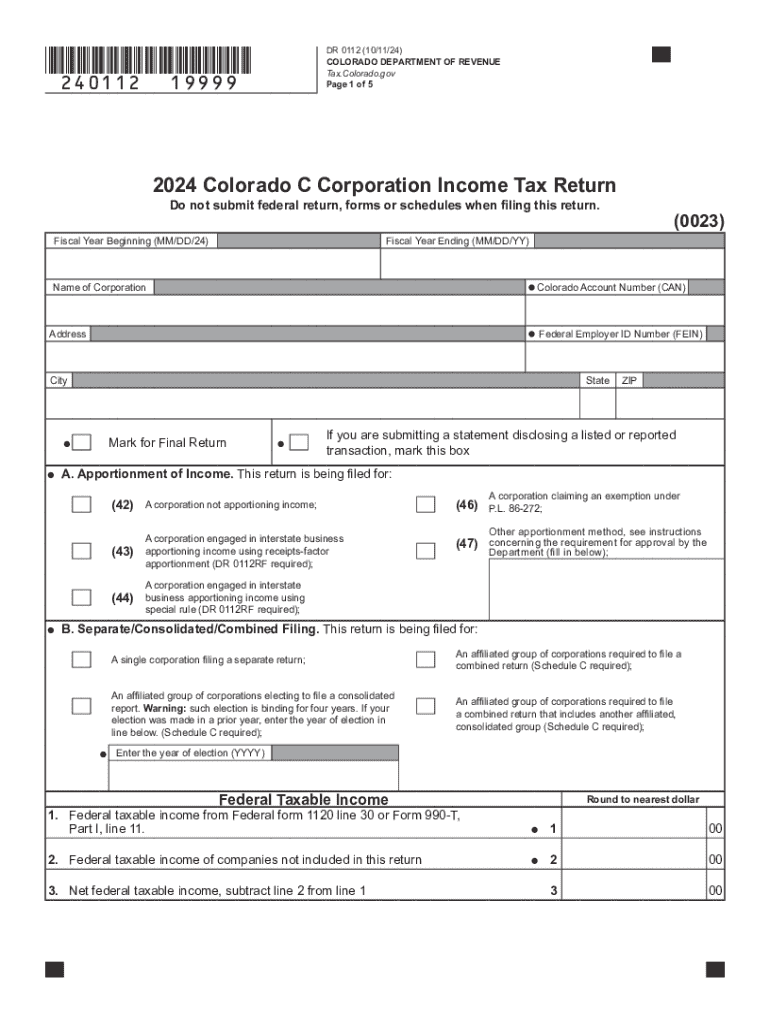

CO DoR 112 2024-2025 free printable template

Get, Create, Make and Sign colorado form 112 instructions

How to edit colorado form 112 instructions online

Uncompromising security for your PDF editing and eSignature needs

CO DoR 112 Form Versions

How to fill out 112 form co

How to fill out CO DoR 112

Who needs CO DoR 112?

Video instructions and help with filling out and completing 112 form colorado

Instructions and Help about 112 form colorado

Laws calm legal forms guide form i T dash 540 individual income tax return resident Louisiana residents file their state income taxes using a form I teach 540 this document can be obtained from the website of the Louisiana Department of Revenue step 1 at the top of the first page give your name and social security number as well as that of your spouse if filing jointly step to enter your current home address city state and zip code provide a daytime phone number step 3 five numbers are listed corresponding to possible filing statuses and to the number corresponding to your filing status step 4 indicate all exemptions being claimed if claiming dependents you must give their names Social Security numbers relationship to you and birthdates step 5 enter your federal adjusted gross income online 7 steps 6 enter your federal itemized deductions on line 8a your federal standard deductions on line 8 B then subtract the ladder from the former enter the difference on line 8 see step 7 complete schedule h in order to complete line 9 step 8 complete lines 10 and 11 as instructed to calculate your Louisiana income tax due before adjustments step nine lines 12a through 15 concerned non-refundable credits you will need to complete schedule G in order to complete line 14 step 10 lines 16 through 18 adjust your tax liability and add any use tax owed step 11 lines 19 through 23 concerned refundable tax credits to complete line 23 you will first need to complete schedule f step 12 lines 24 through 32 document payments already made step 13 lines 33 through 45 concerned voluntary donations step 14 in lines 46 through 58 perform the final calculations as instructed to determine your final balance due or refund owed sign and date the bottom of the fourth page if filing jointly with your spouse they must do the same to watch more videos please make sure to visit laws calm

People Also Ask about colorado form 112 c instructions

Does Colorado have their own W 4 form?

Does Colorado require a state tax form?

Do I need to file a CO return?

How much do you have to make in co to file taxes?

Do I need to file a CO extension?

Do I need to file an extension if I don't owe?

What is the minimum income to file taxes in 2022?

Does co have a state tax form?

Does a single member LLC need to file a Colorado tax return?

Does Colorado automatically extend with federal extension?

Does Colorado accept federal extension for C corporations?

Does Colorado grant automatic extension for corporations?

Is Colorado state tax ID the same as Ein?

What is the Colorado state tax form?

How to file Colorado state tax form?

Does co have a state income tax?

Does Colorado have a state tax ID?

Does an C corp have to file a tax return if no income?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 112 form for eSignature?

Where do I find 112 form colorado 2024-2025?

How do I fill out 112 form colorado 2024-2025 using my mobile device?

What is CO DoR 112?

Who is required to file CO DoR 112?

How to fill out CO DoR 112?

What is the purpose of CO DoR 112?

What information must be reported on CO DoR 112?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.