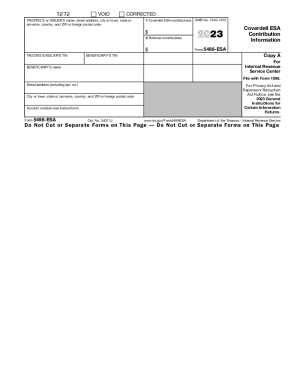

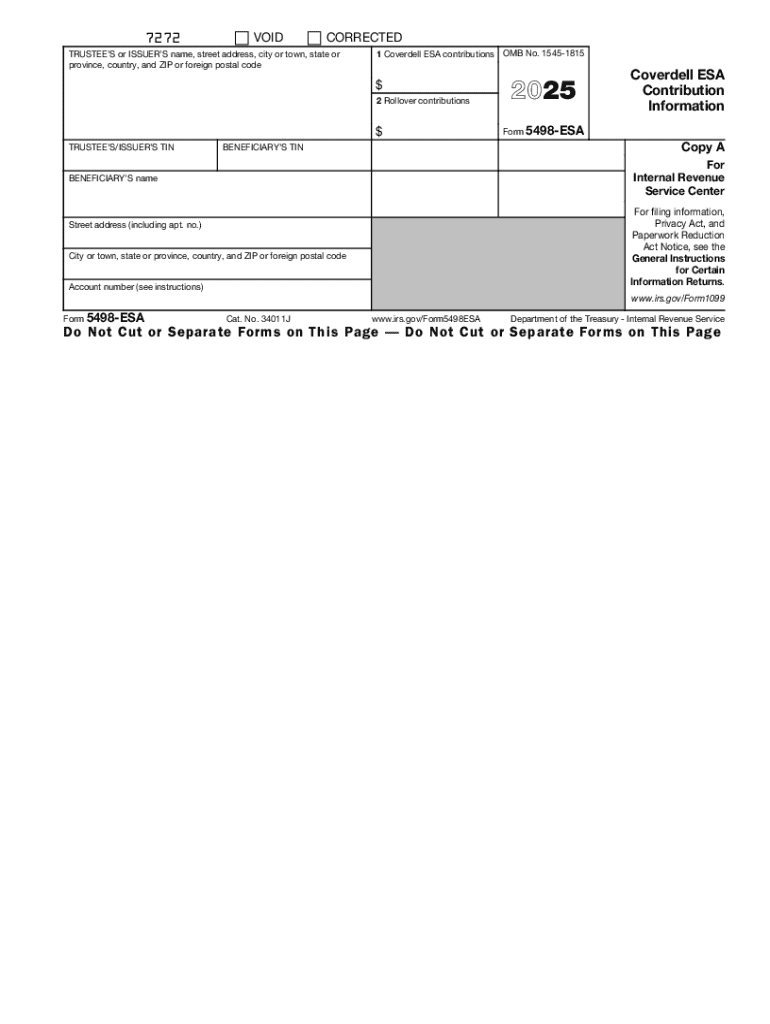

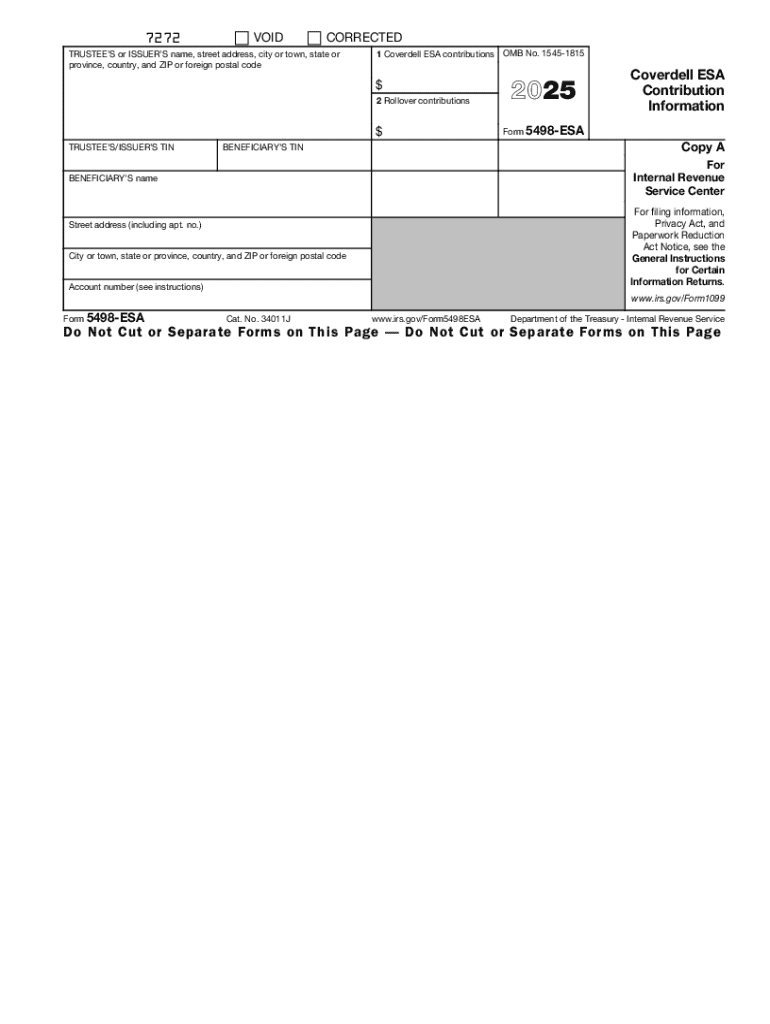

IRS 5498-ESA 2025 free printable template

Show details

7272VOIDCORRECTEDTRUSTEES or ISSUERS name, street address, city or town, state or province, country, and ZIP or foreign postal code1 Coverdell ESA contributions OMB No. 15451815$ 2 Rollover contributions$

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 5498-ESA

Edit your IRS 5498-ESA form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 5498-ESA form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 5498-ESA online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 5498-ESA. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 5498-ESA Form Versions

Version

Form Popularity

Fillable & printabley

Fill

form

: Try Risk Free

People Also Ask about

Do I need to report form 5498 on my tax return?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

Do you report a 5498 on your taxes?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

Does every IRA get a 5498?

Retirement contributions If you have an IRA but made no contributions for the year, the custodian generally won't send you a Form 5498 unless you have a required minimum distribution from the account.

Who files the form 5498 ESA?

File this form for each person for whom you maintained any Coverdell education savings account (ESA).

What do I do if I received a form 5498?

Your IRA trustee or custodian is the one responsible for mailing Form 5498 to the IRS, along with a copy to you. You don't have to do anything with the form itself. Just keep it with your tax records.

What is a 5498 ESA?

What is a 5498-ESA (Education Savings Account)? Form 5498-ESA reports the education savings account contributions or rollovers that were made throughout the year. You do not need to enter this form in your tax return.

Does form 5498 need to be reported on taxes?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

Where do I report form 5498 ESA?

The 5498 ESA tax Form must be filed by the custodian or trustee of the account. This is the entity that issued the account and oversees the account over the years. This form has two copies, Copy A must be sent to the IRS and Copy B must be distributed to the beneficiary.

Do you have to put form 5498 on tax return?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

Does form 5498 need to be reported?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

Where does form 5498 IRA go on tax return?

Form 5498 IRA Contribution Information is information for your personal records and is not required to prepare your tax return. Taxpayers should retain this information for their personal records, but there are no tax consequences to the taxpayer until the funds are distributed from the account.

Do I need to report 5498 to IRS?

Form 5498 is for informational purposes only. You are not required to file it with your tax return. This form is not posted until May because you can contribute to an IRA for the previous year through mid-April. This means you will have finished your taxes before you receive this form.

What is form 5498 or 5498 ESA?

Form 5498-ESA is used to report contributions and rollovers made to a Coverdell Education Savings Account for a given tax year. Find more information about Coverdell Education Savings Accounts.

What is a form 5498 used for?

The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement arrangement (IRA) to report contributions, including any catch-up contributions, required minimum distributions (RMDs), and the fair market value (FMV) of the account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 5498-ESA without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including IRS 5498-ESA, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I execute IRS 5498-ESA online?

Easy online IRS 5498-ESA completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I complete IRS 5498-ESA on an Android device?

Complete your IRS 5498-ESA and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is for filing information?

Filing information refers to the required documentation submitted to a regulatory agency or governing body, providing details relevant to compliance, disclosure, or reporting obligations.

Who is required to file for filing information?

Individuals or entities such as corporations, nonprofits, or businesses that meet certain criteria set by regulations or laws are required to file for filing information.

How to fill out for filing information?

To fill out filing information, one should accurately complete the designated forms, providing all required data and documentation, and ensure compliance with any specified guidelines or formats.

What is the purpose of for filing information?

The purpose of filing information is to ensure transparency, compliance with laws and regulations, and provide necessary information to authorities or stakeholders.

What information must be reported on for filing information?

The information that must be reported typically includes financial data, organizational structure, compliance with laws, and any relevant operational details as mandated by the filing requirements.

Fill out your IRS 5498-ESA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 5498-ESA is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.